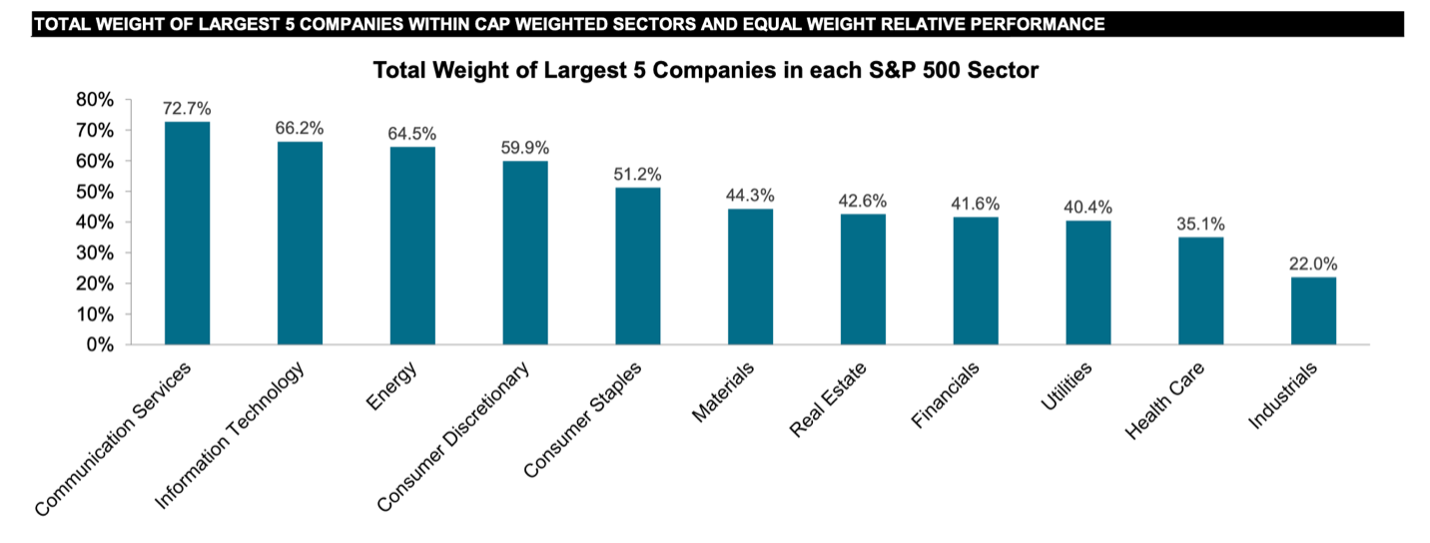

The sectors that have the highest concentration in the largest five companies can benefit most from an equal-weight strategy.

An equal-weight strategy can reduce concentration risk in portfolios. By weighting each constituent company equally, a small group of companies is not able to have an outsized impact on the index.

The five sectors with the greatest total weight of the largest five companies include communication services, information technology, energy, consumer discretionary, and consumer staples. Conversely, the sectors with the lowest concentration in the largest five names are industrials, healthcare, and financials, according to S&P Dow Jones Indices.

Notably, the total weight of the largest five companies in the communication services, information technology, energy, and consumer discretionary sectors have increased meaningfully in recent months.

How to Get Balanced Exposure

Investors can use equal-weight strategies for more balanced exposure to sectors with the highest concentration risk. These strategies include the Invesco S&P 500 Equal Weight Communications Services ETF (EWCO), the Invesco S&P 500 Equal Weight Energy ETF (RYE), the Invesco S&P 500 Equal Weight Technology ETF (RYT), the Invesco S&P 500 Equal Weight Consumer Discretionary ETF (RCD), and the Invesco S&P 500 Equal Weight Consumer Staples ETF (RHS).

The simple arithmetic of rebalancing connects equally weight strategies to anti-momentum effects. If the price of a constituent increases by more than the average of its peers, its weight will increase. Therefore, the position will be trimmed at the next rebalance as the portfolio returns to equal weights.

Conversely, if a stock falls by more than the average of its peers, its weighting will fall too. The index will add more weight to the security at the next rebalance. Thus, equal-weight indexes sell relative winners and purchase relative losers at each rebalance, adding a value tilt to portfolios.

For more news, information, and analysis, visit the Portfolio Strategies Channel.