Economic indicators are released every week to help provide insight into the overall health of the U.S. economy. In this article, we cover three of the most important economic releases from the past week: the BLS employment report, job openings and labor turnover (JOLTS), and the ADP employment report. These data points yield valuable insights into the health of the labor market and by extension, the overall economy.

Policymakers and advisors monitor economic indicators such as these to understand recession risk and the direction of interest rates. The data can significantly impact business decisions and financial markets. In the week ending on July 6th, the SPDR S&P 500 ETF Trust (SPY) rose 0.35% while the Invesco S&P 500® Equal Weight ETF (RSP) was down .12%.

Employment Report

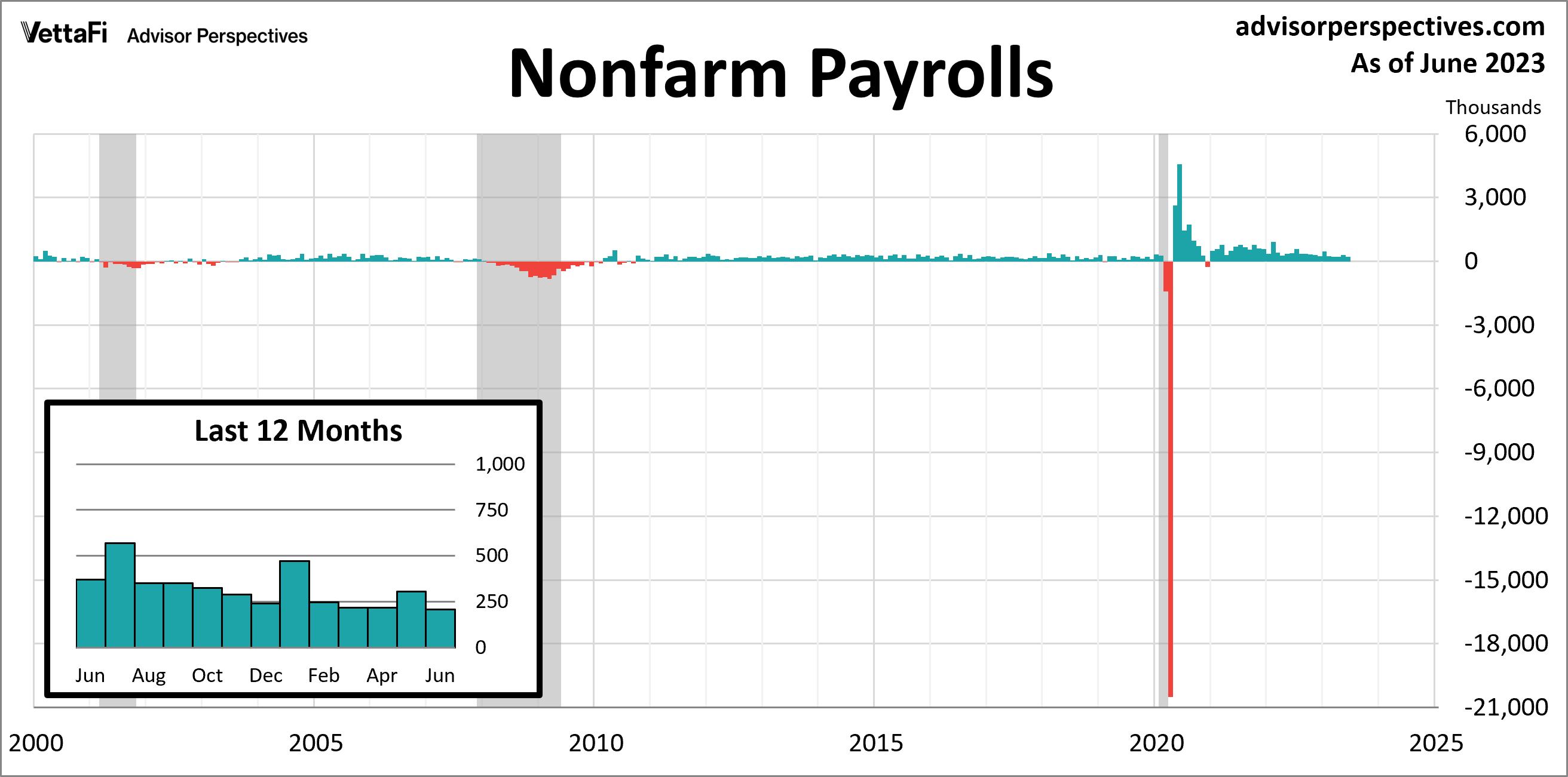

The labor market added jobs for the 30th consecutive month in June but showed signs of easing. The June employment report revealed 209,000 jobs were added last month, less than the expected 235,000 addition. June’s jobs numbers were the smallest monthly increase since December 2020. In addition, the report indicated that the unemployment rate ticked down to 3.6%, while wage growth remained stable at 4.4%. The labor force participation rate also held steady at 62.6% for the fourth consecutive month. Overall, the jobs report provides a glimmer of hope that the Federal Reserve’s efforts to combat inflation are yielding results. Still, the labor market remains resilient, and future rate hikes remain a distinct possibility.

Job Openings and Labor Turnover (JOLTS)

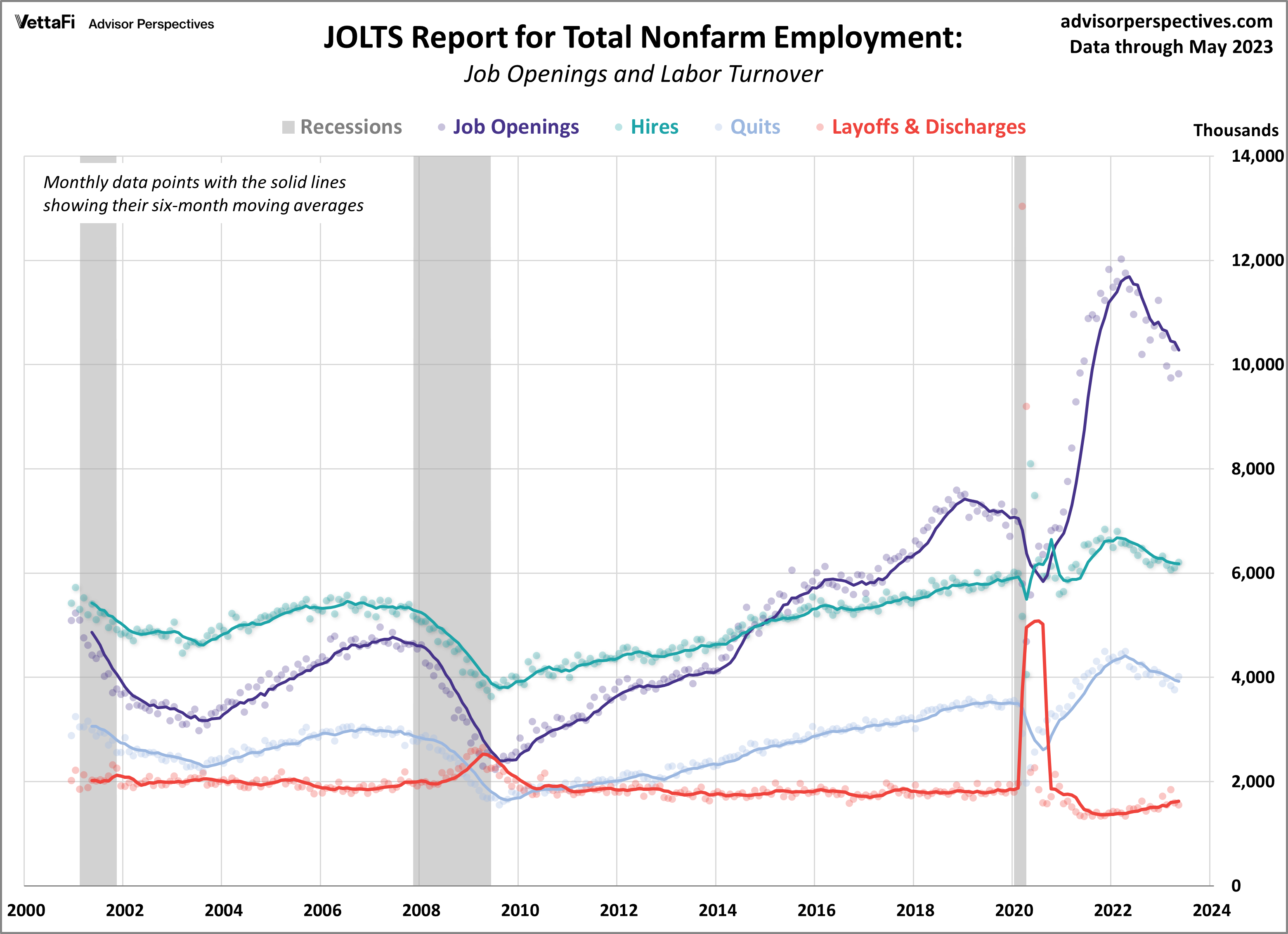

The May JOLTS report revealed that the labor market is cooling but remains hot. In May, job openings fell by almost half a million from the previous month, reaching 9.824 million. While economists anticipated a decrease, the actual figure was even lower than the expected 9.935 million vacancies. Other key data points from the report showed that the number of hires and layoffs were little changed at 6.2 and 1.5 million, respectively. Quits rose to 4.0 million. A rise in quits often means workers feel confident about leaving their position for a better opportunity and pay.

The JOLTS data helps gauge labor demand and an imbalance between worker demand and supply could potentially result in upward pressure on inflation. While the latest report shows signs of a cooling labor market, there are still 1.61 jobs available per unemployed worker and job openings are still well above pre-pandemic levels.

ADP Employment Report

The U.S. labor market remains strong as private sector job growth unexpectedly surged in June. The ADP employment report revealed 497,000 private jobs were added last month, an increase from the 267,000 private jobs added in May. The latest figure was more than twice the forecast of 228,000. This reinforces the resilience of the labor market in the face of the Fed’s rate hikes and the ongoing risk of recession. The growth last month was led by strong gains in consumer-facing services such as leisure and hospitality, trade and transportation, and education and health services.