With stocks trading near their all-time highs as the economy continues to bounce back from the pandemic lows of 2020, Wednesday represents a special day for equity traders and stock index ETF investors: the 125th birthday of the Dow Jones Industrial Average.

The Dow Jones, which debuted over a century ago with just 12 members, has climbed to nearly 35,000, as it currently trades just off its best levels historically. The famed index’s best year was in 1915, when the benchmark rallied 81.7%. Meanwhile, the index’s greatest losses came in the post-Depression year 1931, when it sank 52.7%.

The index of those first 12 companies closed its first trading day, May 26, 1896, at just 40.94. The group was made up of companies like General Electric Co., a still-prominent member of the index, as well as bygone companies like American Cotton Oil and Distilling & Cattle Feeding.

Each year the Dow has gained an average of 7.69%, scoring 1,464 record closes, according to Dow Jones Market Data. It first scrambled above 100 in 1906, crested 1000 in 1972, and finished above 10000 in 1999.

For ETF investors looking at investing in Dow stocks outside of the famous SPDR Dow Jones Industrial Average ETF Trust (DIA), there are a number of options to choose from.

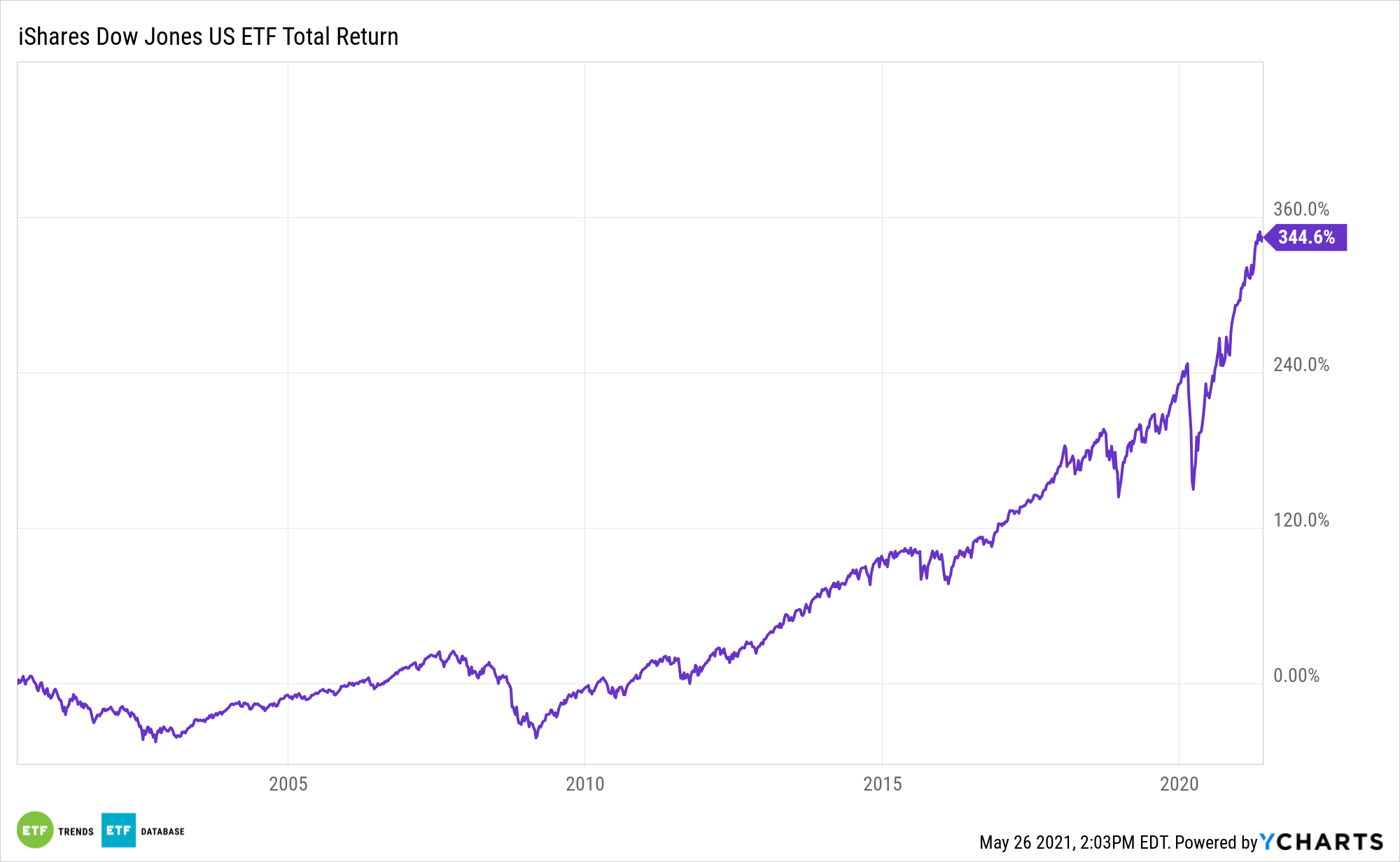

iShares Dow Jones US ETF (IYY)

IYY seeks to track the investment results of the Dow Jones U.S. Index composed of U.S. equities. The fund generally invests at least 90% of its assets in securities of the underlying index and in depositary receipts representing securities of the underlying index. The underlying index aims to consistently represent the top 95% of U.S. companies based on a float-adjusted market capitalization, excluding the very smallest and least liquid stocks. It has a lower 0.20% expense ratio and offers exposure to a broad range of large- and mid-sized U.S. companies.

ProShares Ultra Dow30 (DDM)

Investors bullish on the returns of the Dow can look at this leveraged ETF from ProShares. The Ultra Dow30 is a leveraged ETF that seeks to replicate two times the daily performance of the DJIA. The fund invests in a number of securities to achieve its objective. Investments include equity securities from the index, derivatives including SWAP agreements and futures contracts, and money market instruments for short-term cash management. The fund’s expense is a bit higher at 0.95%.

ETF investors can also explore the following funds for value and dividend investing:

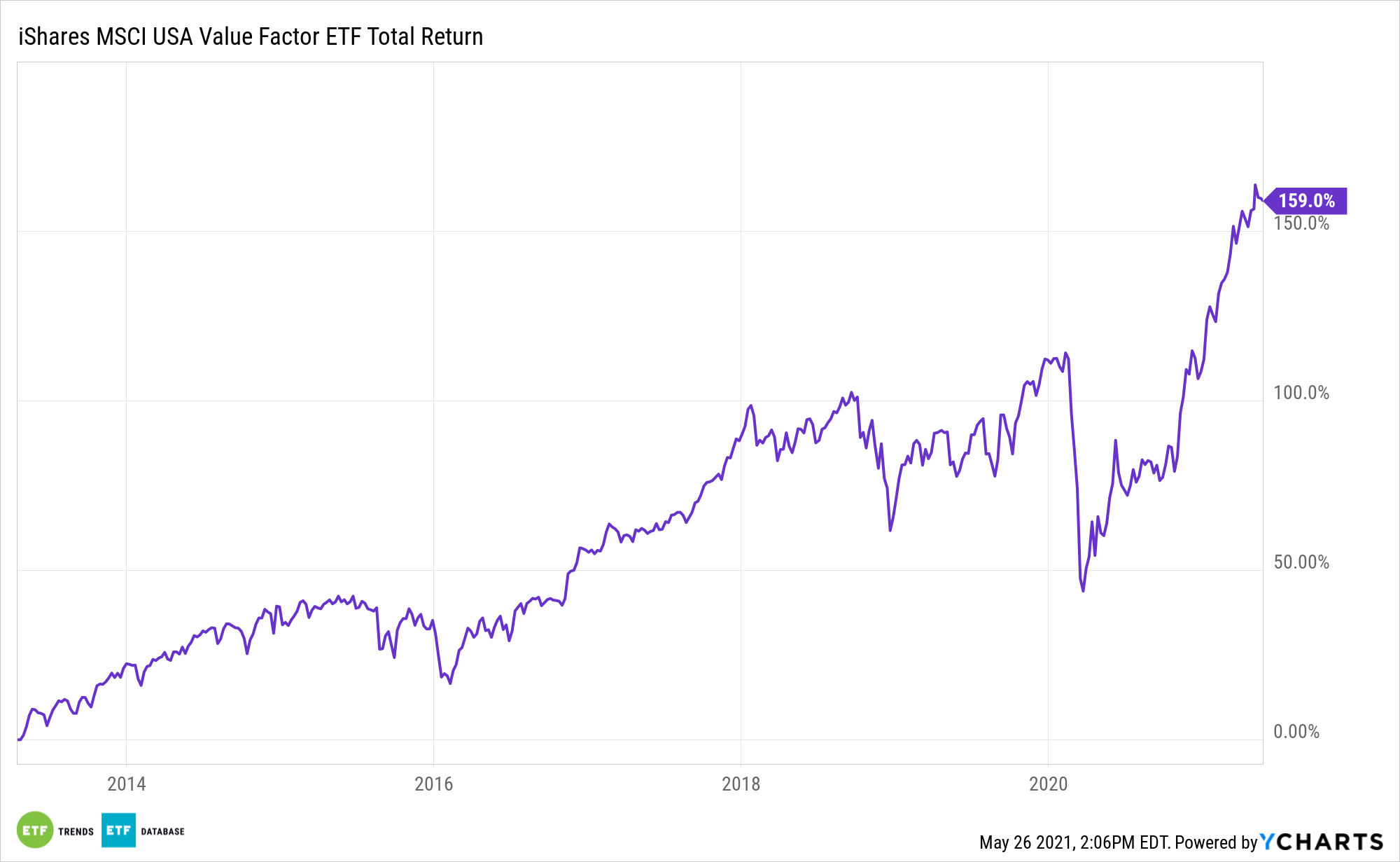

iShares MSCI USA Value Factor ETF (VLUE)

VLUE seeks to track the investment results of the MSCI USA Enhanced Value Index, which is composed of U.S. large- and mid-capitalization stocks with value characteristics and relatively lower valuations.

VLUE generally will invest at least 90% of its assets in the component securities of the underlying index and may invest up to 10% of its assets in certain futures, options and swap contracts, cash, and cash equivalents. The index is based on a traditional market capitalization-weighted parent index, the MSCI USA Index, which includes U.S. large- and mid- capitalization stocks.

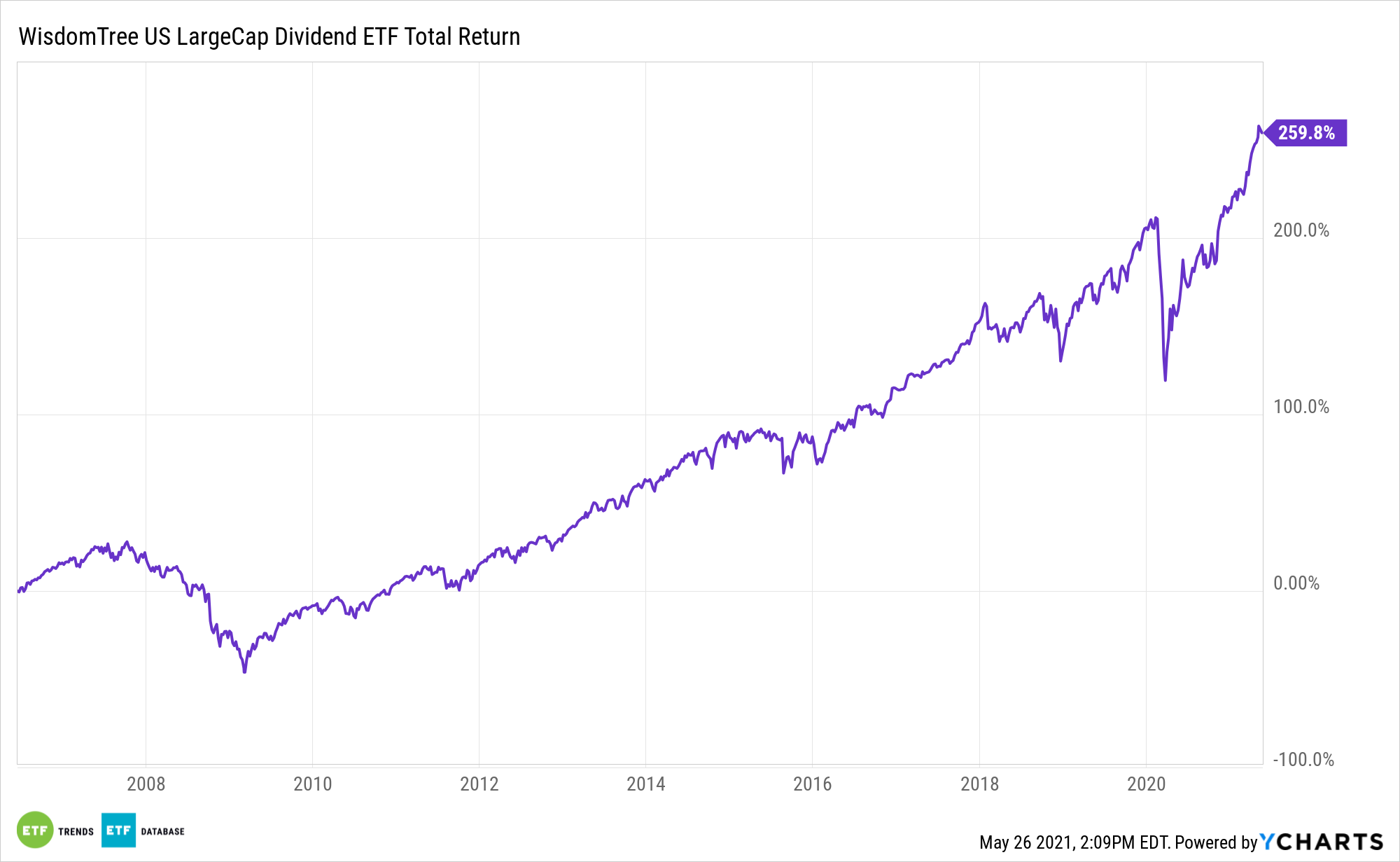

WisdomTree U.S. LargeCap Dividend Fund (NYSEArca: DLN)

DLN seeks to track the price and yield performance, before fees and expenses, of the WisdomTree U.S. LargeCap Dividend Index, which is a fundamentally weighted index that is comprised of the large-capitalization segment of the U.S. dividend-paying market.

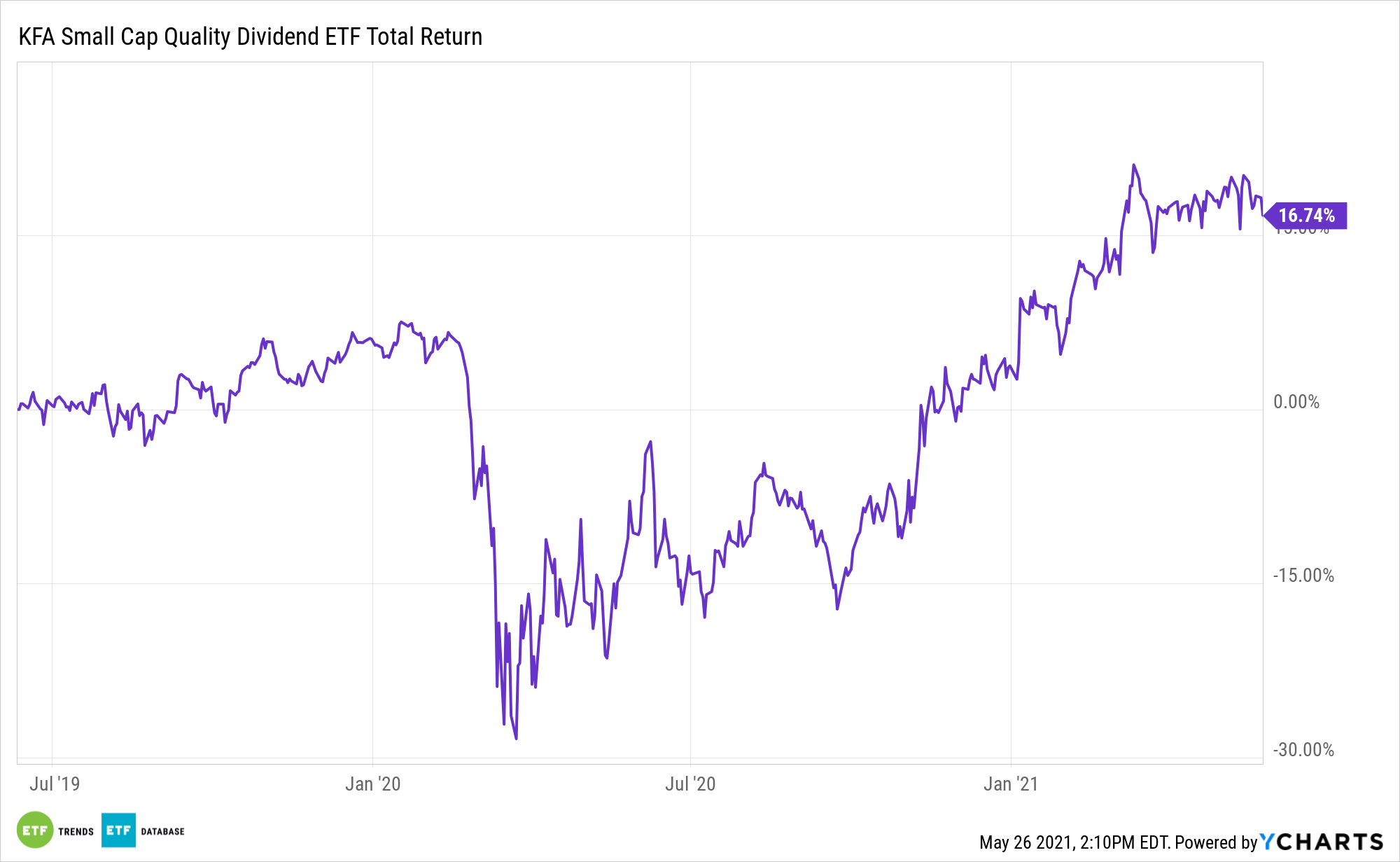

KFA Small Cap Quality Dividend Index ETF (KSCD)

KSCD seeks exposure to companies with reliable dividend growth and a strong record of stable cash flows, healthy balance sheets, and durable business models, according to KraneShares. KSCD uses a smart beta strategy and provides dividend growth strategies that can potentially improve performance in down markets.

The fund invests 80% of its assets in the Russell 2000 Dividend Select Equal Weight Index. The index “takes a smart beta approach to investing in U.S. small cap companies,” per KraneShares. “The strategy seeks to measure the performance of US companies that have successfully increased their dividend payments over a period of ten years.”

For more market trends, visit ETF Trends.