Current events in the past couple of weeks have shown us two things. Great marketing can bring people back to movie theaters. And even industry leaders like Netflix can have trouble navigating the crowded streaming market. While that’s a huge shift from what we usually see (a clear shift in consumers toward digital media consumption), long-term trends still point to stronger consumer preferences for internet-based media (e.g., streaming video, streaming audio, and online gaming). This note looks at some of the recent events in the media industry. It also looks at how investors can capture the changing landscape with ETFs.

Movie theaters are riding the wave of goods-to-services spending.

This weekend, both AMC Entertainment Holdings (AMC) and Cinemark Holdings (CNK) reported a record-breaking box office weekend with the release of Barbie and Oppenheimer in addition to the carryover from Mission Impossible: Dead Reckoning One and Sound of Freedom. According to IMDB, Barbie grossed $162M this weekend while Oppenheimer grossed $82M. For AMC, this weekend was its best weekend globally since 2019 based on both attendance and admissions revenue, with over 7.8 million moviegoers in attendance Thursday through Sunday. Similarly, Cinemark reported its best summer weekend and one of its highest-grossing box office weekends in the company’s history. IMAX Corp (IMAX) also released a press statement that put this weekend as IMAX’s biggest share ever recorded at a film’s opening weekend with over 20% of the share for Oppenheimer.

Movie theaters have not seen a weekend like this in a long time. AMC cites that the last time was the release of Avengers: Endgame in May 2019. This was pre-pandemic before many of the changes we are familiar with in the media industry. What has changed? Pre-pandemic, theatrical windows were around 90 days (or 3 months). Now, theatrical windows have shortened to approximately 30 days (or 1 month) before moving to streaming or video-on-demand. Additionally, many streaming services are focusing on creating original content to stay competitive and are releasing movies directly on streaming instead of to theaters.

Streaming stocks remain relatively strong but lose some steam.

Last week, Netflix stock ran into some issues after its 2Q earnings report. Although the number of subscribers increased by 8% y/y, this was largely driven by Netflix’s password crackdown. And Netflix’s revenue grew by only 2.7% y/y. Many new subscribers switched to lower-priced tiers when they were removed from shared accounts. They are also taking advantage of Netflix’s newer ad-based tiers. Netflix also faces the issue that they were an early mover — before many other streaming services like Disney+ and Paramount were in the picture. This is typically an advantage. However, the company has reached a point where it is more difficult to increase subscribers and therefore increase revenue without continuously raising prices. To solve this issue, Netflix has created some ad-based plans which can generate revenue through more hours watched. This shifts some of the focus to retaining subscribers instead of adding new ones.

Long-term, streaming continues to grow compared to other media consumption methods.

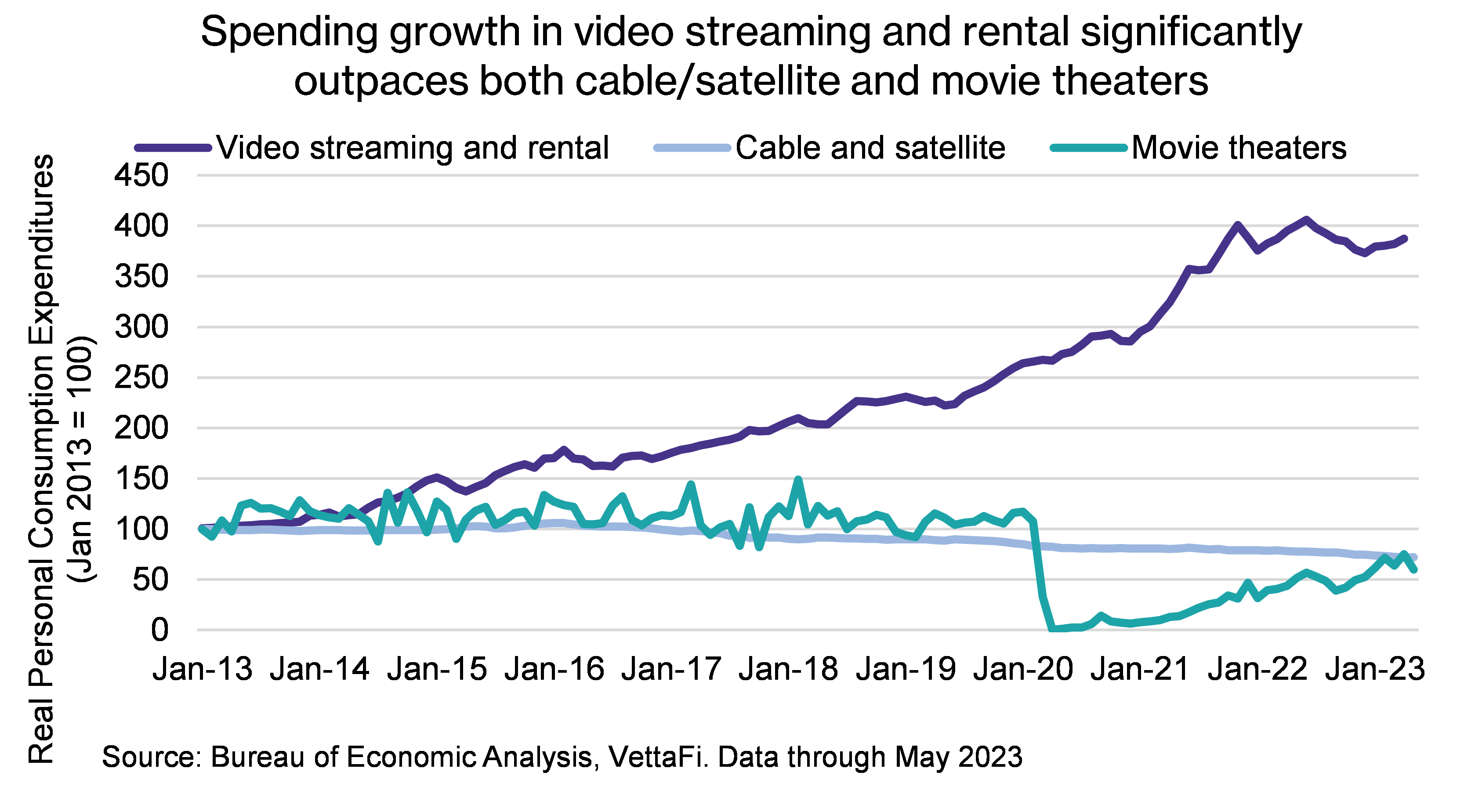

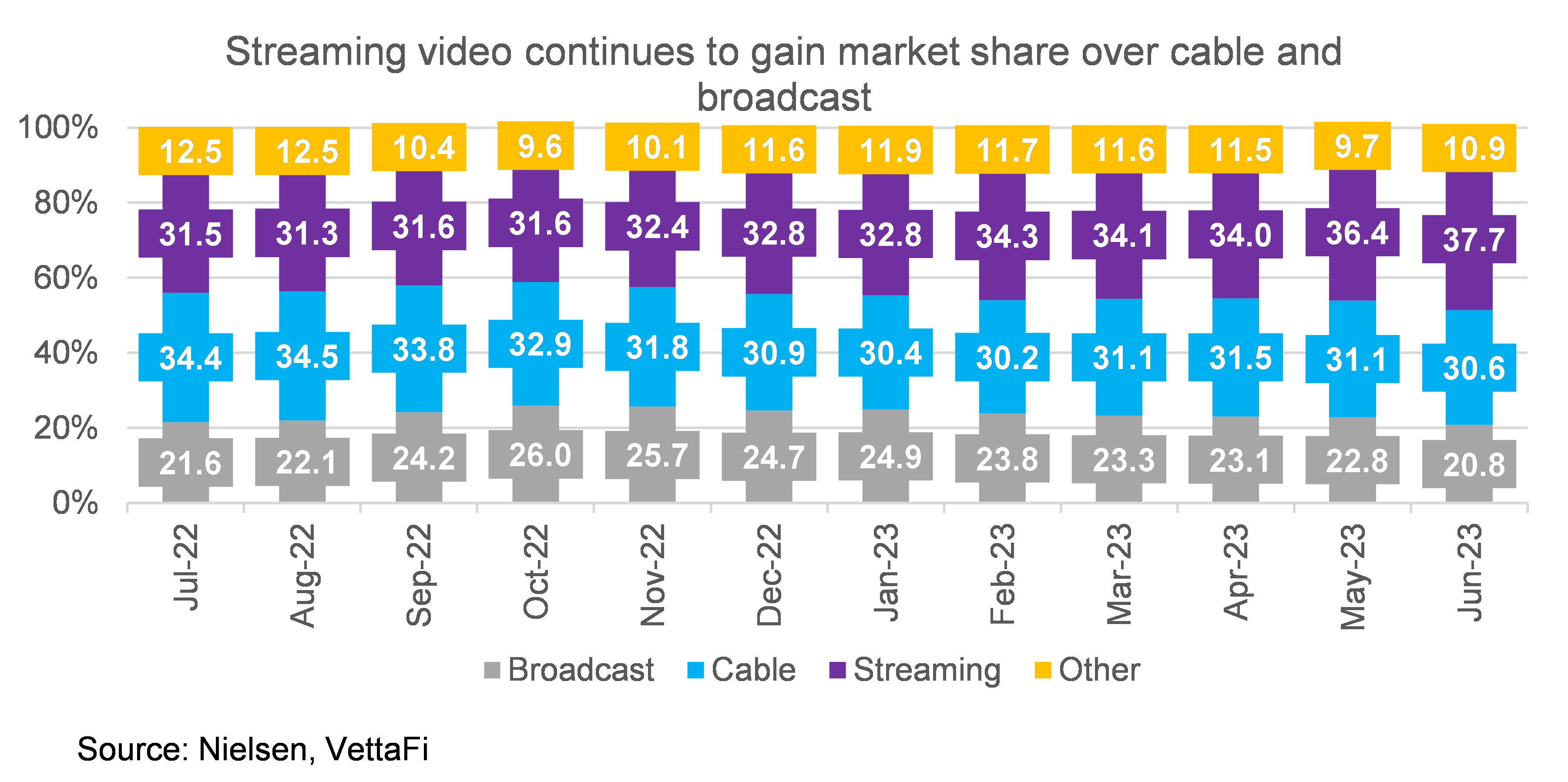

Despite Netflix losing some steam this past quarter, the long-term outlook for streaming stocks still looks positive. And it should be resilient even if we see a return to movie theaters. Movie theaters are an experiential purchase and consumers will continue to attend, particularly on special occasions. Many consumers are now reallocating spending into service/entertainment areas like travel and restaurants. This typically fall into the same category as movie theaters. It is more likely that streaming will continue to take the majority of its share from cable and satellite, particularly as many companies begin shifting resources to their streaming channels over their broadcast or cable channels. According to data from Nielsen, streaming has been the dominant TV option. Many consumers valuing to choose from a broad range of titles on demand. The number of households that are broadband-only (no cable or satellite boxes) has also increased from 12.7% in 2019 to 35.5% in January 2023.

Streaming and Next Gen Media ETFs capture the changing media landscape.

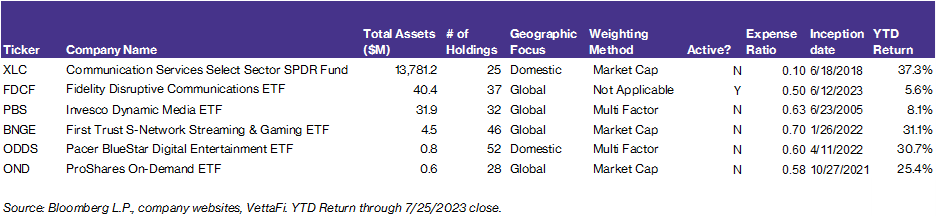

Video streaming is a strong example of the consumer shift in media consumption. But this also applies to other forms of entertainment like audio streaming and online video gaming. Both have also become increasingly popular as consumers focus on less physical goods and opt for entertainment with on-demand, cloud-based storage options that can be enjoyed as a social experience. Broader communication ETFs capture this shift. Certain industry/thematic ETFs, which focus on streaming content or next-generation media delivery, better capture this. The Invesco Dynamic Media ETF (PBS) focuses on broader media companies which include streaming stocks but also expands its definition to other holdings — for example, it currently holds GoodRx Holdings (GDRX) and Yelp Inc (YELP). (It is worth noting that this ETF will change its name, ticker, index, and strategy at the end of August. Its name and ticker will change to the Invesco Next Gen Media ETF (GGME).) ETFs like the First Trust S-Network Streaming & Gaming ETF (BNGE) and the Pacer BlueStar Digital Entertainment ETF (ODDS) target digital entertainment like content streaming, video gaming, and online betting. The ProShares On-Demand ETF (OND) focuses on on-demand experiences including streaming, but also areas like ride-sharing. As consumers continue to shift preference toward consuming media via connected devices, there is potential for these next-generation media ETFs to benefit from these trends long-term.

For more news, information, and analysis, visit our Portfolio Strategies Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for BNGE, for which it receives an index licensing fee. However, BNGE is not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of BNGE.