While some have noted that the recent stock leadership has been too defensive in nature, it has been anything but that at the sector level, with cyclical sectors crushing defensive sectors by 11.58% in 2019 thanks primarily to Technology representing over a 30% weight in the cyclical basket.

Absent a material tightening of financial conditions or a deterioration in the restarted China-U.S. trade talks, we believe that cyclicals will remain in the driver’s seat for the remainder of the year even if total returns begin to moderate.

WHAT WE’VE SEEN

- With Tech’s over 30% return on the year, they have driven 40% of the outperformance of cyclicals relative to defensives. On the flip side, Health Care’s political-driven struggles leading it to be the worst performing sector was the second greatest contributor representing nearly 48% of defensives.

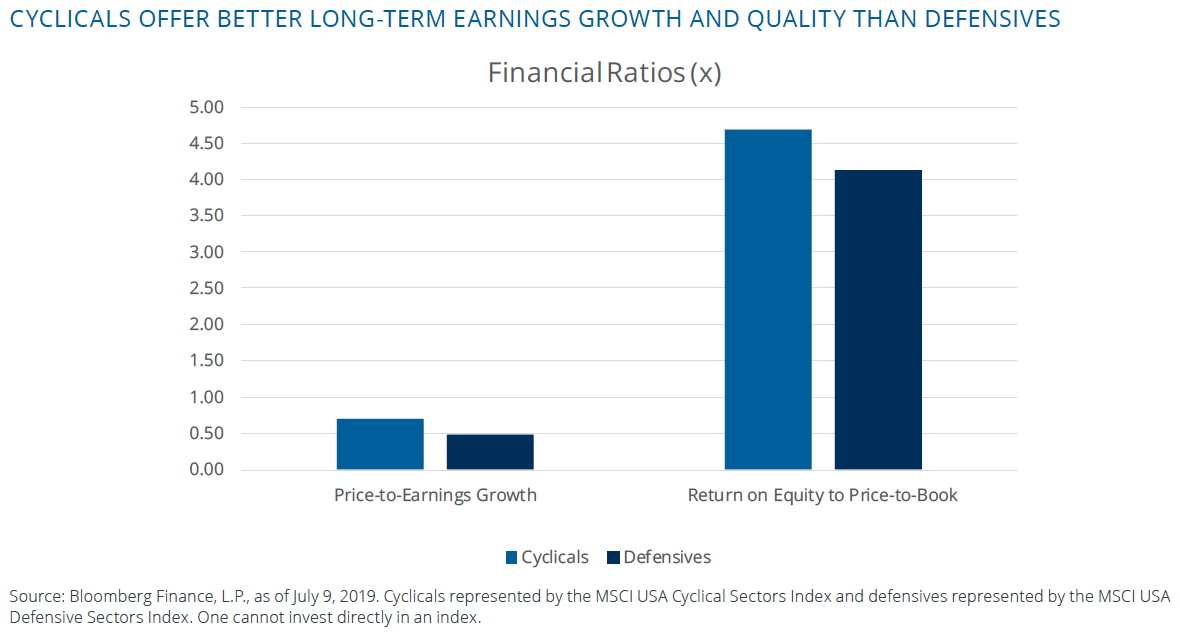

- From a ratio perspective, cyclical sectors offer better growth and quality characteristics even with higher valuations than Defensive Sectors. More specifically, both the Price-to-Earnings Growth and Return on Equity to Price-to-Book Ratios are higher implying that investors looking for quality growers in a low economic growth world may continue to find opportunities with cyclicals.

MONEY IN MOTION

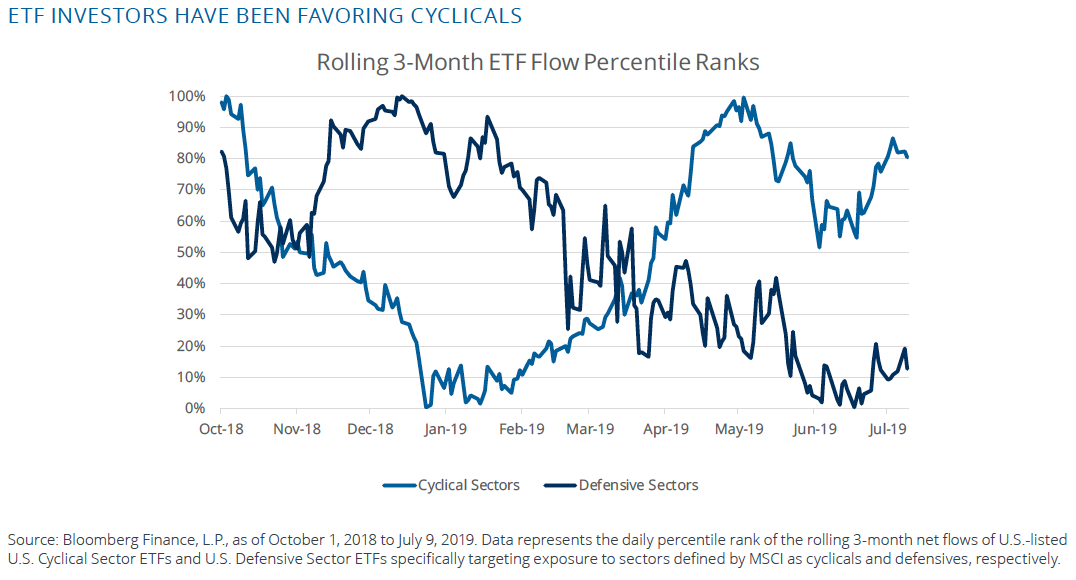

- Over the last 3 months, ETF investors have added $1.29 billion to cyclical sectors and redeemed $1.34 billion from defensive sectors. However, over the last month, defensive sectors have brought in $1.29 billion helping to cut into the large gap between the groups.

- However, the recent outflows in the Tech sector in June are notable. While we do not view this is a true rotation away from cyclical exposure, some gains have been taken off the table prior to the upcoming earnings season.

- To put recent flows into perspective, investors have generally favored cyclical sectors over defensive sectors since mid-April. This stands in sharp contrast to investor sentiment during Q4 2018 and the better part of Q1 2019 highlighting how much performance has driven flows.

WHAT’S NEXT?

After the last period when defensives beat cyclicals (Q1 and Q2 2016), cyclicals went on to outperform in 7 consecutive quarters. Using this period as a potential prologue, cyclicals have room to continue besting defensives after suffering for 3 quarters in a row last year.

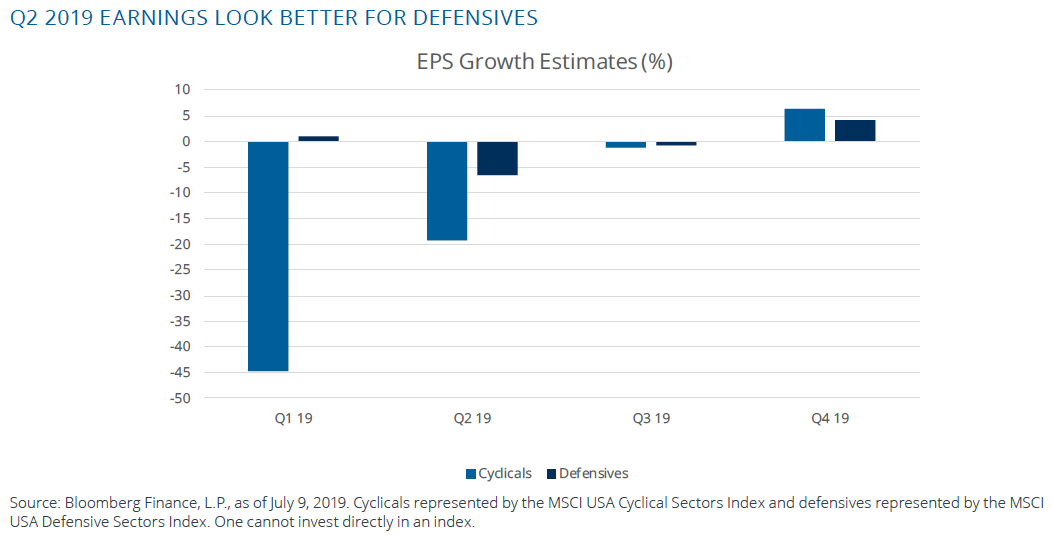

- Along with Real Estate and Communication Services, defensive sectors – Health Care and Utilities – are expecting to see positive EPS growth in Q2 2020; although, Consumer Staples and Energy are anticipated to be negative.

- On the other the hand, driven by pronounced margin compression in large Tech names, the near-term earnings picture does not look favorable for cyclical sectors. However, investors will likely look beyond Q2 and even Q3 as they anticipate the benefits of looser monetary policy and a potential pickup in economic data that historically boosts cyclicals on a relative basis.

IMPLEMENTATION IDEAS

IMPLEMENTATION IDEAS

- With 150% long exposure to cyclical sectors and 50% short exposure to defensive sectors, the Direxion MSCI Cyclicals Over Defensives ETF [RWCD] provides investors with a means to overweight cyclicals and underweight defensives in one fund.

- If investors do not believe in the thesis that cyclicals continue to have room for relative outperformance, the Direxion MSCI Defensives Over Cyclicals ETF [RWDC] offers investors a fund that overweights defensive sectors and underweights cyclical ones.

DEFINITIONS

- MSCI USA Cyclical Sectors Index: The MSCI USA Cyclical Sectors Index is based on MSCI USA Index, its parent index and captures large and mid-cap segments of the US market. The index is designed to reflect the performance of the opportunity set of global cyclical companies across various GICS® sectors. All constituent securities from Consumer Discretionary, Financials, Industrials, Information Technology and Materials are included in the Index.

- MSCI USA Defensive Sectors Index: The MSCI USA Defensive Sectors Index is based on MSCI USA Index, its parent index and captures large and mid-cap segments of the US market. The index is designed to reflect the performance of the opportunity set of global defensive companies across various GICS® sectors. All constituent securities from Consumer Staples, Energy, Healthcare, Telecommunication Services and Utilities are included in the Index.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-476-7523 or visit our website at direxioninvestments.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Shares of the Direxion Shares are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 pm EST (when NAV is normally calculated) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense reimbursements or recoupments and fee waivers in effect during certain periods shown. Absent these reimbursements or

recoupments and fee waivers, results would have been less favorable.

Direxion Relative Weight ETFs Risks – Investing involves risk including possible loss of principal. The Funds’ investments in derivatives may pose risks in addition to, and greater than, those associated with directly investing in or shorting securities or other investments. Investing in, and/or having exposure to, foreign instruments may involve greater risk than investing domestic instruments. The Funds’ returns and net assets may be affected largely by fluctuations in currency exchange rates, political, diplomatic or economic conditions and the regulatory requirements of foreign countries which typically are not as strict as in the U.S. There is no guarantee that the returns on the Funds’ long or short positions will produce high, or even positive returns and a Fund could lose money if either or both of the Fund’s long and short positions produce negative returns. Please see the summary and full prospectuses for a more complete description of these and other risks of the Funds.

Distributor for Direxion Shares: Foreside Fund Services, LLC.