U.S. markets and stock exchange traded funds gave up early morning gains Friday as more stringent measures to contain the coronavirus pandemic fueled greater concerns over the potential lingering negative effects on the economy.

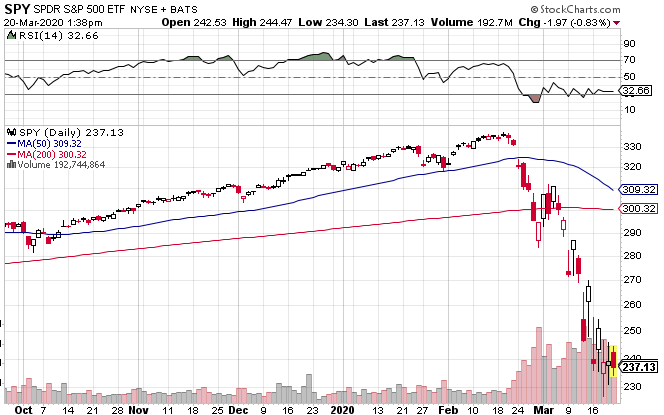

On Friday, the Invesco QQQ Trust (NASDAQ: QQQ) decreased 0.5%, SPDR Dow Jones Industrial Average ETF (NYSEArca: DIA) fell 1.1%, and SPDR S&P 500 ETF (NYSEArca: SPY) dropped 0.8%.

The state of New York ordered all non-essential workers to stay home to curtail the spread of COVID-10 after California earlier asked 40 million people to stay indoors, Reuters reports.

Markets dipped even lower after the Trump administration said it was working with Mexico to suspend nonessential travel between the two countries, the Wall Street Journal reports.

Investors are now hoping that additional stimulus measures will help prop up the economy, with the Senate to discuss a $1 trillion package that would include direct financial help for Americans.

“I don’t think we’re out of the woods by any stretch,” Lamar Villere, portfolio manager at Villere Balanced Fund, told Reuters. “Most people haven’t been tested yet for coronavirus so the size of the spread is not known or understood. As that number goes up there’s the potential for more investor caution.”

The Federal Reserve has already taken aggressive action to mitigate the fallout in financial markets, providing billions of dollars at near-zero rates to central banks dealing with a shortage in U.S. dollars. Additionally, the Fed said it would launch a new lending facility to backstop money-market funds.

“There is a semblance of calm,” Seema Shah, chief strategist at Principal Global Investors, told the WSJ. “All the measures that central banks have taken over the past week have started to feed into the system and improve liquidity.”

Nevertheless, the markets are still on pace to close the week with steep losses as the pandemic is anticipated to cause an economic recession. The Dow is also set for its worst week since October 2008.

SPDR S&P 500 ETF

For more information on the markets, visit our current affairs category.