While confidence is far from restored in emerging markets (EM) assets given the effects of the coronavirus, some investors may be looking for value opportunities in the EM space amid the current panic selling. However, before investors go bargain hunting, they need to exercise some discipline as opposed to allocating their capital blindly.

In an interview with Institutional Investor, Arup Datta, Head of Global Quantitative Equity at Mackenzie Investments, discussed how EM provides the perfect backdrop for quantitative strategies. This same lens could be applied for investors looking for EM opportunities while assets are cheap.

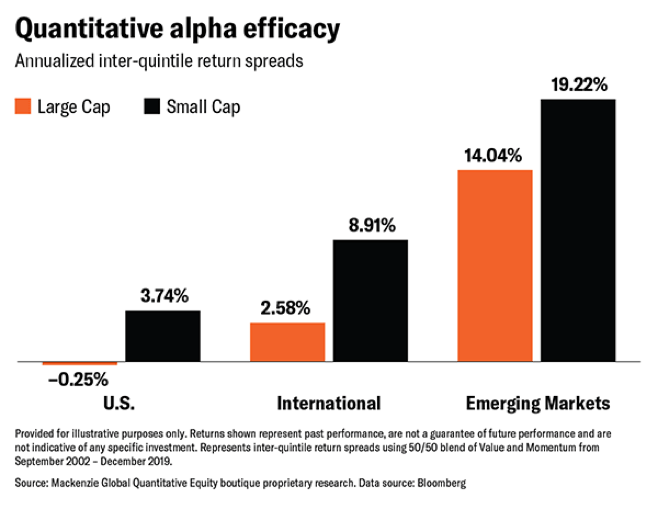

“First, it’s a less efficient market than the rest of the world, and there’s also less competition than there is in U.S. large cap,” said Datta. “Both of those facts should lead to more alpha for either fundamental investors or quants. However, we believe it’s the breadth of names in emerging markets that plays into the strengths of quantitative strategies.”

“For example, in our investible emerging market universe we cover about 6,000 stocks that we rank on a daily basis,” Datta added. “It’s very hard for a fundamental manager to do that – I don’t know of any fundamental manager that can. Breadth is your friend, and you can leverage computing power and your models to cover more stocks pretty easily. I believe that’s why, historically speaking, quants have delivered good alpha in emerging markets.”

Investors looking at EM must also be aware of the volatility these equities can exhibit, especially given the latest market reactions to the coronavirus.

“Everyone knows that emerging markets are more volatile stocks than, say, U.S. large cap,” Datta said. “Risk models are relevant everywhere, but become even more relevant in an area like EMs where the stocks you trade move around more than in other areas. A good quant manager builds its own proprietary risk model – we don’t just rely on standard providers. We build our own risk model that is attuned to our process and can better determine the risk in our portfolios. It’s much more finely honed in terms of how we position size a name. Once we like a name, we use our algorithm to determine how much we can buy of that name.”

For investors looking for the continued upside in emerging market assets as the effects of the coronavirus weaken in China, the Direxion MSCI Emerging Over Developed Markets ETF (NYSEArca: RWED) offers them the ability to benefit not only from emerging markets potentially performing well, but from emerging markets outperforming developed markets.

RWED seeks investment results that track the MSCI Emerging Markets IMI – EAFE IMI 150/50 Return Spread Index. The Index measures the performance of a portfolio that has 150 percent long exposure to the MSCI Emerging Markets IMI Index and 50 percent short exposure to the MSCI EAFE IMI Index.

For more relative market trends, visit our Relative Value Channel.