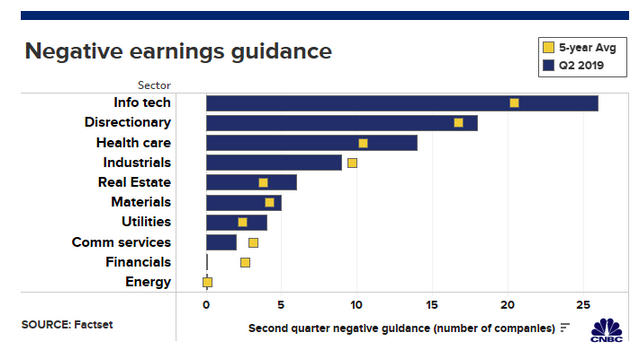

U.S. equities reached record highs to kick off the trading week ahead of Independence Day, but the fireworks could be short-lived when second-quarter earnings reports begin to flood the markets in mid-July. Wall Street analysts are bracing for weaker-than-expected earnings results, particularly when 77% of the 113 companies that have issued earnings per share guidance are expecting earnings to shrink, according to FactSet data.

“The harsh reality is data is going to impact sentiment,” said Michael Yoshikami, founder of Destination Wealth Management. “I don’t think it’s something that can be ignored. Even though markets are at all-time highs, the economy is definitely slowing.”

A possible play could be for international equities strength over U.S. equities when earnings begin to roll out. The Direxion FTSE International Over US ETF (NYSEArca: RWIU) gives investors the opportunity to capitalize on their hunch that international equities will outdo U.S. equities.

“Stocks are priced for perfection. You haven’t seen too much suffering yet, but it’s kind of incipient. It’s creeping into the numbers little by little,” said Mitchell Goldberg, president of ClientFirst Strategy. “When stocks are priced for perfection, even little things become insurmountable.”

“If you’re worried about earnings, you should be taking some chips off the table,” Goldberg said. “We’ve had a real nice rally this year. I wouldn’t be surprised if we had a pullback.”

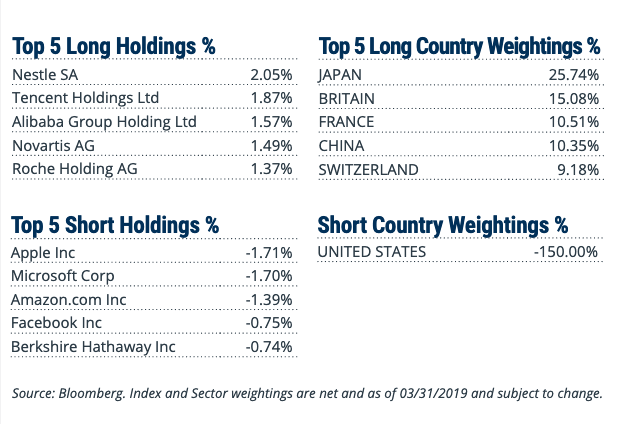

RWIU seeks investment results, before fees and expenses, that track the FTSE All-World ex US/Russell 1000 150/50 Net Spread Index. The FTSE All-World ex US/Russell 1000® 150/50 Net Spread Index (R1AWXUNC) measures the performance of a portfolio that has 150% long exposure to the FTSE All-World ex US Index and 50% short exposure to the Russell 1000® Index.

On a monthly basis, the Index will rebalance such that the weight of the Long Component is equal to 150% and the weight of the Short Component is equal to 50% of the Index value. In tracking the Index, the Fund seeks to provide a vehicle for investors looking to efficiently express an international over domestic investment view by overweighting exposure to the Long Component and shorting exposure to the Short Component.

On the flip side, for investors sensing continued upside in U.S. equities over international equities, the Direxion FTSE Russell US Over International ETF (NYSEArca: RWUI) offers them the ability to benefit not only from domestic U.S. markets potentially performing well, but from their outperformance compared to international markets.

For more relative market trends, visit our Relative Value Channel.