Building wealth can be a painstaking process in a world where most want satisfaction immediately. However, for those brimming with discipline, small increments allocated towards investing can pay off, especially when applied to a small cap value-added strategy.

“I’m going to show you how to accumulate money in a way most people can accomplish: If you start early, by setting aside less than $100 a month and investing it wisely, you can retire with millions,” wrote Paul Merriman in MarketWatch. “Think about $100 a month. That’s less than $25 a week. If you’re ready to seize an opportunity, it shouldn’t be too daunting to squeeze that much from a budget.”

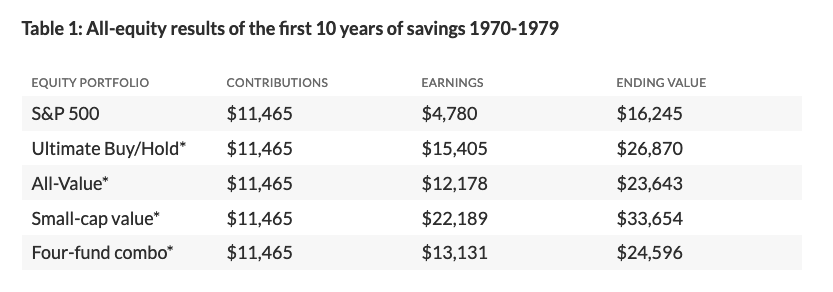

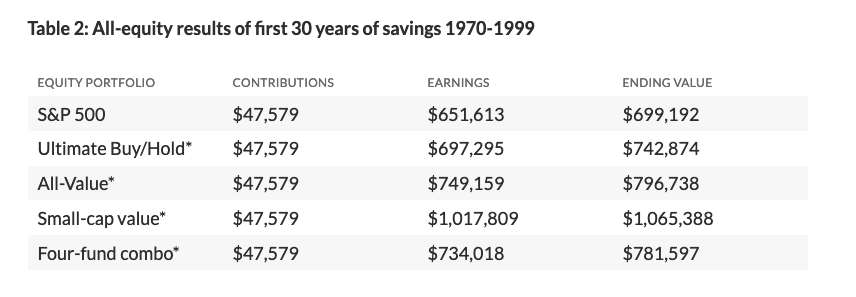

“In today’s world, that can still be a squeeze. But in the long run, the payoff will leave you with no doubt that it was worth it,” wrote Merriman. “I’ll illustrate how this would have worked out if you had begun saving this modest amount at the start of 1970. The numbers assume you increased your savings by 3% each year to factor in an assumed inflation rate.”

Here’s how your money would’ve done starting in 1970 through 1979:

Here’s how it would like from 1970 through 1999:

Here’s how it would like from 1970 through 1999:

In both cases, small cap value consistently outperformed the rest of the group. For investors looking for concentrated exposure in small caps, here are a few funds to look at:

In both cases, small cap value consistently outperformed the rest of the group. For investors looking for concentrated exposure in small caps, here are a few funds to look at:

- Vanguard Small-Cap Index Fund ETF Shares (NYSEArca: VB): seeks to track the performance of a benchmark index that measures the investment return of small-capitalization stocks. The fund employs an indexing investment approach designed to track the performance of the CRSP US Small Cap Index, a broadly diversified index of stocks of small U.S. companies.

- Vanguard Small-Cap Value Index Fund ETF Shares (NYSEArca: VBR): seeks to track the performance of a benchmark index that measures the investment return of small-capitalization value stocks. The fund employs an indexing investment approach designed to track the performance of the CRSP US Small Cap Value Index, a broadly diversified index of value stocks of small U.S. companies.

- Vanguard Small-Cap Growth Index Fund ETF Shares (VBK): seeks to track the performance of a benchmark index that measures the investment return of small-capitalization growth stocks. The fund employs an indexing investment approach designed to track the performance of the CRSP US Small Cap Growth Index, a broadly diversified index of growth stocks of small U.S. companies.

Small Caps Over Large Caps

If investors believe that small cap equities will outperform large cap equities, the Direxion Russell Small Over Large Cap ETF (NYSEArca: RWSL) provides a means to not only see small cap stocks perform well, but a way to capitalize on their outperformance versus their large cap brethren. RWSL seeks investment results, before fees and expenses, that track the Russell 2000®/Russell 1000® 150/50 Net Spread Index.

The index measures the performance of a portfolio that has 150% long exposure to the Russell 2000® Index (the “Long Component”) and 50% short exposure to the Russell 1000® Index (the “Short Component”). On a monthly basis, the Index will rebalance such that the weight of the Long Component is equal to 150% and the weight of the Short Component is equal to 50% of the Index value. In tracking the Index, the Fund seeks to provide a vehicle for investors looking to efficiently express a small-capitalization over large-capitalization investment view by overweighting exposure to the Long Component and shorting exposure to the Short Component.

For more market trends, visit ETF Trends.