What’s the overlap between the top 10 names in the S&P 500 now versus 20 years ago? Just one.

Exxon Mobil is the only familiar name when comparing a list of the largest corporations in the U.S. in 2003 and 2023. Despite the continuous shift in the largest names in the S&P 500, most investors are still allocating to a cap-weighted S&P 500 fund, effectively betting on the continuance of existing trends in the market — betting that the same large names will continue to generate strong returns.

The largest names in the S&P 500 in 2003 included Wal-Mart Stores, General Motors, Exxon Mobil Corporation, Ford Motor, General Electric, Citigroup, ChevronTexaco, Intl. Business Machines, American Intl. Group, and Verizon Communications.

Twenty years later, the index’s top holdings include Apple, Microsoft Corporation, Amazon.com Inc., NVIDIA Corporation, Alphabet Inc. Class A, Berkshire Hathaway, Alphabet Inc. Class C, Tesla Inc., Meta Platforms Inc. Class A, and Exxon Mobil Corporation.

The concentration of those top names has also evolved tremendously, with the S&P 500 growing ever more top-heavy, leaving investors facing historic levels of concentration risk. While the purpose of the S&P 500 is to provide exposure to 500 companies, the five largest companies have grown to account for nearly 20% of its weighting as of April 17, a significant rise from 14% in 2003.

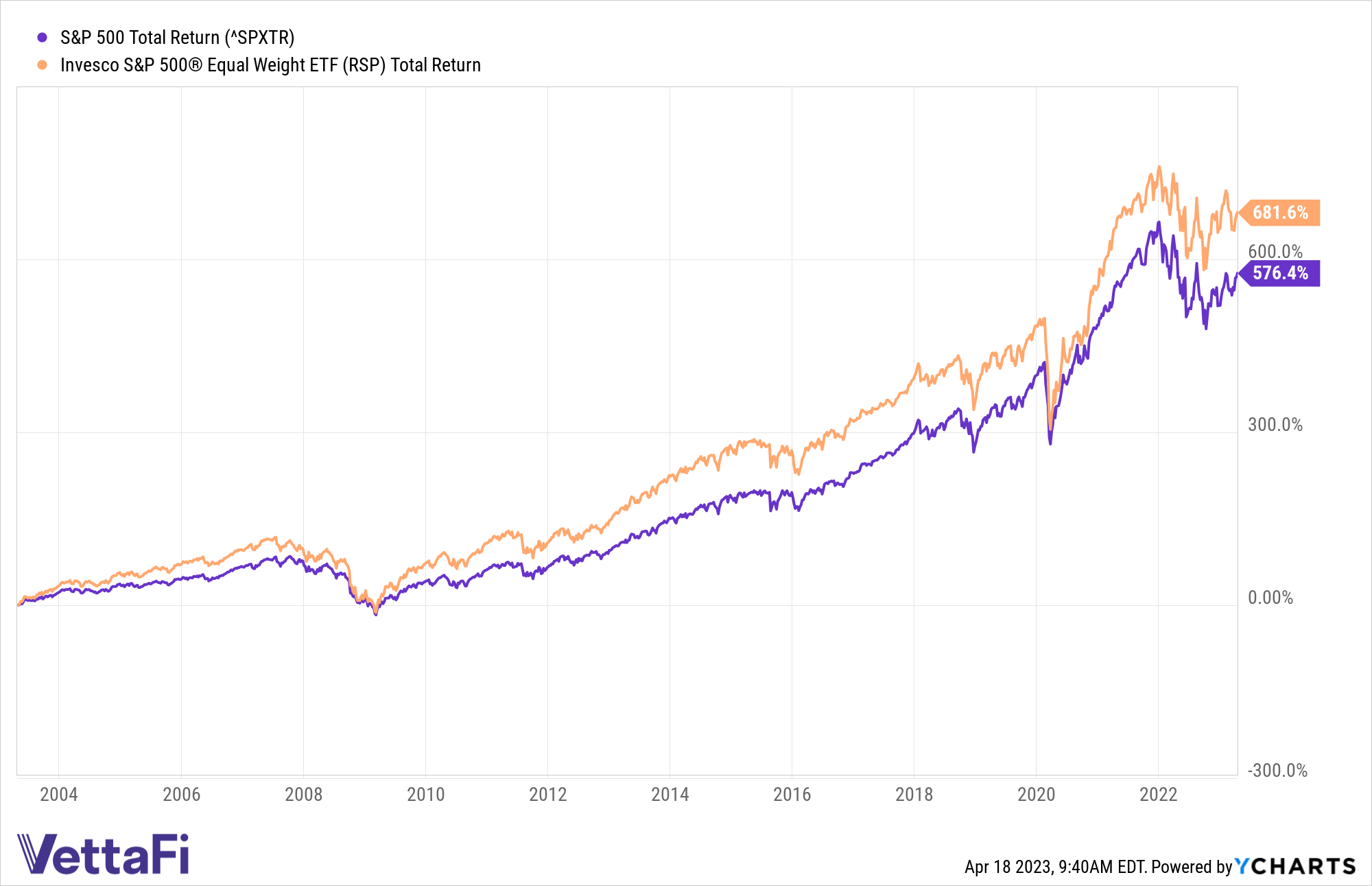

The Invesco S&P 500® Equal Weight ETF (RSP) is based on the S&P 500 Equal Weight Index, which is designed to be a size-neutral version of the S&P 500. It includes the same constituents as the cap-weighted S&P 500, but each company in the S&P 500 Equal Weight Index is allocated the same weight — 0.2% — at each quarterly rebalance, mitigating concentration risk.

See more: “How Does RSPE Compare to RSP?”

Equal weight’s anti-momentum and value factor tilts have helped it outperform the S&P 500 over various periods. During challenged markets in 2022, RSP outpaced the S&P 500 by 7%. Since RSP’s inception in April 2003, RSP is outpacing the S&P 500 by over 10,000 basis points.

Concentration in the S&P 500 reached a new milestone last month as the combined weight of the largest two constituents in the S&P 500 reached an all-time high.

In late March, Apple and Microsoft reached a combined weight of 13.3% in the S&P 500, the highest level on record. Such a high concentration in the S&P 500’s top holdings can leave investors vulnerable in the event that the companies’ current high valuations fall back to earth.

During the market downturn in 2022, the largest S&P 500 companies shed a greater share of value than other constituents in the index. The 10 largest names in the index were worth a combined $7.986 trillion at the end of 2022, down 37% from 2021. The combined market value of all companies in the index fell about 20% during the year, according to S&P Dow Jones Indices.

The largest constituent in the benchmark index, Apple, declined 26.4% on a total return basis in 2022, making it the largest contributing constituent for the S&P 500’s disappointing showing in 2022. Amazon and Tesla followed, falling 49.6% and 65.0% in 2022, respectively. Shares of Microsoft dropped 28.0%, and Meta plummeted 64.2% last year.

For more news, information, and analysis, visit the Portfolio Strategies Channel.