By: BCM Investment Team

Pricing pressures continue to plague manufacturers as supply chain issues persist and activity eases off highs, though the Richmond Fed Manufacturing Index remains firmly in growth territory. Economists continue to speculate about if/when these price increases will filter through to consumers, and currency developments have us wondering how much of that consumer base could be international. And as many investors chase top performers—often to their own detriment—inflation anxiety continues to make its presence felt in the markets, though it does appear to be easing somewhat. Are you aware of how different asset classes typically behave in varying inflationary environments? And as volatility continues in the crypto market amid talk of increased regulation out of China—Bitcoin climbed back above $40,000 after dramatic weekend losses—what regulatory approach are other major governments taking?

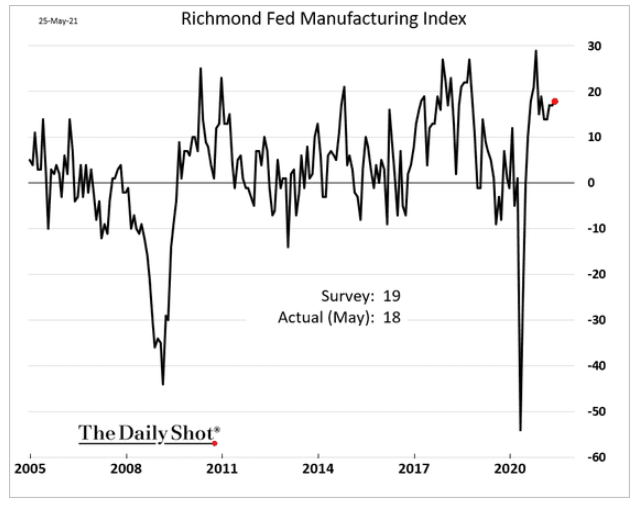

- The regional Fed surveys, while off their pandemic-bounce highs, continue to indicate robust manufacturing activity:

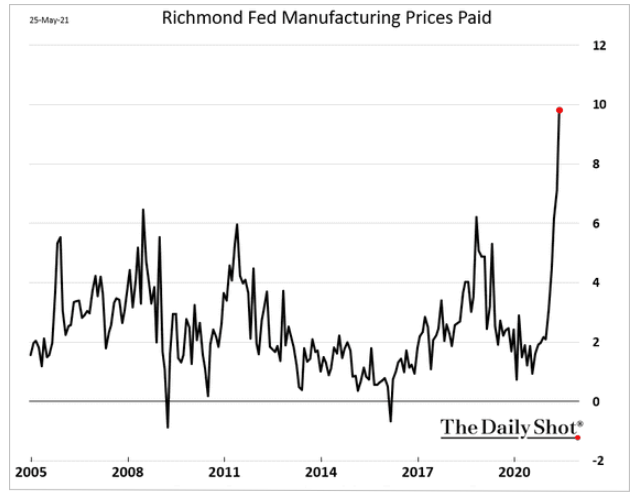

- Costs of goods sold continue to rise due to pent-up demand and supply shortages. Will these price increases get passed through to consumers?

- Chinese currency strength should be helping with the trade deficit…

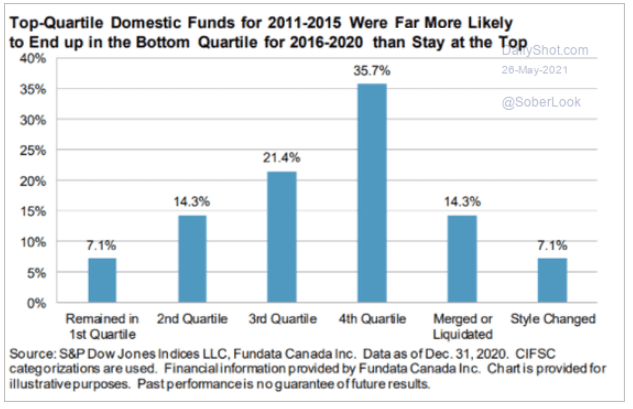

- Driving by using the rear-view mirror doesn’t make sense, why invest this way? Slow and steady can get investors to reach their goals…

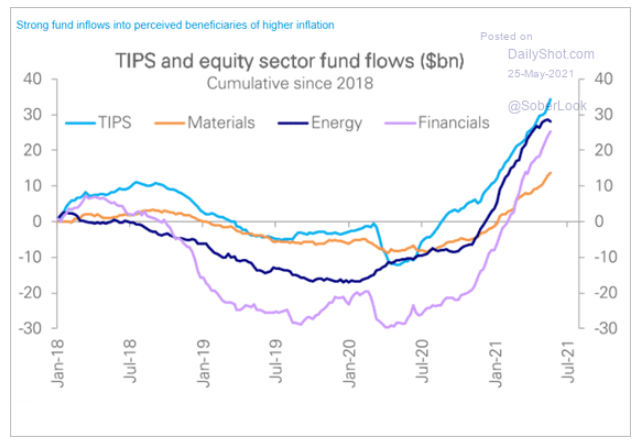

- Those worried about inflation have been investing accordingly:

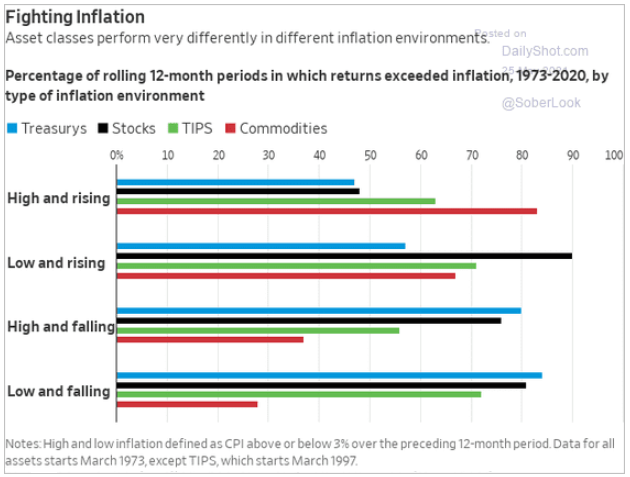

- Historic inflation and its effect on some major asset classes:

- Interesting. As inflation fears grew, gold retreated. Now that inflation fears are subsiding, gold is rising again…

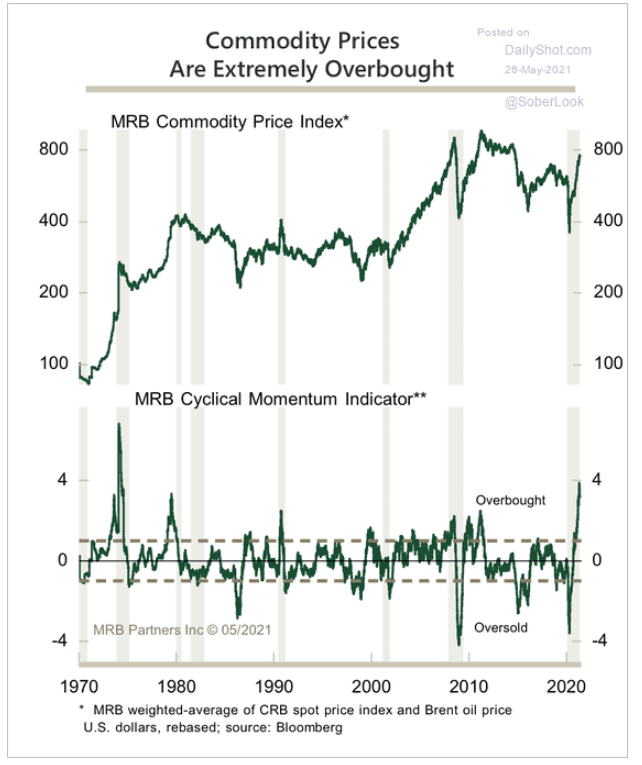

- While this data is as of May, it is a nice historical gauge. We note many commodity prices have retreated since…

- An update on how governments view crypto:

This article was contributed by Beaumont Capital Management Investment Team, a participant in the ETF Strategist Channel.

For more insights like these, visit BCM’s blog at blog.investbcm.com.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are they a recommendation to take any action. Individual securities mentioned may be held in client accounts. Past performance is no guarantee of future results.