Despite the deep declines in emerging markets this year, with respect to value compared to price, many of these plays from abroad present a profitable opportunity that can be realized, especially if China and the U.S. ameliorate their trade differences.

“Investors obviously are still a little bit edgy and therefore we would expect periods of volatility to continue,” said Mark Hackett, chief of investment research at Nationwide Funds Group, which manages $60 billion. “As the headlines continue to get more nerve wracking with regards to a global slowdown and trade wars and government shutdowns, it’s easy to spook investors, but we think those are temporary versus permanent.”

While the majority of investors might be driven away by the red prices in emerging markets, they should be looked at as substantial markdowns, especially if trade negotiations between the U.S. and China result into a tangible trade deal with permanence.

“The emerging market complex is still pretty healthy–near the highs of the cycle when looking at earnings growth,” Hackett told ETF Trends. “The U.S. had this sort of sugar rush in 2018; growth in 2019 is still strong, just not as strong as 2018.

For investors looking for the continued upside in emerging market assets, whether driven by a weakening USD or continued developments around trade, the Direxion MSCI Emerging Over Developed Markets ETF (NYSEArca: RWED) offers them the ability to benefit not only from emerging markets potentially performing well, but from emerging markets outperforming developed markets.

Conversely, if investors believe that resolutions to the big issues impacting sentiment today are in motion, the Direxion MSCI Developed Over Emerging Markets ETF (NYSEArca: RWDE) provides a means to not only see developed markets perform well, but a way to access a convergence/catch-up in performance of DM relative to EM, a spread that has clearly widened over the past 6 months.

How will rising interest rates fueling a stronger dollar affect emerging markets?

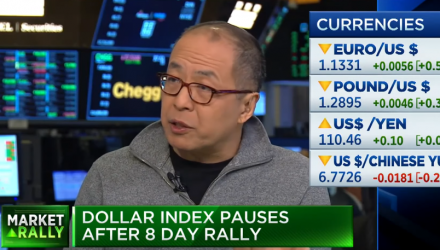

In the video below, Win Thin, emerging markets strategy at Brown Brothers Harriman, discusses what the latest moves in the dollar mean for the overall stock market.

For more market trends, visit ETF Trends.