Investors can breathe a collective sigh of relieve after seeing U.S. equities racked thanks to the breakdown of trade deal negotiations with China. Turns out U.S. equities can take a punch and take it pretty well, which could be a good sign for the domestic markets moving forward.

Hedge funds are responding by eliminating their positions that would’ve protected them from the downside according to one analyst.

“The majority of hedge funds, cautious of the risk of a correction in the US market, seem to have intentionally held down their exposure to US stocks in April. But they also seem to have cleared away their downside hedge positions,” said Nomura quantitative strategist Masanari Takada. “Of course, this also means hedge funds have left themselves defenseless in the event of another sharp drop in US stocks.”

“It would appear that the majority of hedge funds do not expect another sharp rise in volatility, and that they have concluded that the correction has run its course,” he added.

For investors looking for continued upside in U.S. equities over international equities, the Direxion FTSE Russell US Over International ETF (NYSEArca: RWUI) offers them the ability to benefit not only from domestic U.S. markets potentially performing well, but from their outperformance compared to international markets.

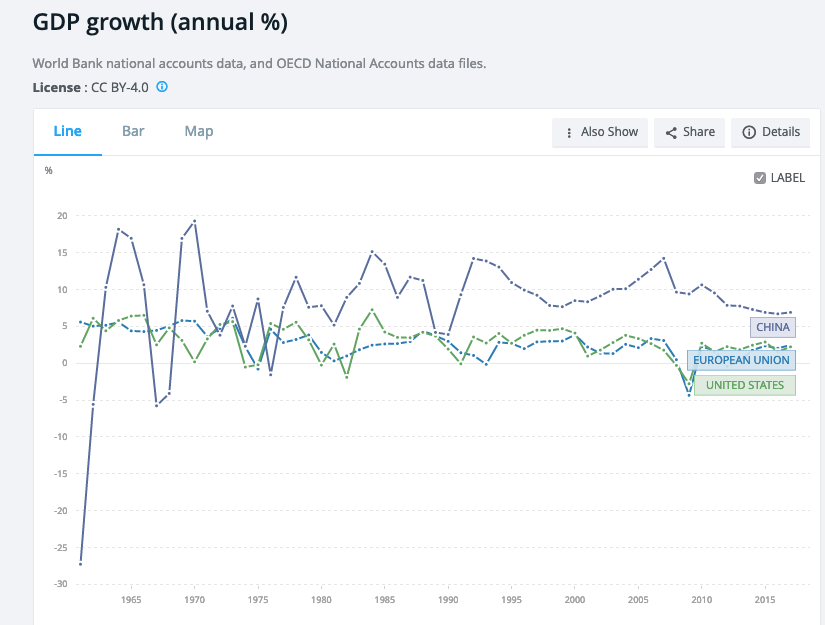

Despite a number of roadblocks heading into 2019 after a rough fourth-quarter market showing to end 2018, the U.S. economy rebounded in the first quarter this year, beating analysts’ expectations of 2.5 percent growth with a 3.2 percent growth number.

The higher U.S. GDP comes global economic growth remains a primary concern. Earlier this month, the IMF cut its global growth forecast to the lowest level since the financial crisis, citing the impact of tariffs and a weak outlook for most developed markets.

According to the IMF, the world economy will grow at a 3.3 percent pace, which is 0.2 percent lower versus the initial forecast in January. Nonetheless, strength in leading markets like the U.S. with its healthy labor market are keeping global growth afloat.

Will the U.S. continue its upward trajectory in the second quarter and through the rest of 2019? Helping to boost the case for international equities is stiff competition from China.

A mix of Chinese stimulus measures have been providing the fodder for economic growth, such as lower taxes, no corporate tax breaks, monetary policy adjustments, and more market access for foreign companies to set up shop. All in all, Wall Street is looking at the Chinese government’s latest efforts as a plus for its economy, which makes it rife for investment.

“Investors look to have locked in profits on their long VIX calls (premised on a rise in the VIX). This rollback of downside hedges may have indirectly supported the US equity rebound,” wrote Takada. “As a result, US equity exposure at hedge funds overall has turned upward again.”

For more market trends, visit ETF Trends.