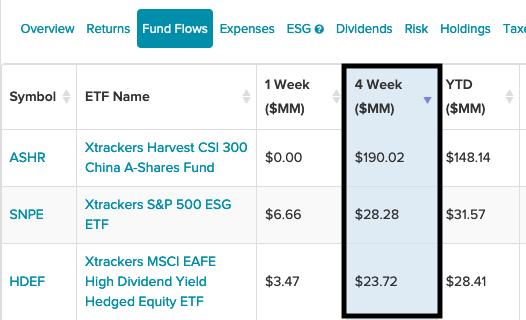

China equities, ESG, and high dividends have been dominating the inflows the past month for ETF provider DWS. Here are three funds investors should take notice of.

At the top of the list is exposure to China’s A-Shares equities via the the Xtrackers CSI 300 China A-Shares ETF (ASHR). ASHR seeks investment results that correspond to the CSI 300 Index.

The underlying index is designed to reflect the price fluctuation and performance of the China A-Share market and is composed of the 300 largest and most liquid stocks in the China A-Share market. The fund’s 0.65% expense ratio is right around the categorical average, but investors get a significant bang for their buck with ASHR up about 55% the past year.

ASHR was the first U.S.-listed ETF to offer direct exposure stocks listed in mainland Chinese markets in Shenzhen and Shanghai. Unlike some other ETFs that use derivatives to mimic A-shares, ASHR buys the stocks directly.

ESG and High Dividends

Coming in at second is the Xtrackers S&P 500 ESG ETF (SNPE) with a low 0.10% expense ratio. SNPE seeks investment results that correspond generally to the performance, before fees and expenses, of the S&P 500 ESG Index.

The index is a broad-based, market capitalization weighted index that provides exposure to companies with high ESG performance relative to their sector peers, while maintaining similar overall industry group weights as the S&P 500 Index. SNPE is up 17% within the past year.

Last but not least is the Xtrackers MSCI EAFE High Dividend Yield Equity ETF (HDEF). In the current low-yield environment, flows into this fund highlight the need for investors to seek other sources of fixed income aside from safe haven government debt.

HDEF offers broad exposure to developed markets outside of the U.S., but with a twist: it looks for stocks that pay high dividends compared to their price, and then hedges out the currency exposure that an investment in international equities brings. This delivers isolated exposure to the performance of the underlying equities in local prices.

Currency fluctuations can be a significant driver of gains and losses, and some investors may prefer the potential diversification benefit of exposure to non-U.S. dollar investments. ETF investors can get this hedged high dividend exposure at just a 0.20% expense ratio.

For more news and information, visit the Smart Beta Channel.