By Todd Rosenbluth, CFRA

The S&P 500 Low Volatility Index, behind Invesco S&P 500 Low Volatility ETF (SPLV) holds the least volatile stocks in the broader benchmark used by many equity investors. Unlike the S&P 500 Index, which holds nearly all the same securities as it did three months ago, let alone three years ago, the Low Vol index is reconstituted quarterly to ensure it regularly provides exposure to the moderate risk securities. Changes within a year are common, as the median average turnover for the last 28 years has been 64%, but the index rebalance that took place last week was an abnormally high (63%) from what the index consisted of in February.

Mutual funds that incur high portfolio turnover regularly pass along capital gains to shareholders, but SPLV has not incurred a short- or long-term gain since its 2011 inception, and we do not expect one in 2020. In general, ETFs are highly tax efficient due to their creation and redemption process, which involves delivering the holdings directly to authorized participants that support trading.

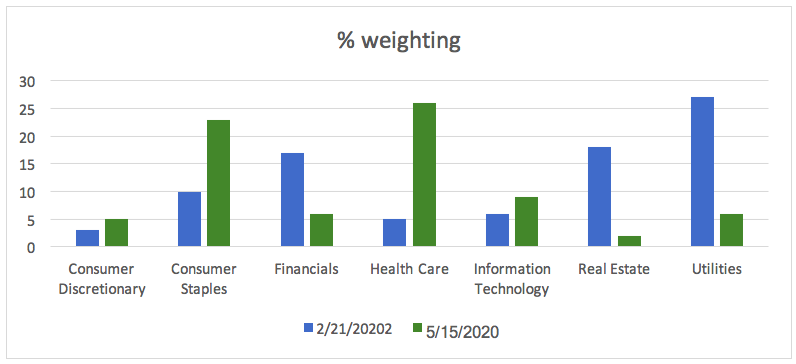

According to CFRA Research, some of SPLV’s lower volatility ETF peers, such as Fidelity Low Volatility Factor (FDLO) and iShares Edge MSCI Minimum Volatility (USMV), are relatively diversified across sectors. However, SPLV tends to concentrate in a few sectors, often ones with traditional defensive characteristics, such as above-average dividend yields, while having less exposure to more economically sensitive sectors. In February, SPLV had 27% in Utilities and 18% in Real Estate, but just 6% in Information Technology and 3% in Consumer Discretionary.

With the latest rebalance, the weightings in the Utilities and Real Estate sectors shrunk to 6% and 2%, respectively, while Consumer Discretionary and Information Technology rose to 5% and 9%. In the past, some people have expressed concerns that SPLV was too heavily weighted to the smallest sectors in the market. Yet, now the fund has more technology exposure than utilities and real estate combined.

Figure 1: Sector Weighting of S&P 500 Low Volatility Index at Recent Rebalances

Source: S&P Dow Jones Indices. As of May 15, 2020

The biggest increases occurred in two other traditional defensive sectors: Consumer Staples and Health Care. The weighting in Consumer Staples more than doubled to 23%, while the Health Care stake soared five-fold to 26%.

During the emergence of the bear market, some sectors held up better than others. In the 13 weeks ended May 15, the Health Care and Consumer Staples sectors declined just 3.5% and 12% on a price basis, much less than the15% loss for the S&P 500 Index and the 22% and 26% losses for the Utilities and Real Estate sectors, respectively.

Smart-beta index-based ETFs, such as SPLV, are rebalanced periodically and in normal markets investors should be mindful to understand that the stocks and sectors they were exposed to will change. Yet, a low volatility portfolio in a highly volatile market warrants additional scrutiny, as evidenced by the nearly two-thirds of new additions to SPLV as well as the weightings in some sectors rising or shrinking by more than 1,000 basis points. CFRA thinks that investors who rely solely on past performance or costs to determine what is an appropriate ETF are missing out on what truly is important – the securities inside.

Todd Rosenbluth is Director of ETF & Mutual Fund Research at CFRA.