Tailwinds for emerging markets could lie ahead as the U.S. dollar begins to reverse from its initial strength in 2018. This bodes well for the iShares MSCI Emerging Markets ETF (NYSEArca: EEM), which is up 8 percent thus far in 2019.

“Patience” has been a constant buzzword in Federal Reserve lexicon as of late and on Wednesday, the central bank will release the minutes from the Jan. 29-30 meeting in which they elected to keep the federal funds rate unchanged.

Investors and traders alike will no doubt dissect the Fed minutes to extrapolate their own interpretations from it. Nonetheless, the word “patience” will once again come under the proverbial microscope.

Last month, the Fed voted unanimously to hold its policy rate in a range between 2.25 percent and 2.5 percent. More dovishness by the Fed in 2019 can help keep dollar gains in check for the rest of the year.

Per a Nasdaq Dorsey Wright monthly update, the “recent movement of the dollar provides tailwinds for some areas of the market that were, for most of 2018, fighting stiff headwinds. In particular, international equities is one area of the global markets that tends to perform better when the dollar is weakening.”

Source: tradingeconomics.com

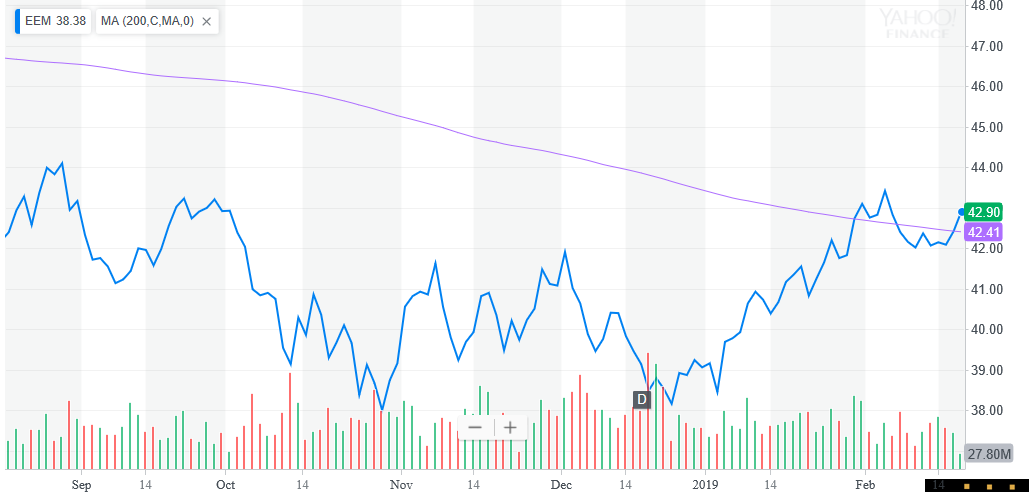

In the meantime, as the dollar begins to exhibit signs of languishing, EEM has crossed up past its 200-day moving average after a tumultuous 2018. A stronger U.S. dollar as well as the tariff-for-tariff war between the United States and China are to think for much of that.

The recent strength in EEM comes after it fell 17 percent in 2018.

Trend Tilted Towards the Positive

The Nasdaq Dorsey Wright update also notes that “the trend chart of EEM has returned to a positive trend and has seen a surge in its technical fund score, which currently sits at an impressive 4.30 (out of a possible 6). All in all, the technical outlook for EEM, and emerging markets in general, has taken a turn for the better as we kick off 2019, while the US equity market has similarly regained solid footing.

Investors might be sitting on their hands when it comes to international market exposure since the elephant in the room is whether a possible trade deal between the United States and China is looming as the primary trigger event. Trade negotiations going awry can certainly send markets abroad in the wrong direction, but it doesn’t mean investors should avoid them entirely,

Despite the deep declines in emerging markets in 2018, with respect to value compared to price, many of these plays from abroad present a profitable opportunity that can be realized, especially if China and the U.S. ameliorate their trade differences.

For investors looking for the continued upside in emerging market assets, whether driven by a weakening USD or continued developments around trade, the Direxion MSCI Emerging Over Developed Markets ETF (NYSEArca: RWED) offers them the ability to benefit not only from emerging markets potentially performing well, but from emerging markets outperforming developed markets.

Conversely, if investors believe that resolutions to the big issues impacting sentiment today are in motion, the Direxion MSCI Developed Over Emerging Markets ETF (NYSEArca: RWDE) provides a means to not only see developed markets perform well, but a way to access a convergence/catch-up in performance of DM relative to EM, a spread that has clearly widened over the past 6 months.

For more market trends, visit ETF Trends.