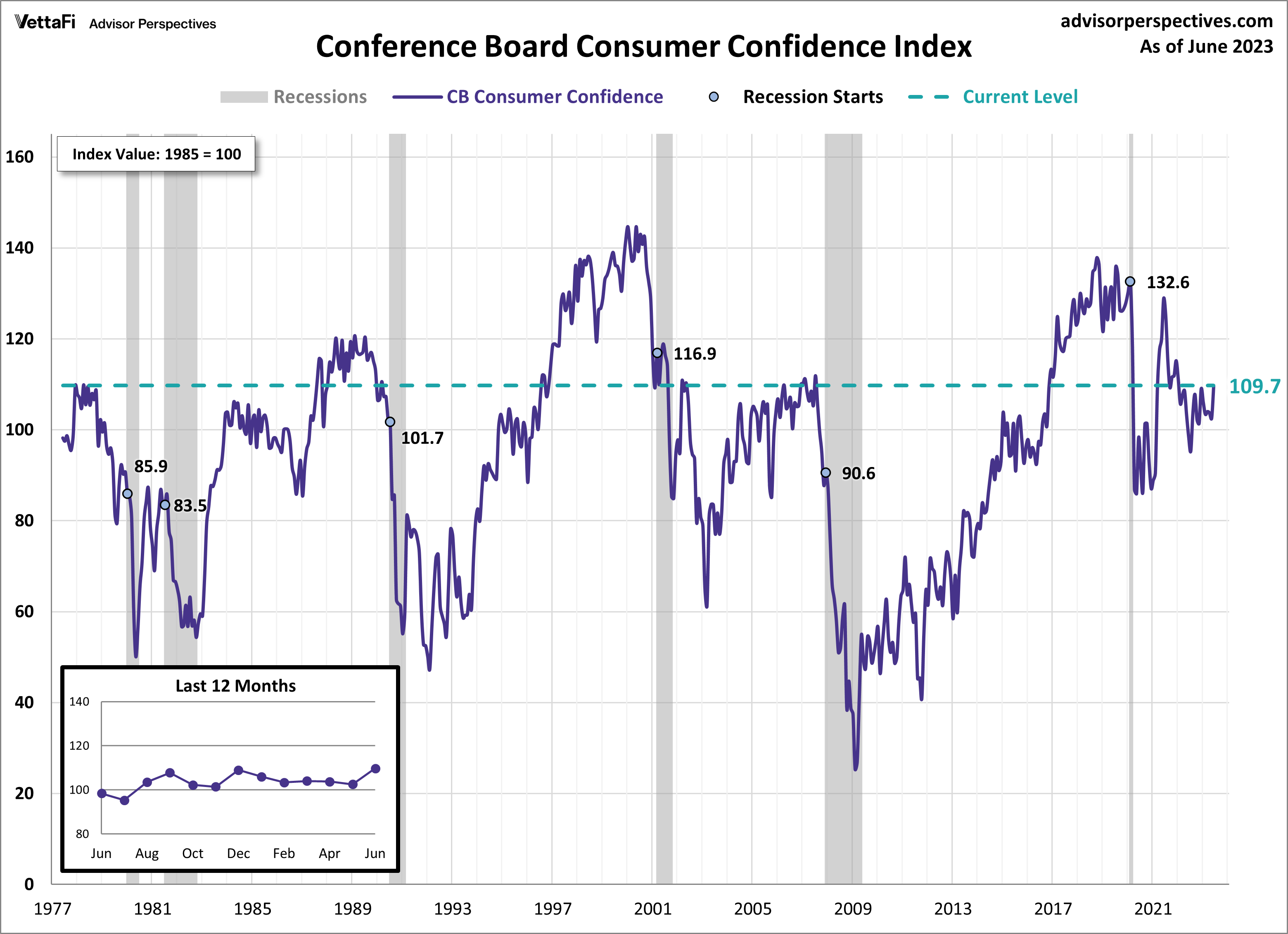

This week the VettaFi Voices discuss what lies ahead for the U.S. economy and U.S. markets. Consumer confidence ticked up significantly from 102.5 in May to 109.7 in June. It hasn’t been this high since the first month of 2022. A day after that news was released, Jerome Powell said there were likely more rate hikes ahead. That’s largely because of the relentless strength of the U.S. labor market. Inflation data right now seems uncertain — is it cooling or not? The Conference Board LEI is apparently indicating a recession. However, quite a few market participants say we may have dodged it — at least for now. Also, SPY is up 15% as we head into the end of the first half. The data is all over the place. Is there any consensus to be found among the VettaFi Voices as to what we can expect?

Todd Rosenbluth, director of research: VettaFi held a webcast with WisdomTree experts for advisors this week. It asked, “Will the Fed push the economy into a recession?” Sixty-one percent of respondents chose “Yes, we may be in one already.” Only 39% chose “No, the soft landing will be achieved.” I don’t know [if] I agree with the majority, but that might be more hopefulness. Inflation has cooled, and it seems likely the Fed only paused its rate hiking program. It will likely raise rates further, not cut them in the second half.

However, in June, we saw investors return to putting fresh money into equity ETFs on optimism for the second half of 2023. The Vanguard 500 ETF (VOO) had pulled in $5.6 billion alone and now has $14 billion for the year.

Mega-Cap Performance Fading

But there’s also demand for the Invesco S&P 500 Equal Weight ETF (RSP). The equal-weight version of the 500 has pulled in over $4 billion. I view RSP demand [as supporting the idea]that investors believe the mega-caps that drove the market for much of the year will continue to give way to other large-caps. This does not feel like recessionary times in the stock market. There’s market breadth. 417 stocks in the S&P 500 were up in June. The economically sensitive sectors — industrials and materials — are leading the charge.

Jen Nash, economic and market research analyst: Like Todd, I tend to lean away from the majority of respondents to that poll question. But I wouldn’t say I’m 100% convinced we aren’t already in a recession.

When you break down the June reading of the Conference Board’s consumer confidence index, the expectations index is still below the level associated with a recession within the next year, meaning most consumers are still anticipating a recession at some point over the next six to 12 months. With that being said, consumers are feeling optimistic about labor market conditions. They are also hopeful that inflation will continue to decline. Compared to other recessions, the current reading is not recessionary.

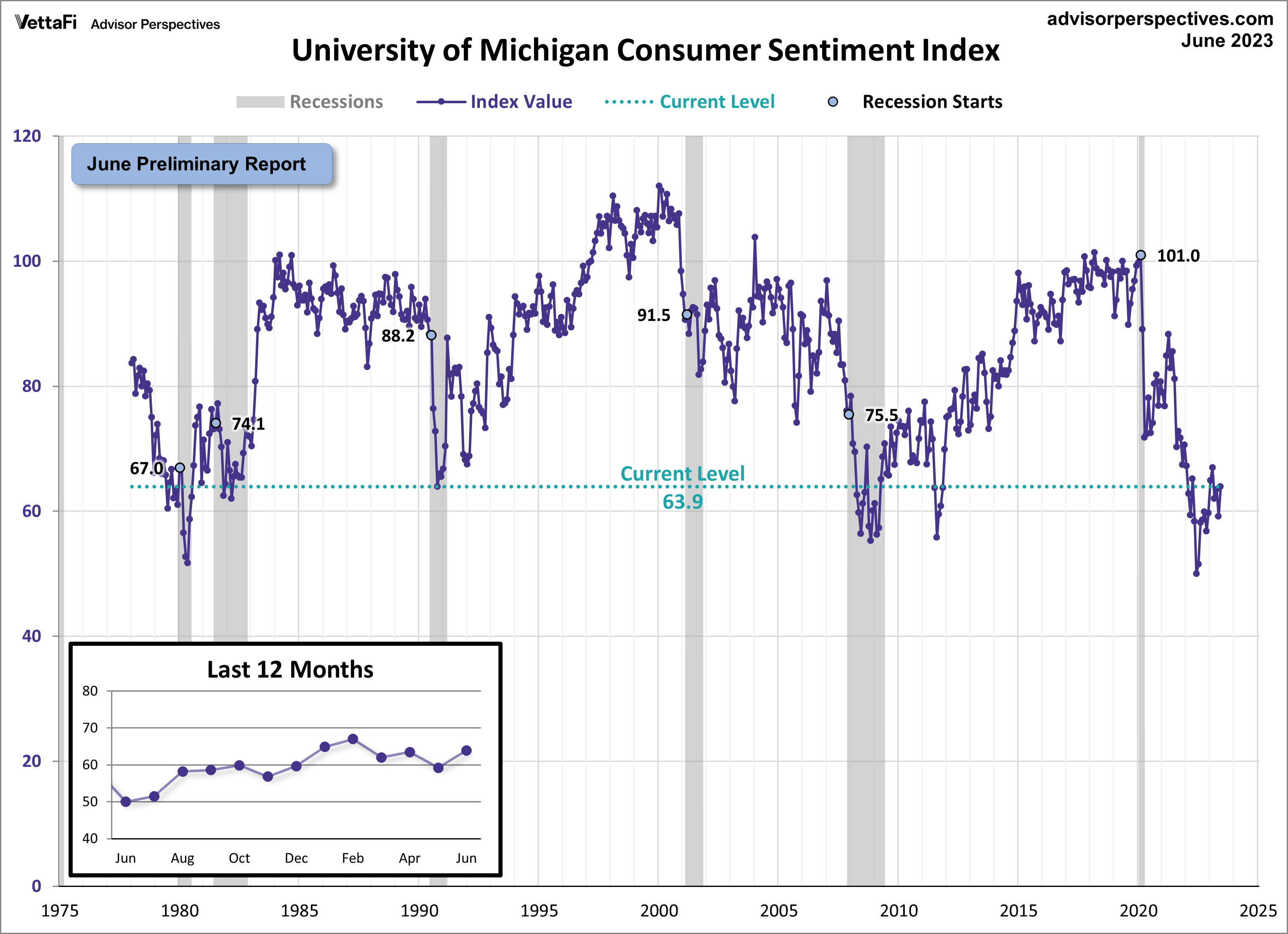

While we are on the subject of consumer attitudes, I’d like to discuss the Michigan Consumer Sentiment Index. The preliminary reading for June showed the index rose to its highest level in the past four months. That’s mainly due to consumer optimism that inflation is easing. However, the current reading of 63.9 is still historically low for the index and is sitting at recessionary levels. The final reading for June will come out tomorrow.

Digging Into the Data

Even if the final reading comes in higher than the preliminary, we would still be hovering at recessionary levels. I believe the index would need to reach an even higher level than it did in February for the non-recession argument to be considered when it comes to this indicator.

It seems like the two sentiment indicators above might be telling different stories. However, the common theme between them is that consumers are feeling inflation ease. Despite CPI and PPI dropping in May, the inflation situation is unclear. I believe inflation is cooling, just at a prolonged rate. The Fed’s preferred measure of inflation is the core PCE price index. We will get the latest numbers Friday, but the current forecast shows that it’s expected to remain at 4.7%, well above the Fed’s 2% target rate. For that reason, future rate hikes for the remainder of the year seem extremely likely.

LEI and Housing

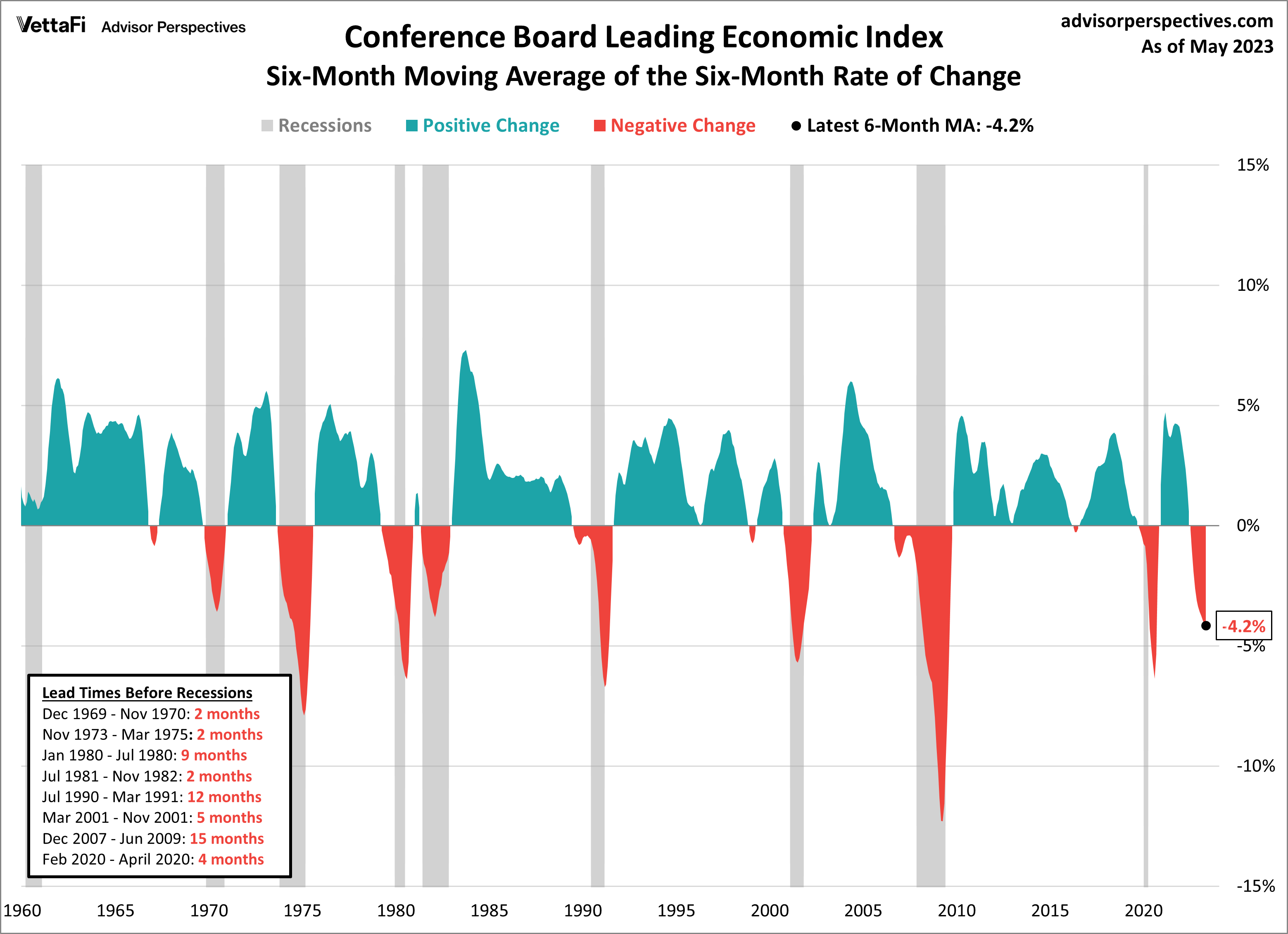

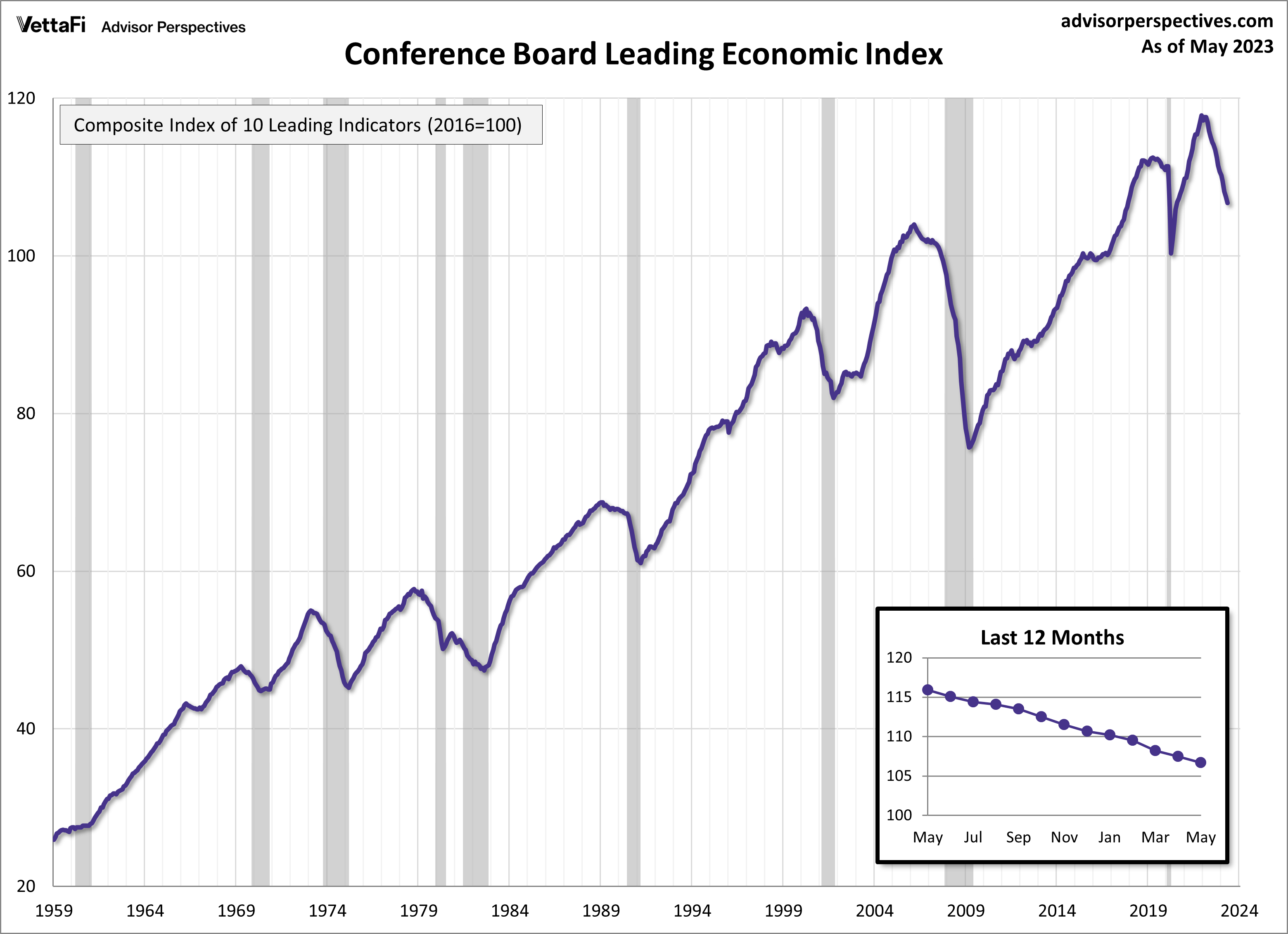

The Conference Board Leading Economic Index is one of my favorite indicators to report on each month. The index has decreased for 14 consecutive months and has been signaling a recession for quite some time.

Another popular way to use the LEI as a recession indicator is to look at it on a rate of change basis, specifically the six-month moving average of the six-month rate of change. The current level is at -4.2%, which is clearly recessionary, yet the question of “Are we in a recession?” is unclear.

Although it wasn’t mentioned, the last piece of economic data I want to touch on is current housing data. An increase in housing activity leads to economic growth. In May, there were increases in building permits (5.2%), housing starts (21.7%), new home sales (12.2%), and existing home sales (0.2%). Additionally, builder confidence rose for the sixth straight month to its highest level in almost a year. The upward trend in these housing categories strengthens the non-recession argument.

Rosenbluth: The housing data is obviously good for related ETFs. The iShares U.S. Home Construction ETF (ITB) is already up 40% this year, and the Invesco Dynamic Building & Construction ETF (PKB) was up 31%.

More Evidence Against Recession

Dave Nadig, financial futurist: While there are plenty of challenges in the next 18 months, a technical recession just doesn’t seem to be in the cards. I mean:

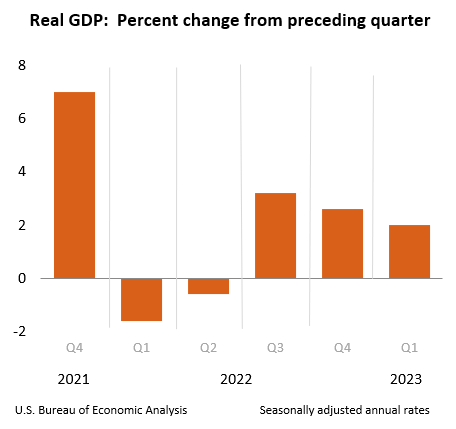

Two percent growth is hardly setting us up for the back-to-back contractions required for NBER to “call it,”… and that 2% is substantially above the 1.3% estimates.

Now, does that mean that “two hike Powell” can’t scare the economy (or the market) into a corner? Of course not. It’s a sentiment market, and if the words from Washington are “hike” and “inflation,” then people may cut back unexpectedly — from labor issues to consumer spending. But we really just don’t see that yet.

Rosenbluth: I agree, Dave. We have not seen that. Risk-taking has returned to ETF markets more than it did earlier in the year.

Roxanna Islam Swan, associate director of research: I think the big story will still be about the consumer. As we all know, they contribute more than two-thirds of GDP. The average consumer doesn’t care too much about the Fed or interest rate hikes (or maybe isn’t even aware of it). So they won’t feel a lot of those effects unless it touches employment/wages, which are doing pretty decently right now. And that’s why confidence is high. It’s likely they pay more attention to prices they’re seeing at the grocery store, which are also higher but still better than a few months ago. And I think many people are still in the mindset that we’re in a better time now than we were in the early pandemic. Essentially, “I’m not furloughed anymore, I can eat at restaurants again, I can order something online and have it arrive with one-day shipping. So that means the economy is good again, right?”

Questions Around GDP

Nash: The Conference Board is banking on contraction in Q3/Q4 of this year and Q1 of 2024. They believe the recession likely will be due to continued tightness in monetary policy and lower government spending.

Nadig: Yep! My low-confidence reaction, however, is that skating by is more likely than true recessionary contractions. We’ll see!

Nash: This was from their latest report earlier this month before today’s heavily revised GDP reading. I agree that two consecutive quarterly contractions seem less likely after the 2.0% growth in Q1.

[Responding to Roxanna] Where the consumer can get hit is when they get laid off. However, so far, labor contractions have been pretty narrowly confined (tech, finance). The interest rate situation mostly just slows down mobility. It means fewer moves and fewer house sales means fewer Ikea runs and trips to Home Depot. But those are pretty long cycle and “baked in” at this point.

Islam: But there are definitely consumers that are feeling that pressure. If you listen to commentary by some of the large retailers like Walmart, you can see that the lower-income to middle-income consumer is changing their spending habits. They’re shifting spending into necessary purchases and away from certain discretionary products. But that doesn’t necessarily mean they’ll stop buying things — personal savings rates are still relatively low, around 4%. People are changing the way they’re spending.

A Shift in Consumer Habits

I think e-commerce will continue to be a huge trend moving forward as people look for ways to save money and shop for discounts. Not just for discretionary items, but for almost anything. I need to get better at this, but I know many people who open up two or three grocery store apps. Then, you can easily check the prices before you go — then you can figure out where you want to go buy each item. So the consumer has grown smarter. I think they will remain resilient until there is something that starts affecting the employment situation.

Nash: I am guilty of being one of those people opening up two different grocery store apps while in one store to compare prices. I haven’t yet had to open up a third app, though.

Islam: I need to!

Uneven Consumer Sector Performance

Nadig: Well, to be fair, there’s now piles of evidence that the entire consumer sector is just riddled with “price-over-volume” inflation. All those nice earnings reports were just table after table of “realized margins higher!” So at some point, yes, I would expect consumers to balk more than they have.

So I agree, Rox; pattern shifts more than outright “not spending.”

Rosenbluth: The Consumer Discretionary Select Sector SPDR Fund (XLY) being up 30% this year would make it seem the consumer is strong, but that’s skewed a bit by its market cap weighting, which gives Amazon.com a hefty weight. The Invesco S&P 500 Equal Weight Consumer Discretionary ETF (RCD) is up just over 10% this year and is probably a better indicator of broader consumer spending, given its equal weighting. And yes, I have stuck to ETFs and left the economic data and tea leaf reading to the rest of you.

For more news, information, and analysis, visit the Portfolio Strategies Channel.