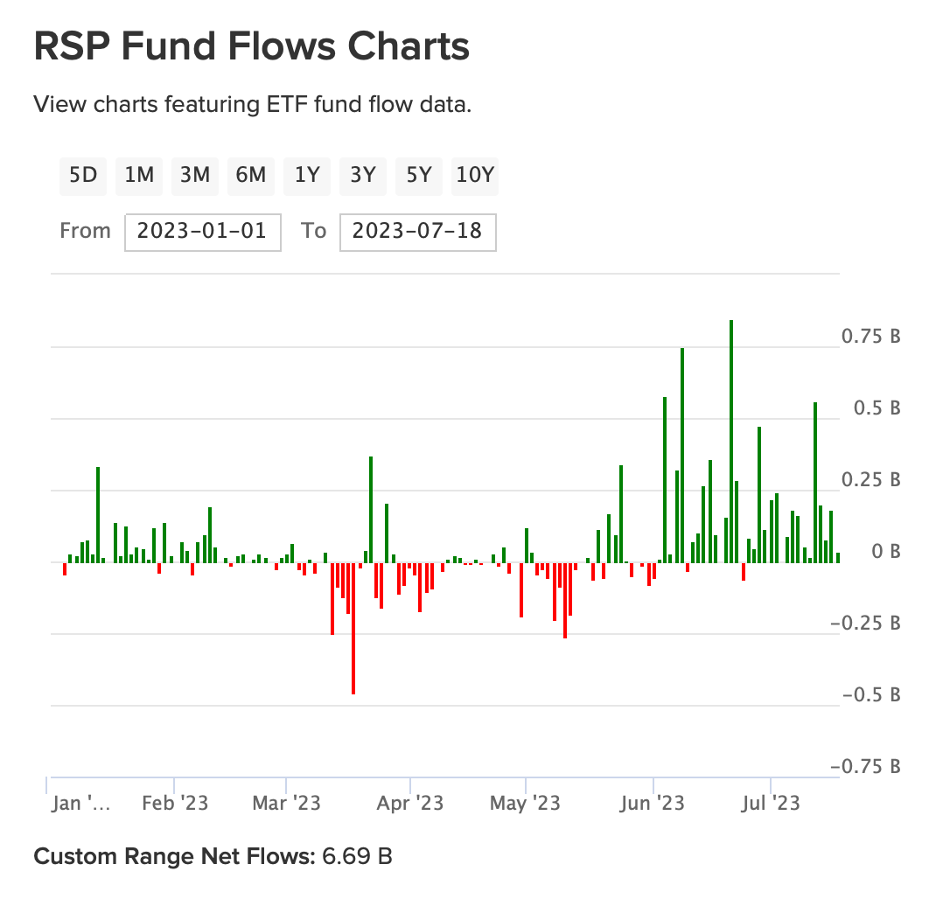

The Invesco S&P 500® Equal Weight ETF (RSP) has seen a tremendous rebound in net flows in recent weeks.

Equal-weight strategies effectively remove size bias from a portfolio. This offers more protection if a large company or sector experiences a downturn. Conversely, equal weighting is positioned to lag when a small number of mega-caps contribute most of the performance.

As of July 18, RSP has accreted $6.5 billion in net flows since June 1. Year-to-date, the fund has garnered $6.7 billion in net flows.

The spike in June flows comes after RSP accreted just $180 million in net flows during the first five months of the year. RSP has $42 billion in assets under management, making it the largest equal-weight ETF available to investors.

See more: “When Does Equal Weight Outperform?”

Why Invest in RSP Now?

Equal-weight strategies look particularly appealing right now, as concentration reached historically high levels during the second quarter. Concentration has historically normalized after periods of high concentration, which benefits equal-weight strategies.

While cap-weighted indexes continue to allocate to past winners, equal weight has an anti-momentum tilt. RSP gives every security in the S&P 500 an equal weight at each quarterly rebalance, providing more exposure to more companies down the cap spectrum and reducing exposure to the largest mega-caps.

The methodology of selling relative winners and buying relative losers adds the small size and value factor tilts to a portfolio.

The value and small size factors tend to do well during accelerating economic growth and falling risk — either falling equity volatility or falling credit spreads, according to Nick Kalivas, head of factor and core equity product strategy for Invesco.

Kalivas said that when there is decelerating growth, there is rising risk and widening credit spreads. This kind of environment acts as a headwind for the size and value factors. Typically, when the market is falling, equal weight will fall faster. Conversely, when the market is recovering, equal weight will rise more quickly.

For more news, information, and analysis, visit the Portfolio Strategies Channel.