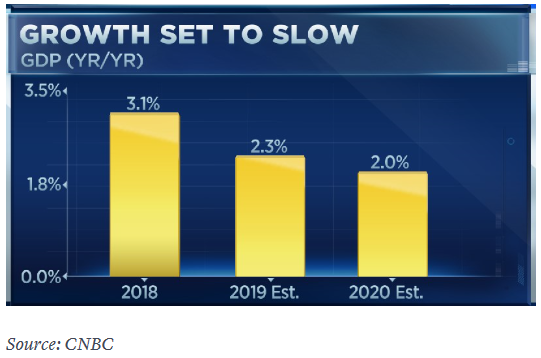

The Federal Reserve didn’t instill much confidence in the capital markets on Tuesday after results from a survey of central bank respondents revealed that gross domestic product is expected to slow to a 2.33 percent rate of growth this year after initially forecasting 2.44 in January.

The 2.33 GDP growth reading is also lower than that of the current growth rate of 3.1 during the fourth quarter of 2018. Things aren’t looking much better for 2020 as survey respondents are expecting GDP to grow under 2 percent.

The reason for the lower reading primarily stems from slower global growth and tariffs. With the U.S. and China working to produce a permanent trade deal, this could be the trigger event to give the central bank more confidence in economic growth.

The reason for the lower reading primarily stems from slower global growth and tariffs. With the U.S. and China working to produce a permanent trade deal, this could be the trigger event to give the central bank more confidence in economic growth.

“If Trump wants to be a two-term president, he needs to make a China trade deal and start lowering tariffs across the board,” said Hank Smith, co-chief investment officer of Haverford Trust. “This will cause business confidence to rise and capital spending to increase, stimulating the economy.”

On the topic of trade, the majority of respondents are expecting a U.S.-China trade deal to materialize this year. 79 percent of respondents are expecting a deal, while 2 percent foresee a new round of tariffs and 17 percent expect tariffs to continue at their current pace.

Related: Slower Economy Could Benefit Growth ETFs

The high number of respondents expecting a deal could allude to the gain in U.S. equities this far already pricing in a deal.

“Ultimately … we feel a trade deal can be accomplished that neither party will love nor hate,” said Richard D. Steinberg, chief investment officer of Steinberg Global Asset Management.

Other factors could also be weighing in on the economy as the Labor Department recently said that 20,000 jobs were added in February, falling well below a Dow Jones poll of economists who were expecting 180,000. It marked the weakest month of job creation since September 2017, stoking more fears of a global economic slowdown.

ETFs to Consider

Will a U.S. slowdown allow international equities to gain the upper hand through 2019?

For investors looking for continued upside in U.S. equities over international equities, the Direxion FTSE Russell US Over International ETF (NYSEArca: RWUI) offers them the ability to benefit not only from domestic U.S. markets potentially performing well, but from their outperformance compared to international markets.

Conversely, if investors believe that international markets will outperform U.S. domestic markets, the Direxion FTSE International Over US ETF (NYSEArca: RWIU) provides a means to not only see international markets perform well, but a way to capitalize on their outperformance compared to the U.S. markets.

For more market trends, visit ETF Trends.