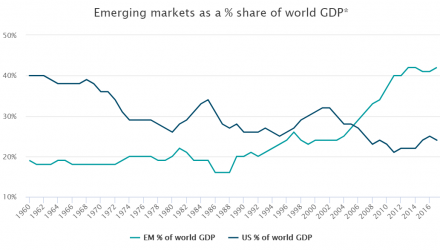

As displayed, emerging markets were roughly half as big as the U.S. economy in 1960, but they have slowly been increasingly their relative size over the past three decades. One might be forgiven for avoiding emerging markets when the space was less than a fifth of global GDP and easily dwarfed by U.S. markets, but those days are long gone.

Roughly since the financial crisis, emerging markets have been a bigger portion of the global economy than the United States. And based on the trend above as well as the strong growth rates seen in a number of emerging markets—the IMF has developing nations easily outpacing global average growth rates—this doesn’t appear to be a situation that looks to turn around anytime soon.

Emerging Markets Impact

The chart above and the trend line showcase that emerging markets are too big to ignore any more. Investors may no longer be able to get by with limited-to-no emerging markets exposure, as writing off nearly two-fifths of the globe’s economic output seems likely to produce an inadequate portfolio at best, and one without many of the world’s key economic drivers at worst.

It is arguable that few understand just how vital emerging markets are to the world economy at this point, or how easily they overshadow American economic output. That seems to be the only reason that makes sense for investors shunning emerging markets, as a single year of sluggishness—following a two-year stretch of solid performance relative to the U.S.—doesn’t appear to be a rational motivation to give up on 40% of the global economy.

One of the most important items to keep in mind for market allocations is that few would claim that avoiding the U.S. market would result in a complete portfolio; the American economy is simply too massive. Consider that next time someone wants to skip a market that is roughly double the economic size of the United States.