Meb Faber, the CEO and Chief Investment Officer of Cambria Funds, has put together a blog summary of his 104-tweet tweet-storm, focused on thoughts surrounding global investing. Titled, “The Case for Global Investing,” the blog looks at Faber’s six favorite 2019 research pieces on global investing, and it’s plenty more succinct for all.

These pieces include the investing book, “Triumph of the Optimists,” which has provided yearly updates summarizing the long-run returns on stocks, bonds, bills, inflation, and currency in 26 global markets for decades. Faber also highlights a podcast with Business Professor Elroy Dimson, which goes over the potential result of high valuations.

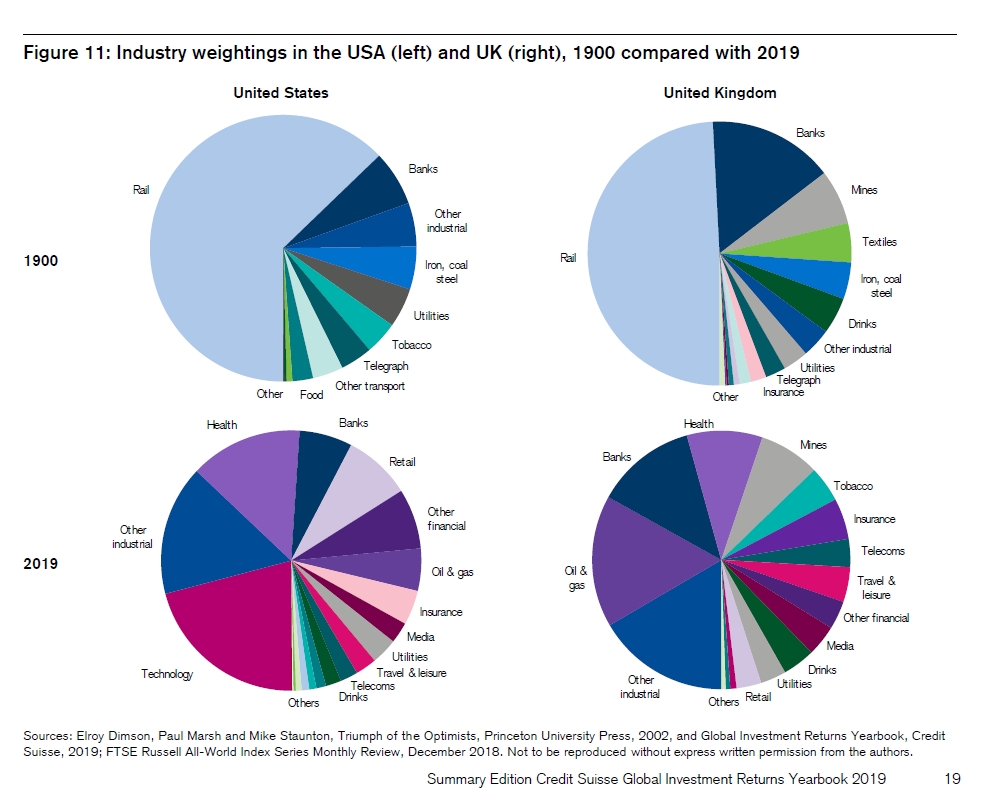

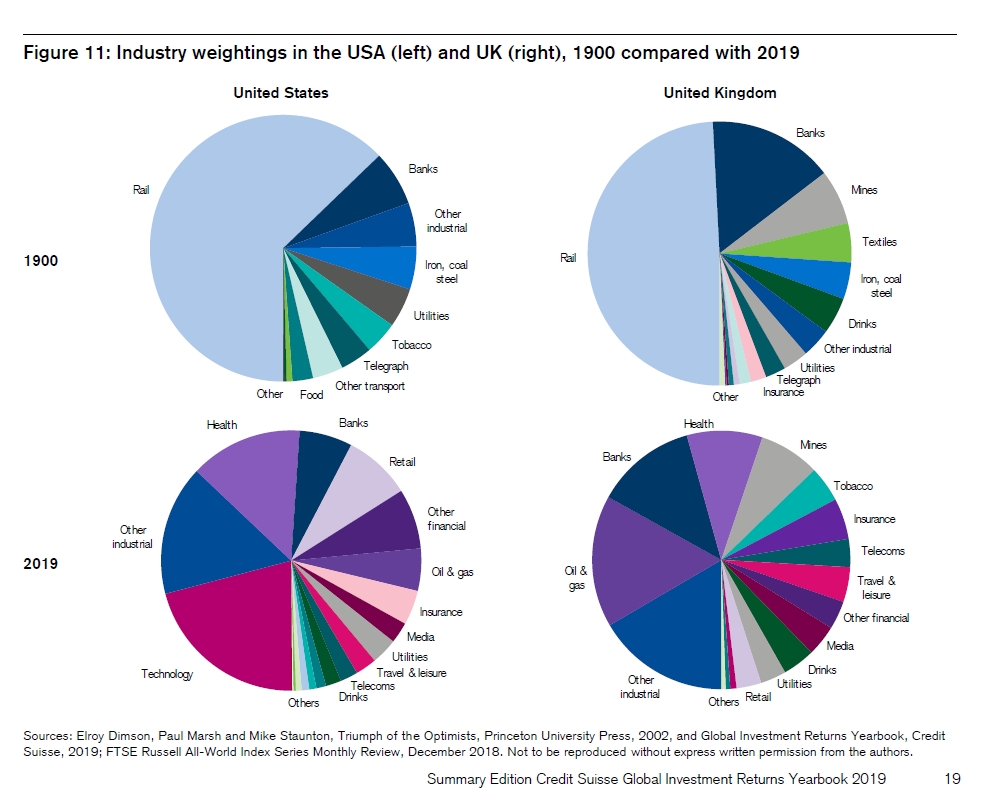

Several charts featured in the blog post also tell a story concerning the state of the global stock market back in 1900 versus where things are today. For example:

Many other charts, graphs, and stats are scattered throughout Faber’s blog, highlighting the nature of change in the market over the decade when it comes to aspects such as return revenue rates, inflation, the market capitalization of various indices, and geographic portfolio exposure. There are also breakdowns of these graphics to highlight where the changes are, and what to consider today.

Fortunately, even if a more organized version of Faber’s tweet-storm still proved to be a lot to comprehend, he has also summarized some key points regarding global investing into four bullet points:

- Diversifying globally can save your butt

- Investors should start with global market allocation (50% US / 50% Foreign) for full opportunity set and breadth

- Consider adding value tilts (This is uncomfortable for some)

- Relax and sleep tight

Faber is a co-founder and the Chief Investment Officer of Cambria Investment Management; he is a manager of Cambria’s ETFs and separately managed accounts. Faber has authored numerous white papers and books. He is a frequent speaker and writer on investment strategies and has been featured in Barron’s, The New York Times, and The New Yorker. He graduated from the University of Virginia with a double major in Engineering Science and Biology.

For more market trends, visit ETF Trends.