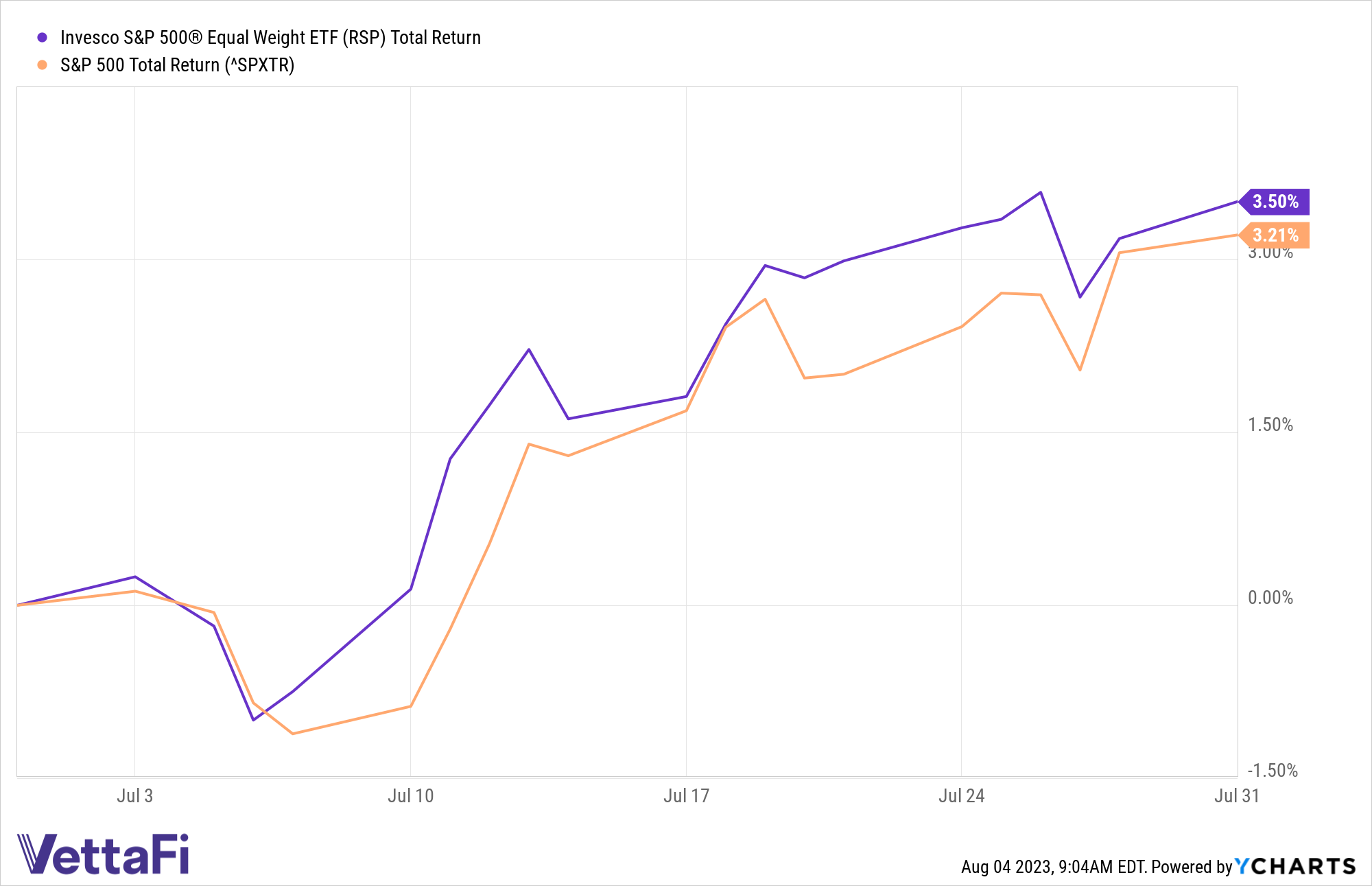

Equal weight slightly outperformed the benchmark in July as market breadth remained stronger than in the first half.

The market continued to climb in July as investors focused on second-quarter earnings reports, further propelled by better-than-expected macroeconomic updates. For the second month, returns were broad even as market breadth declined slightly (remaining above the narrowness seen during the first five months.)

The S&P 500 Equal Weight Index, tracked by the Invesco S&P 500® Equal Weight ETF (RSP), outpaced its cap-weighted parent S&P 500 last month, up 3.5% compared to the benchmark’s 3.2% rise.

RSP gives every security in the S&P 500 an equal weight at each quarterly rebalance. Equal weight’s methodology of selling relative winners and buying relative losers adds the small size and value factor tilts to a portfolio, which led to the strategy’s significant outperformance last year.

Over the past 12 months, consumer discretionary has been the top performing sector for the equal-weighted index. Conversely, information technology has been the top performer for the benchmark.

Most equal-weighted sectors outperformed their cap-weighted counterparts in July. Equal-weighted energy notable outpaced the cap-weighted sector by about 350 basis points during the month.

The sectors in which equal weight lagged were industrials (by 0.3%), consumer staples (by 0.1%), communication services (by 5.1%), and health care (by 0.4%), according to S&P Dow Jones Indices.

Over the trailing 12-month period, however, equal-weighted industrials and health care are beating their cap-weighted counterparts.

The Invesco ESG S&P 500 Equal Weight ETF (RSPE) offers the same methodology as RSP, but screens for ESG criteria. Equal-weighted strategies can provide diversification benefits and reduce concentration risk by weighting each constituent company equally so that a small group of companies does not have an outsized impact on the index.

For more news, information, and analysis, visit the Portfolio Strategies Channel.