![]() Investors can look to a multi-factor, smart beta ETF strategy to potentially enhance returns in a slowing bull market environment.

Investors can look to a multi-factor, smart beta ETF strategy to potentially enhance returns in a slowing bull market environment.

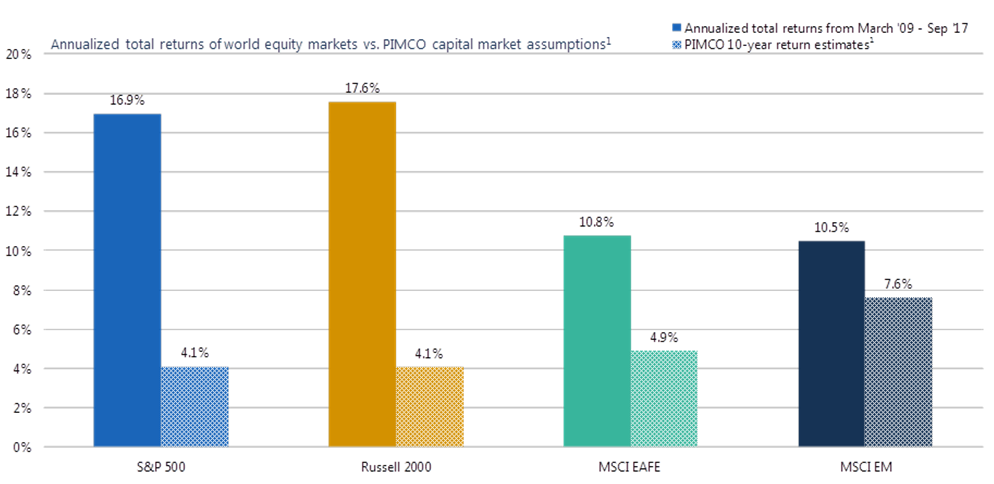

On the recent webcast (available On Demand for CE Credit), Valuations Matter: The Time for Multi-Factor is Now, Andy Pyne, Equity Strategist for PIMCO, warned that future returns are expected to slow from the breakneck pace of yesteryear as the bull rally extends. The U.S. equities and S&P 500, which have been the best performers since the financial downturn, are anticipated to generate lower returns while developed Europe, Australasia and Far East, along with the emerging markets, are projected to quicken their pace after falling behind U.S. markets in recent years.

Despite the slower growth rate ahead, investors will still try to seek out avenues of alpha, but more are growing weary of the underperformance of active managers. For instance, less than 20% of active U.S. large blend funds outperformed their passive counterparts over the past five years and little over 10% of active large blend funds outperformed over the past decade.

Alternatively, investors may look to smart beta strategies that combine the best of actively managed styles in a low-cost, passive index-based ETF wrapper. For instance, Rob Arnott, Chairman and CEO of Research Affiliates, pointed to the Research Affiliates Fundamental Index approach of smart beta strategies that specifically targets time-tested factor exposures.

Choosing which factors to incorporate in a diversified portfolio matters, Arnott said, especially given varying valuations and potentially heightened prices of specific factors in the current market environment. For example, the low-beta and high profitability factors are currently trading at elevated valuations.

Consequently, given the risks of potential underperformance in a single factor strategy, investors may consider multi-factor ETFs that could offer greater diversification. Pyne pointed to multi-factor strategies that could provide exposure to multiple factors like value, quality, momentum, low volatility and size to increase diversification and potentially lower tracking error compared to broad market indices.