As a way to access diversified exposure to these various market segments, investors can look at something like the ROBO Global Robotics & Automation Index ETF (NASDAQ: ROBO), the original ETF dedicated to robotics investing.

The ROBO ETF follows the ROBO Global Robotics & Automation Index, which provides access to the entire value chain of robotics, automation and artificial intelligence. The ROBO Global Robotics & Automation Index is comprised of 97 global companies from 14 countries in North America, Europe, Asia and the Middle East and offers almost no overlap with traditional equity indices.

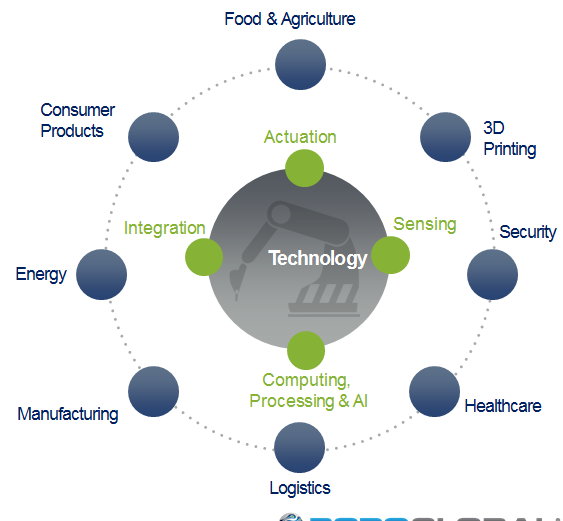

Robotics-related and automation-related companies include any technology, service or device that supports, aids or contributes to any type of robot, robotic action or automation system process, software or management. For instance, products and services include products that incorporate artificial intelligence, unmanned vehicles, software that enables virtualized product design and implementation, three-dimensional printers, navigation systems and medical robots or robotic instruments.

![]()

Top country weights include U.S. 40%, Japan 27%, Germany 9%, Taiwan 6% and Switzerland 5%. The portfolio includes a hefty tilt toward mid-caps 52%, followed by small-caps 25% and large-caps 23%, which reflects the focus on developing companies in the nascent space. Specifically, the underlying index may include 40% bellwether stocks and 60% non-bellwether stocks.

“The robotics and automation landscape is enabling a technological revolution that will fundamentally change how we work and live,” Studebaker said. “Robotics has transitioned from an industrial application to multiple applications across the entire economy. The ROBO Index provides diversified exposure to the entire value chain of robotics and automation.”

Financial advisors who are interested in learning more about robotics and artificial intelligence can watch the webcast here on demand.