It’s not just the future. Investors can use artificial intelligence in their portfolios with assets like the QRAFT AI Enhanced U.S. Large Cap Momentum ETF (AMOM).

AMOM is an actively-managed exchange traded fund that aims to provide investors with long-term capital appreciation by utilizing a proprietary artificial intelligence system to select large-capitalization U.S. stocks to be held in the portfolio. The fund seeks to achieve its investment objective by investing at least 80% of its net assets, plus the amounts of any borrowings for investment purposes, in securities of U.S.-listed large-capitalization companies.

Just like a sailboat needs wind to move, traders need momentum in order to play price action. That’s the impetus for AMOM’s methodology, which focuses on equities exhibiting strong momentum.

As such, AMOM seeks to hold stocks with exposure to the momentum factor. The fund utilizes artificial intelligence to determine how a company’s momentum over a certain period would change and/or affect the company’s performance over time and recommends a weighting of such company based on its potential for maximum return as compared to other companies.

In addition, AMOM offers factor exposure and may be appropriate for investors seeking exposure to the momentum factor. Finally, since AMOM functions as an investment strategy based on cutting-edge technology, QRFT may be appropriate as an alternatives allocation.

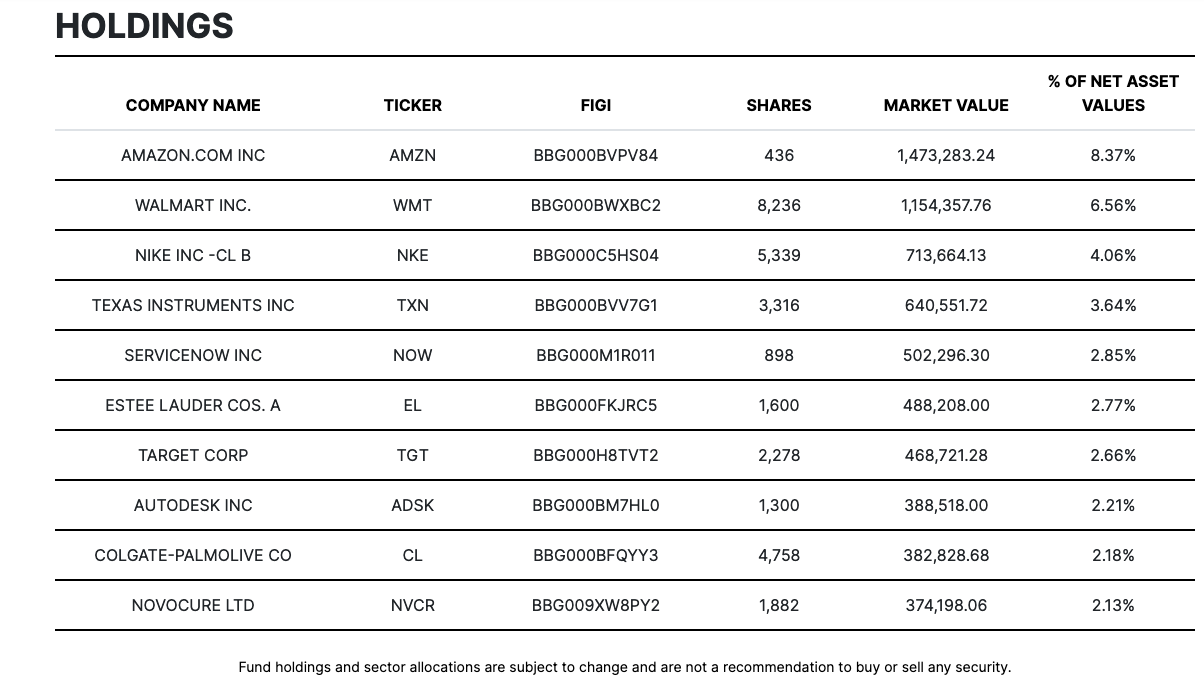

Amazon Tops AMOM’s Momentum Mix

A look at AMOM’s top holdings doesn’t show a one-sided skew towards big tech, highlighting the fund’s momentum mix in various sectors. The largest holding, at the time of writing, is Amazon at 8.37%.

The online retail giant will actually be reporting its first quarter earnings results on April 29. As such, AMOM will be one to watch should Amazon deliver blockbuster earnings.

Early indications are optimistic.

“Most investors will probably be feeling optimistic about the e-commerce and technology giant’s report,” a Motley Fool article published in Nasdaq noted. “The company has a solid recent track record of easily beating — often crushing — its own guidance and Wall Street’s consensus estimates on both the top and bottom lines.”

“In the last three quarters of 2020, Amazon’s earnings exceeded analysts’ expectations by a whopping 606% (second quarter), 67% (third quarter), and 95% (fourth quarter),” the article added.

For more news and information, visit the Smart Beta Channel.