While emerging markets (EM) have been sensitive to the U.S.-China trade war developments, it’s not to say that developed markets (DM) aren’t susceptible to the tariff wars between the two largest economies. Aside from the trade war, there are other key developments outlined by ING, which could affect how DMs respond—a key mover for the Direxion MSCI Developed Over Emerging Markets ETF (NYSEArca: RWDE).

One of those factors will be how the U.S. Federal Reserve will respond to economic data and how that will factor into interest rate policy.

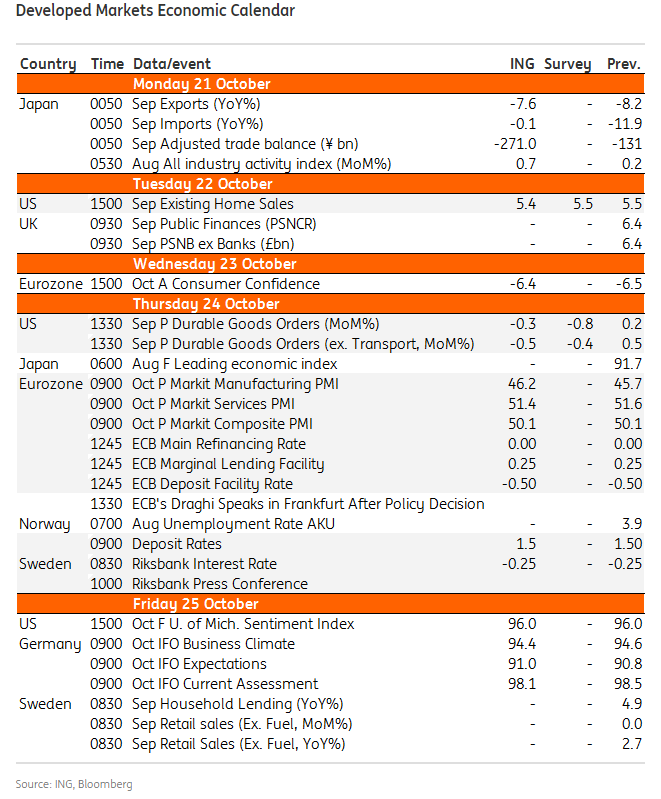

“We await the final few data releases and Fed speeches ahead of the 30 October FOMC meeting, but we would need to see incredibly strong figures from what are largely second-tier releases to have any chance of preventing a third consecutive interest rate cut from the Federal Reserve,” the ING THINK Economic and Financial Analysis post said. “With business surveys having fallen sharply in recent months, employment growth slowing and wage inflation stalling there is a growing sense that the US is now succumbing to the deepening global gloom.”

“There may be some positives from the housing numbers given consumer confidence continues to hold up for now and the fact mortgage rates have plunged in the wake of the decline in Treasury yields, but the durable goods orders report is likely to underline fears about a decline in investment given lingering trade uncertainty and weakness in key external markets at a time of dollar strength,” ING added.

ING cited other key developments in developed markets:

- The latest goings-on with Brexit

- The forthcoming ECB meeting

- Confidence numbers in the Eurozone

- Swedish interest rate policy

- Interest rate policy for the Norwegian central bank

RWDE provides a means to not only see developed markets perform well, but a way to access a convergence/catch-up in performance of DM relative to EM, a spread that has clearly widened over the past 6 months. The fund seeks investment results, before fees and expenses, that track the MSCI EAFE IMI – Emerging Markets IMI 150/50 Return Spread Index.

The index measures the performance of a portfolio that has 150% long exposure to the MSCI EAFE IMI Index (the “Long Component”) and 50% short exposure to the MSCI Emerging Markets IMI Index (the “Short Component”).On a monthly basis, the Index will rebalance such that the weight of the Long Component is equal to 150% and the weight of the Short Component is equal to 50% of the Index value. In tracking the Index, the Fund seeks to provide a vehicle for investors looking to efficiently express a developed over emerging investment view by overweighting exposure to the Long Component and shorting exposure to the Short Component.

For more relative market trends, visit our Relative Value Channel.