During an up day for broader markets, the tech sector is the top performer, gaining over 3% on Wednesday.

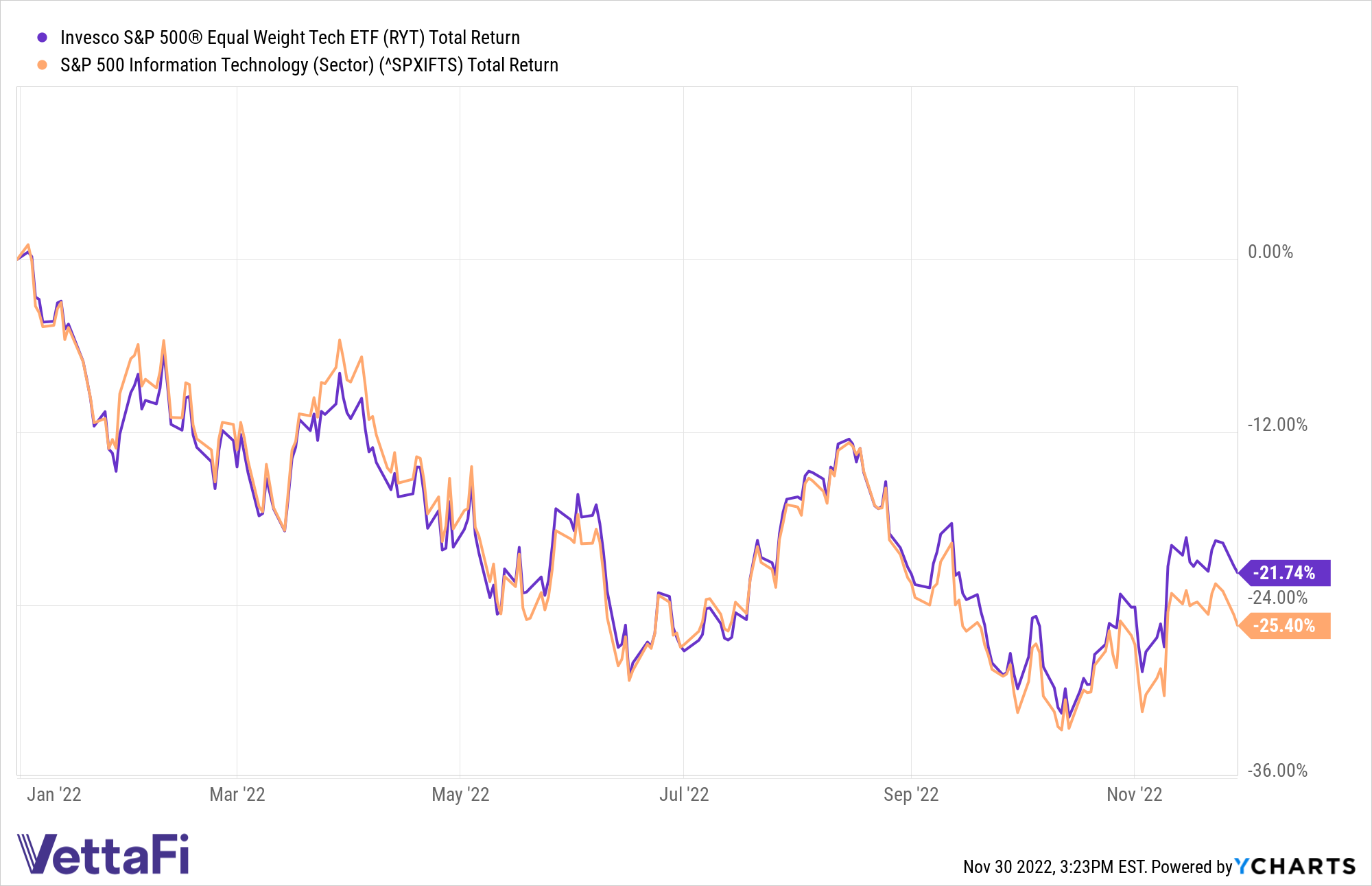

Investors looking to reallocate funds to the technology sector should consider the Invesco S&P 500 Equal Weight Technology ETF (RYT). RYT is based on the S&P 500 Equal Weight Information Technology Index, which is outperforming the cap-weighted sector index over all periods during the past year.

RYT is different from cap-weighted ETFs offering exposure to tech stocks, because its underlying index utilizes an equal-weight methodology, meaning that component companies receive equal allocations at each quarterly rebalance. This results in exposure that is considerably more balanced than other alternatives, and a methodology that some investors believe will add value over the long haul. An equal-weight approach is particularly impactful in the top-heavy tech sector, which is dominated by just a handful of names.

As of November 29, RYT has increased 1.93% in the past month compared to the S&P 500 Information Technology Index’s decline of -0.42% during the same period, each on a total return basis, according to YCharts.

Over three months, RYT has declined –2.16% compared to the cap-weighted index’s decline of –6.18%.

RYT is still down -21.74% year to date, making now an optimal time to allocate following Federal Reserve Chair Jerome Powell’s indication on Wednesday that the central bank is on track to raise interest rates by 50 basis points, a decrease from the previous series of four 50 basis point rate rises.

The S&P 500 Equal Weight Information Technology Index covers the following industries: internet equipment, computers and peripherals, electronic equipment, office electronics and instruments, semiconductor equipment and products, diversified telecommunication services, and wireless telecommunication services.

For more news, information, and analysis, visit our Portfolio Strategies Channel.