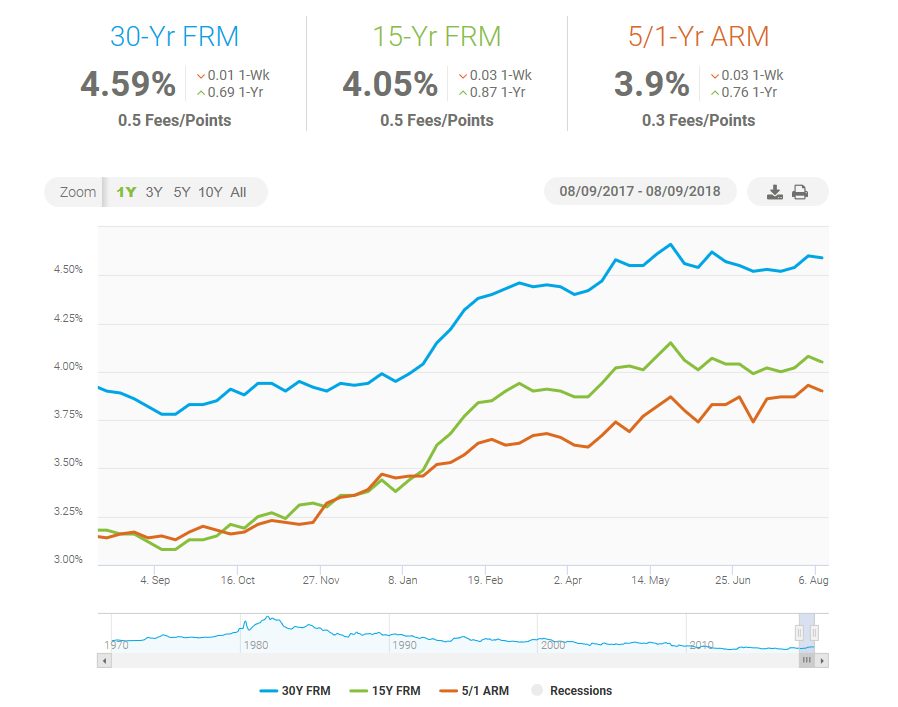

The average 30-year mortgage rate dropped one basis point to 4.59 this week according to secondary market mortgage participant Freddie Mac, as rising rates and higher home prices are tempering a summer season that typically sees an uptick in homebuying activity.

Long-term mortgage rates have been running at their highest levels in the last seven years. The benchmark 30-year mortgage rate reached as high as 4.66% on May 24 compared to a year ago when the interest rate was at 3.9%. In addition, the average rate on the 15-year, fixed-rate loan fell to 4.05% this week from 4.08% last week.

Related: Homebuyers Forge on Despite Rising Mortgage Rates

The data from Freddie Mac corroborates with the National Home Builders Association reporting that average mortgage rates jumped by more than 30 basis points in the second quarter to 4.67% versus 4.34% the previous quarter. Backed by a bull run in the capital markets and data showing that gross domestic product increased 4.1% in the second quarter, the Federal Reserve is expected to hike interest rates in September, but mortgage rates are still at historical lows nonetheless.

“The Fed has taken a cautious approach to raising rates since the recovery began. And mortgage markets have responded in a slow and conservative way. Inflation has also been low since the recovery began. That has also kept rates historically low,” said Taylor Marr, senior economist at real estate brokerage Redfin.

![]()