Lumber prices continue to climb, bolstering sawmill owners and timber sector-related exchange traded funds.

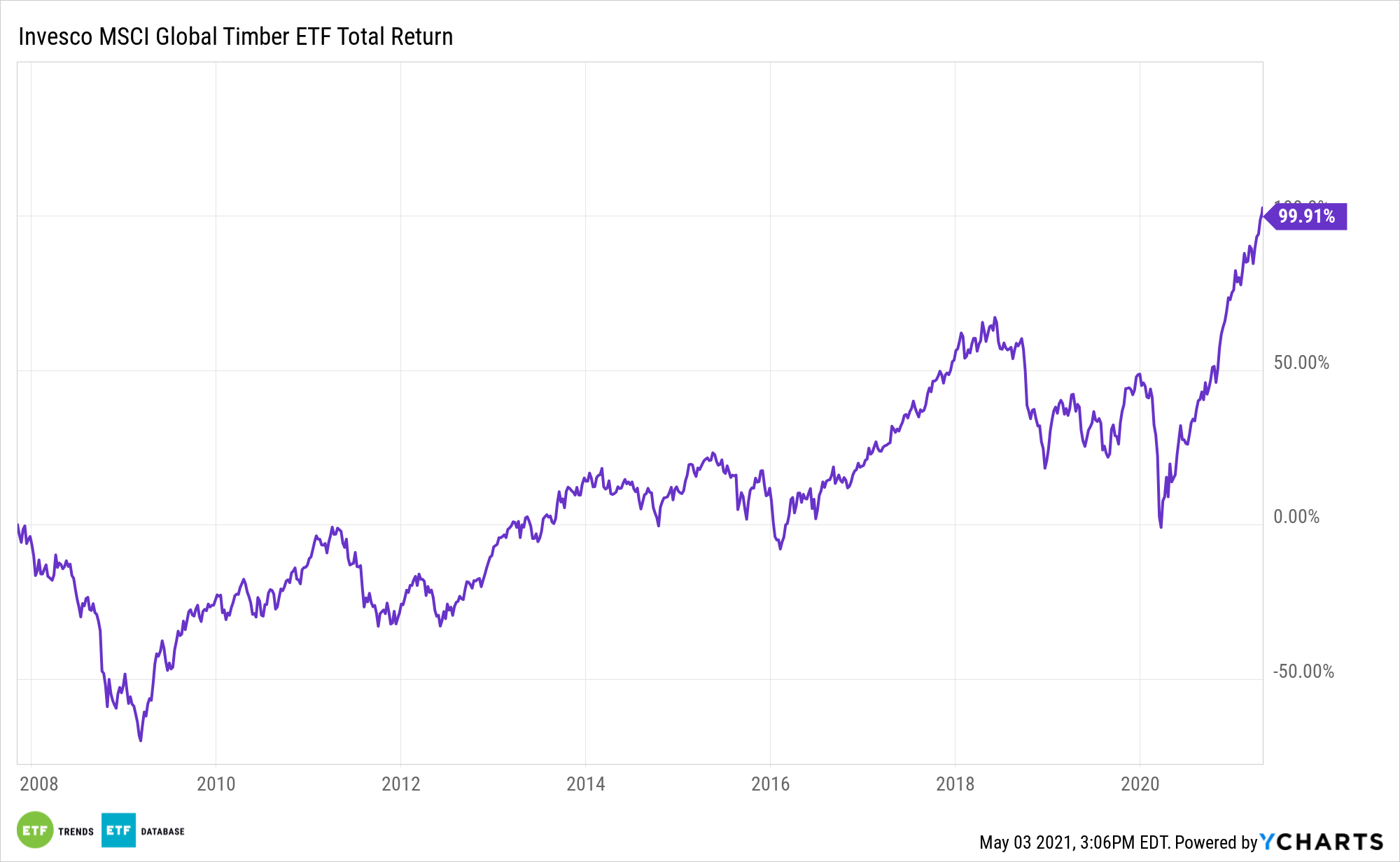

Year-to-date, the iShares Global Timber & Forestry ETF (WOOD) has increased 15.3%, while the Invesco MSCI Global Timber ETF (CUT) has gained 13.8%.

While wood prices grew into record territory last week, sawmill owners in the timber industry like Weyerhaeuser Co. and Canfor Corp. are expected to generate even larger profits than the record earnings they have been reporting for the first three months of 2021, the Wall Street Journal reports.

Sawmills have become the biggest beneficiaries of the wood market rally. The companies are capitalizing on a glut of cheap pine trees in the U.S. South. Meanwhile, demand for finished products like lumber and plywood has surged amid the recent boom in the housing market and refurbishing business.

“Builders are reporting record home sales, and they’re going to need that wood to build those homes,” Eric Cremers, chief executive of PotlatchDeltic Corp., said.

Lumber futures for May delivery are now hovering around an all-time high and about four times the typical price for this period of the year. Furthermore, lumber futures have hit their daily maximum allowed price change by the Chicago Mercantile Exchange for nine of the last 17 trading sessions.

“Nervousness on the part of many traders was palpable, as they considered what the downside of the run might look like,” Random Lengths said in its weekly report.

Random Lengths noted that prices for two-by-fours and other wood products have hit record highs as well. Without any alternatives, traders gave into the sky high prices. Mill owners have pointed to their backed up orders that extend out to June.

“Absent a significant increase in mortgage rates or a Covid resurgence, it is hard to imagine what could cause lumber demand to drop and prices to moderate in the foreseeable future,” Cremers said.

For more news, information, and strategy, visit ETF Trends.