![]() By Ryan Gilmer, CFA – VP Investment Management– TOPS ETF Portfolios

By Ryan Gilmer, CFA – VP Investment Management– TOPS ETF Portfolios

The popularity of ETFs has naturally brought about significant evolution over time. Many of the earliest ETF products were built to track market cap weighted indexes. As time has passed, providers have introduced different index composition strategies including equal weighting, fundamental weighting, revenue weighting, and dividend weighting. While dividend investment strategies have existed for decades, the current environment of elevated US stock valuations and low interest rates has many people wondering if they should tilt their portfolio to a more dividend focused approach.

Results From the Data are Mixed

Academics have long researched the hypothesis that dividend paying stocks outperform their non-paying brethren. WisdomTree argues in their recent study, The Dividends of a Dividend Approach, that high dividend paying stocks outperform over time. Wharton professor Jeremy Siegel’s research divides S&P 500 dividend paying stocks into five quintiles and looks at their performance going back to 1957. The research shows the two quintiles with the highest dividends outperform the S&P 500 by over 2% per year, while the remaining three quintiles underperform by 0.8% – 1.3%. Based on this data, the answer seems simple: overweight the highest dividend payers.

Vanguard Research has come to a different conclusion using a different data set, however, which comes from global equity performance over the past twenty years. Their data divides stocks into four quartiles based on yield. The results show while the highest dividend quartile obviously pays out greater income, the total return between these stocks and the lowest yielding are virtually identical, certainly nowhere near the 2% annualized outperformance that Seigel found. Based on this data, Vanguard argues for a total return approach to investing where the dividend yield is a small, almost insignificant factor.

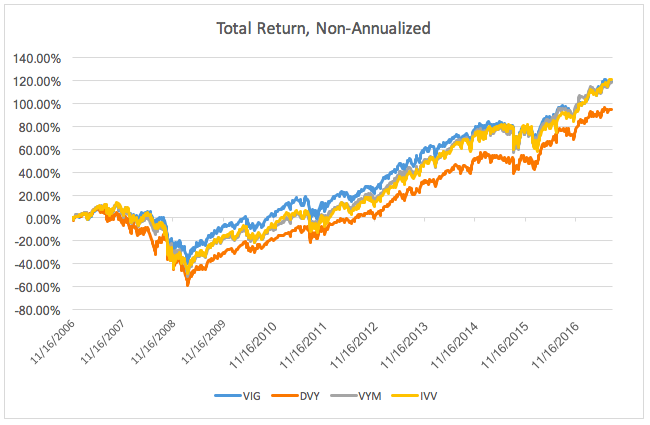

In addition to these two studies, below is a simple chart showing the performance differences between four ETFs since 2006: iShares Select Dividend (DVY), Vanguard Dividend Appreciation (VIG), Vanguard High Dividend (VYM), and iShares Core S&P 500 (IVV):

Data Provided by Bloomberg

Data Provided by Bloomberg

Here are the total returns since 11/16/06:

VIG – 119%

DVY – 94.39%

VYM – 117.66%

IVV – 120.35%

As you can see from the data, the S&P 500 has marginally outperformed 3 popular dividend ETFs over the last decade. Of course, this is nowhere near the complete data set of high dividend paying ETFs. Also, the next five, ten, or fifty years could look completely different. Perhaps dividend strategies could outperform going forward. But as of now, the data regarding dividend strategies seems mixed and inconclusive.

Other Factors to Consider