Just after the Thanksgiving holiday, Germany crossed the one million mark in COVID-19 cases as a second wave has hit the Eurozone hard. With rising cases across the world, ETF investors should keep local currencies hedged as equities markets digest the news.

Fortunately, rather than taking two separate positions in the currency and equities, investors can get both in an ETF wrapper. A pair of funds to consider:

- Xtrackers MSCI Europe Hedged Equity ETF (DBEU): seeks investment results that correspond generally to the performance, before fees and expenses, of the MSCI Europe US Dollar Hedged Index. The fund, using a “passive” or indexing investment approach, seeks investment results that correspond generally to the performance, of the underlying index, which is designed to track the performance of the developed markets in Europe, while mitigating exposure to fluctuations between the value of the U.S. dollar and the currencies of the countries included in the underlying index. It will invest at least 80% of its total assets in component securities of the underlying index.

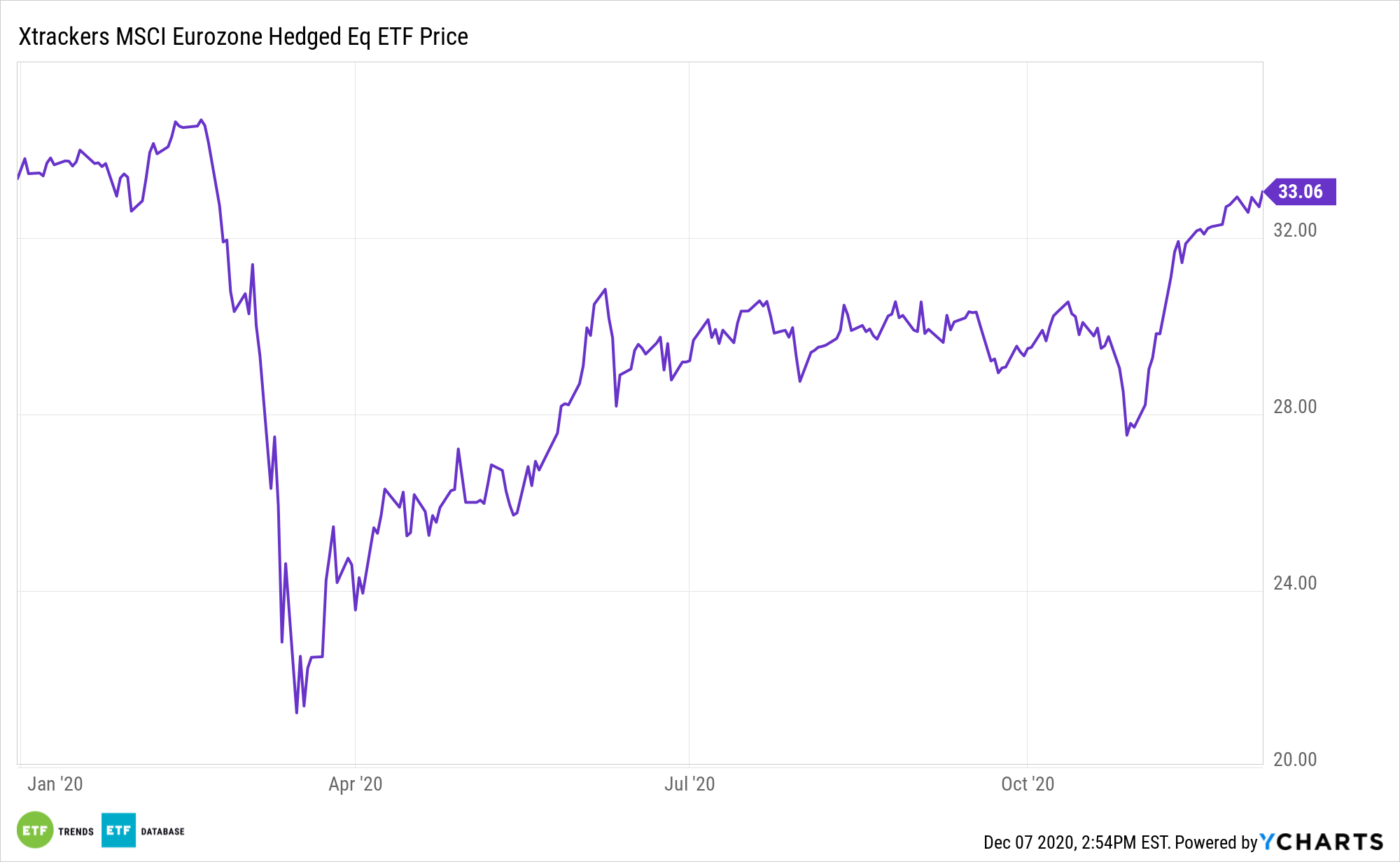

- Xtrackers MSCI Eurozone Hedged Equity ETF (DBEZ): seeks investment results that correspond generally to the performance, before fees and expenses, of the MSCI EMU IMI US Dollar Hedged Index. The fund, using a “passive” or indexing investment approach, seeks investment results that correspond generally to the performance, of the underlying index, which is designed to track the performance of equity securities based in the countries in the European Monetary Union, while seeking to mitigate exposure to fluctuations between the value of the U.S. dollar and the euro. It will invest at least 80% of its total assets in component securities of the underlying index.

Health and Economic Challenges in Europe

“German cases have topped one-million mark, with daily deaths up to a record 426; highlighting the ongoing difficulties in bringing the virus under control,” said Joshua Mahony, Senior Market Analyst at IG. “Despite optimism over the future growth trajectory, there is no getting around the fact that a more drawn-out period of lockdowns will weigh heavily on European growth.

There are some positive signs, however. Less political risk in the U.S. regarding the recent election should buoy equities despite the pandemic.

“Political risk out of the US is all but gone after Donald Trump admitted he would concede if the electoral vote is confirmed in favour of Joe Biden,” said Mahony. “There is little hope of the president reversing a comprehensive victory from Biden, and the prospect of a peaceful handover alleviates some of the underlying risk for markets.

For more news and information, visit the Smart Beta Channel.