Several key economic indicators come out every week to help provide insight into the overall health of the U.S. economy. Policymakers and advisors closely monitor these indicators to understand the direction of interest rates, as the data can significantly impact business decisions and financial markets. In the week ending on June 29th, the SPDR S&P 500 ETF Trust (SPY) rose 0.37 % while the Invesco S&P 500® Equal Weight ETF (RSP) was up 1.58%.

In this article, we take a deeper look at some of the most important economic releases from the past week: personal consumption expenditures (PCE), gross domestic product (GDP), and consumer confidence and sentiment. By examining these data points, we gain valuable insights into consumer perceptions of the economy, which in turn inform consumer spending patterns and contribute to the country’s overall economic growth.

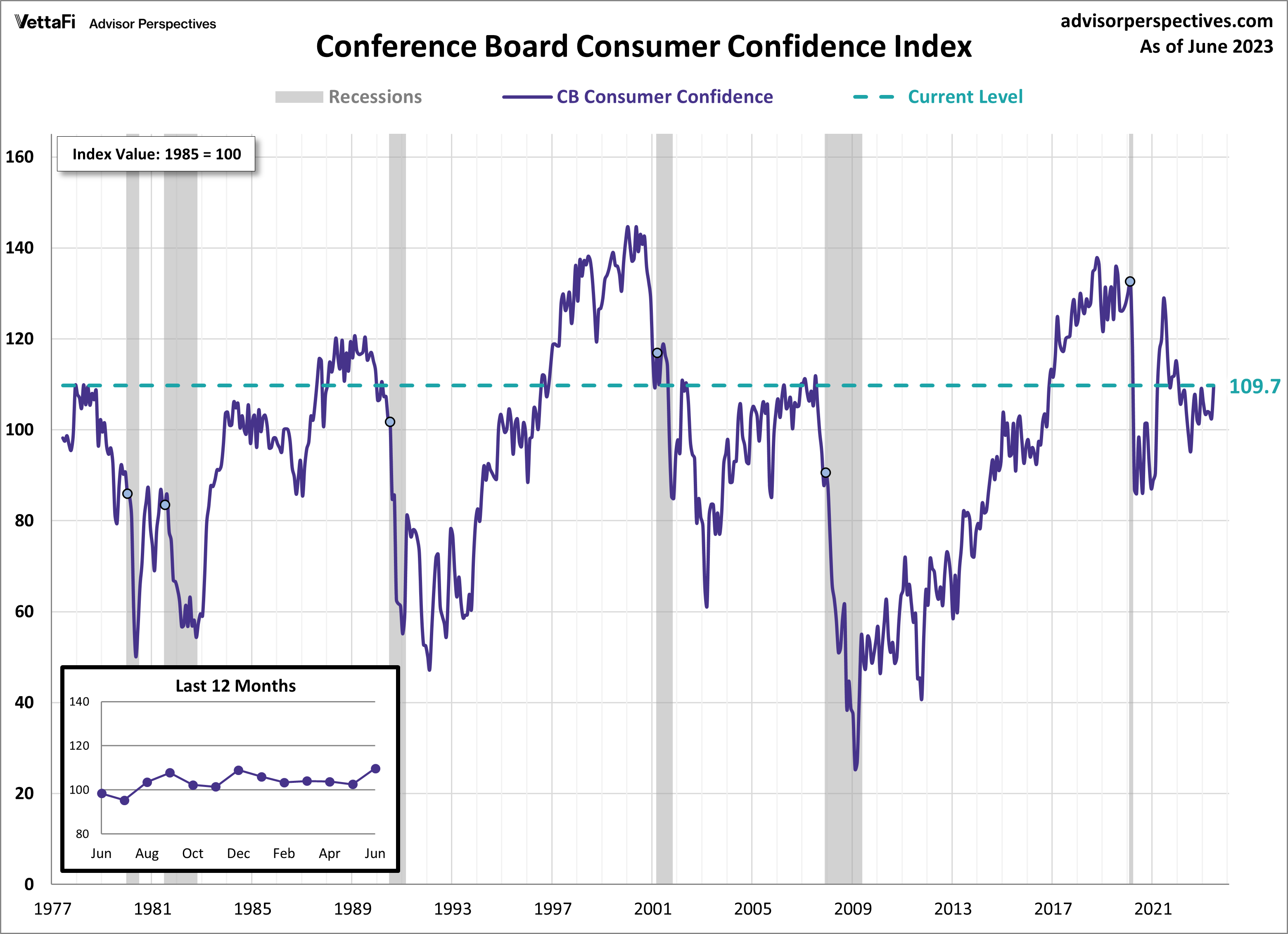

Consumer Confidence

Consumer optimism jumped to its highest level since the beginning of 2022. The Conference Board Consumer Confidence Index® rose to 109.7 in June from an upwardly revised 102.5 in May. The rise in confidence marks the first monthly increase in the past three months. The index is a monthly survey measuring consumer attitudes about current and future economic conditions. Consumers showed increased confidence levels in the present situation, largely due to positive feelings regarding the labor market. Consumer expectations on future economic conditions also rose last month but remained at a level the Conference Board associates with a recession beginning within the next year. The Consumer Discretionary Select Sector SPDR ETF (XLY) is tied to consumer confidence.

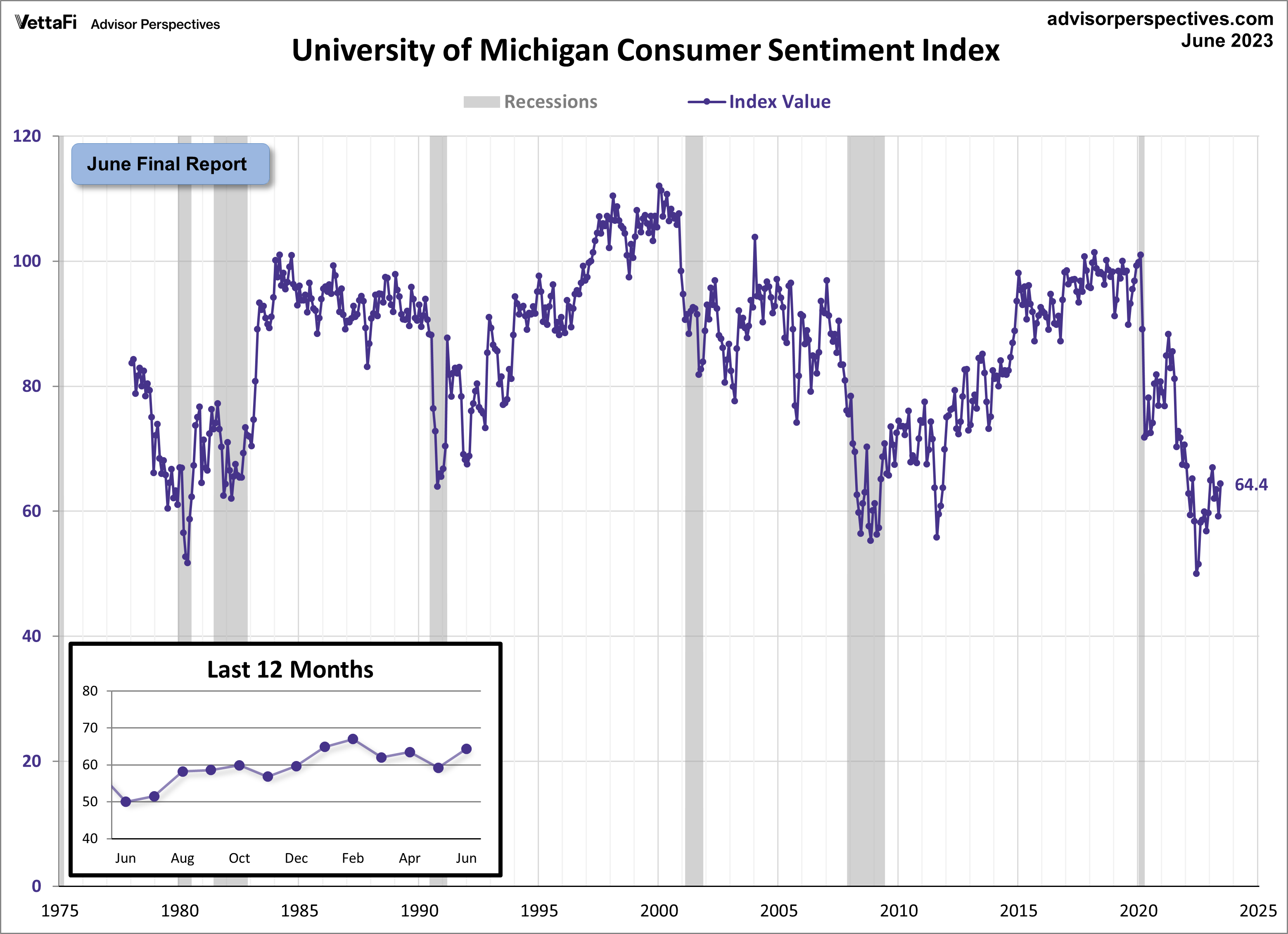

Michigan Consumer Sentiment

Consumer sentiment showed signs of improvement this month, although it remains historically low and at recessionary levels. According to the June final report of the Michigan Consumer Sentiment Index, the index recorded a reading of 64.4, marking an 8.8% increase from May’s final reading and surpassing the forecasted value of 63.9. This is the largest monthly increase the index has seen in almost a year and puts the index at its highest reading in the last four months.

The index is a monthly survey measuring consumers’ opinions with regards to the economy, personal finances, business conditions, and buying conditions. The recent upturn in consumer sentiment can be attributed to a couple of factors. Firstly, the resolution of the debt ceiling crisis earlier this month played a crucial role in boosting consumer confidence. Additionally, a more optimistic outlook towards easing inflation has also contributed to the improved attitudes among consumers. Given that consumer spending accounts for approximately 70% of the economy, consumer attitudes are closely monitored, as their confidence levels directly impact their spending behavior and, consequently, trigger economic growth. The Consumer Discretionary Select Sector SPDR ETF (XLY) is tied to consumer sentiment.

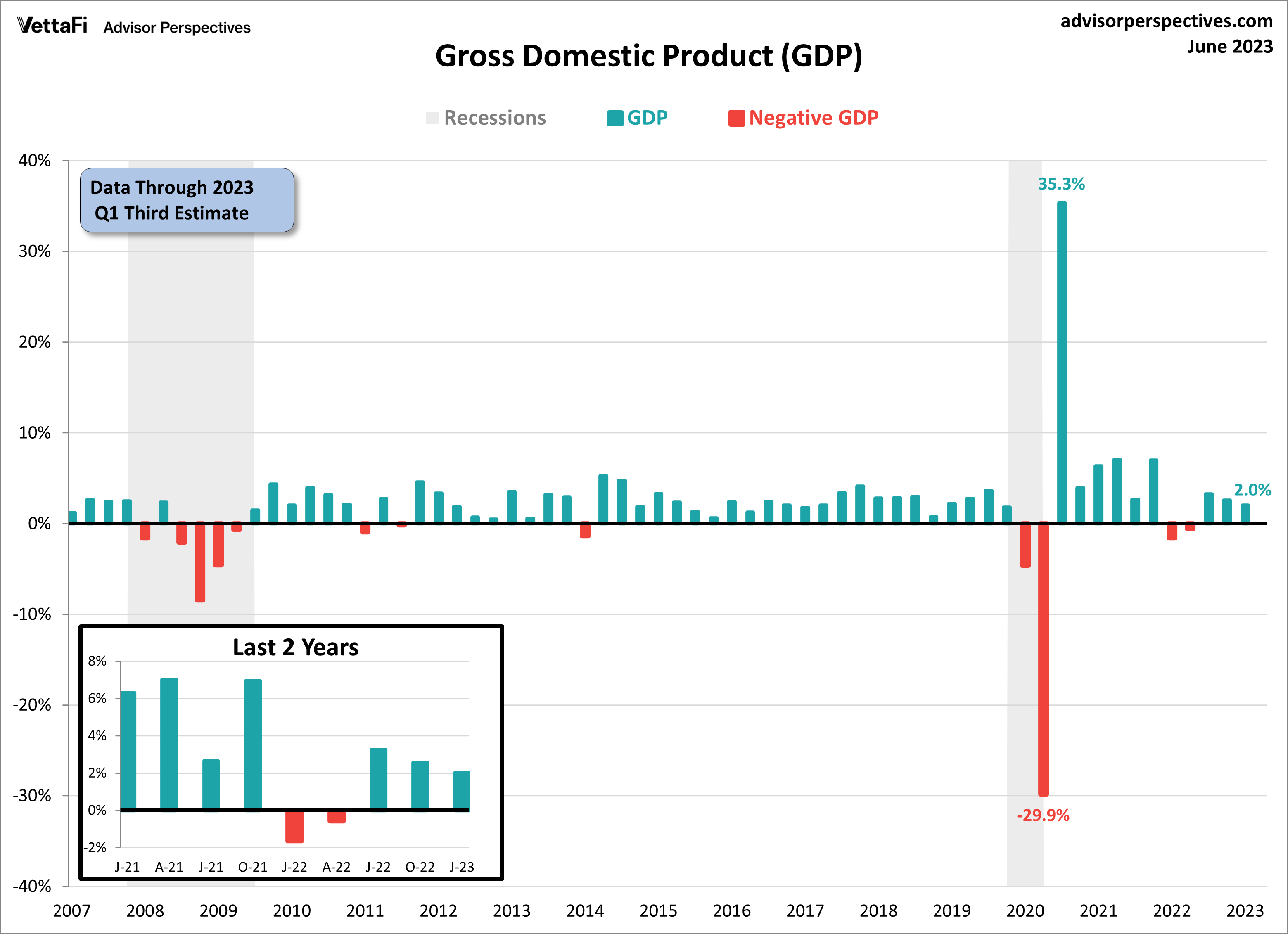

Gross Domestic Product (GDP)

The U.S. economy grew at a stronger pace at the beginning of this year than originally thought. The third estimate for Q1 2023 gross domestic product (GDP) showed the economy grew at an annual rate of 2.0%, a significant upward revision from the 1.3% growth shown in last month’s estimate. While there has been a noticeable deceleration in GDP growth, from 3.2% in Q3 of the previous year to 2.6% in Q4, and now down to 2.0%, the latest data suggests that the economy has not yet come to a standstill. Additionally, the positive GDP reading for the first quarter raises the possibility that the economy may avoid a recession, which is typically characterized by two consecutive quarters of negative GDP growth.

Despite the challenging economic conditions marked by high inflation and rising interest rates, consumers have displayed resilience. Consumer spending emerged as the primary driver of real GDP growth among the four subcomponents. Furthermore, alongside the upward revision in consumer spending, exports also saw significant upward adjustments, resulting in an overall upward revision of GDP. On the other hand, gross private domestic investment experienced the largest decline among the four components in Q1.

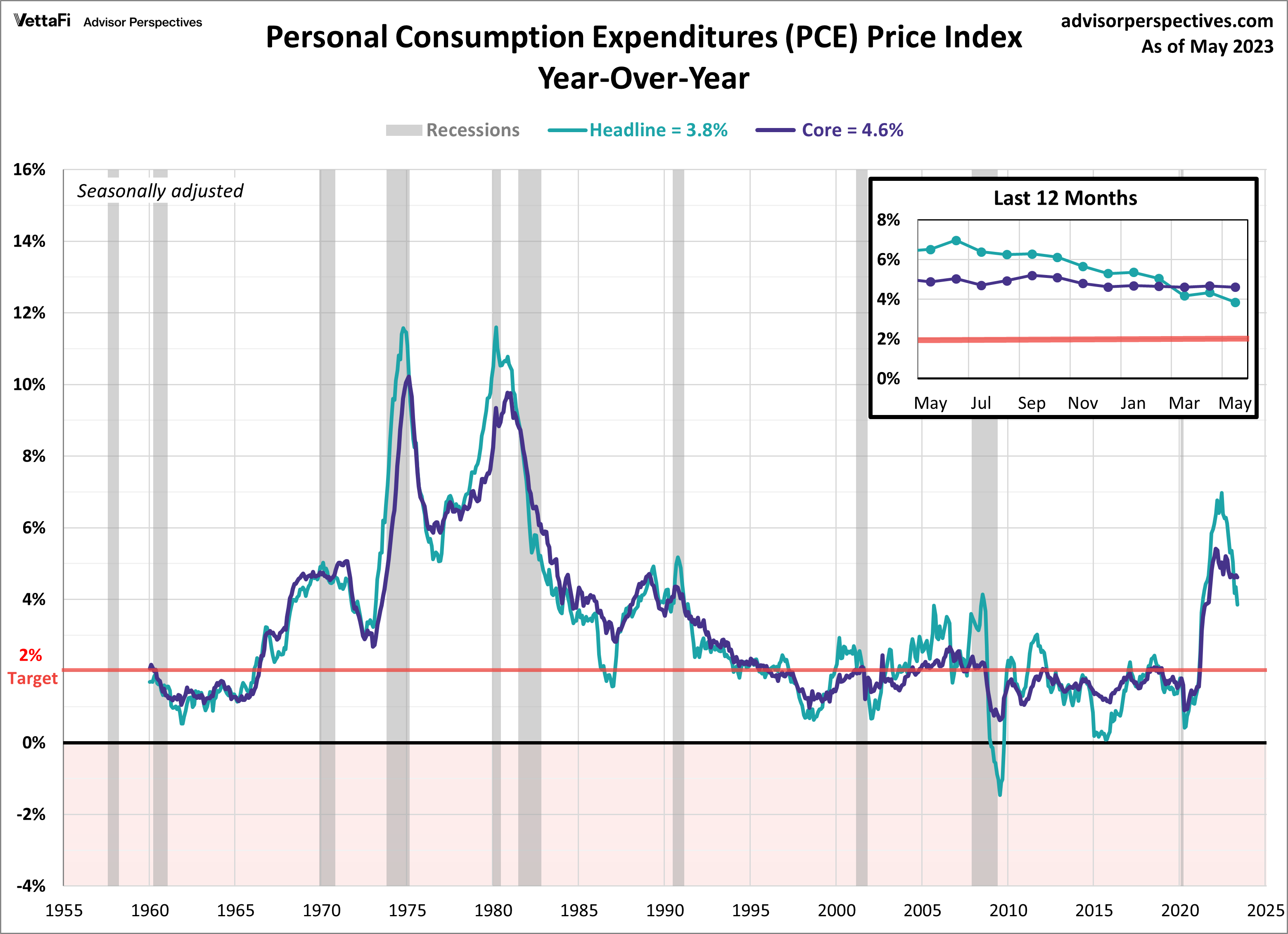

Personal Consumption Expenditures (PCE)

Inflation eased in May as consumers pulled back on spending. The PCE price index rose 3.8% compared to a year ago, a deceleration from 4.3% last month. This month’s reading was below expectations and marked the lowest level since April 2021. Core PCE, better known as the Fed’s preferred measure of inflation, also came in lower than expected in May. The latest data showed an annual increase of 4.6%, just below the 4.7% forecast and down from last month’s 4.7% reading. On a monthly basis, headline PCE rose 0.1% while core PCE rose 0.3% from April. While the core number was in line with expectations, the headline number was lower than anticipated. While this month’s data showed inflation moving in the right direction, the PCE price index remains well above the Fed’s 2% target rate and gives cause for rate hikes later this year.

Economic Indicators and the Week Ahead

The focus for this week shifts to employment as the market awaits the release of several key job reports. The May JOLTS data and June employment reports will provide insights into the health of the labor market, and by extension, the overall economy. Last month’s reports described a strong and resilient labor market. If the trend continues, the Fed will likely follow through with future rate hikes to help combat the fight against inflation.

On Thursday, we will learn if job openings continued to rise for a second straight month in May or if the downward trend seen at the beginning of this year has resumed. Also on Thursday, the ADP employment report will be released, which will set the stage for the more comprehensive BLS employment report released on Friday. Expectations are that 200,000 nonfarm jobs were added in June, down from 339,000 in May, and that the unemployment rate remained at 3.7%.

For more news, information, and analysis, visit our Portfolio Strategies Channel.