The Invesco S&P 500 Equal Weight Industrials ETF (RSPN) has handily outpaced its cap-weighted peers as the industrials sector rallies.

The third top-performing sector on Thursday was industrials, gaining 1.5%. The sector trailed only healthcare and communication services, which gained 1.6% and 1.5%, respectively.

RSPN provides more balanced exposure to the industrials sector. The ETF is different from other ETFs offering industrials sector exposure due to its equal-weighting approach, which has added value in the current environment. RSPN is based on the S&P 500 Equal Weight Industrials, which gives every security an equal weight at each quarterly rebalance.

The industrials sector has rallied significantly in June, up 7.6%. Meanwhile, since June 1, RSPN is up 8.5%. In the past one-month period, RSPN is up 7.3%, while the cap-weighted index has gained 6.4%. Over a one-year period, RSPN has climbed 22.1%, while the industrials sector is up 19%.

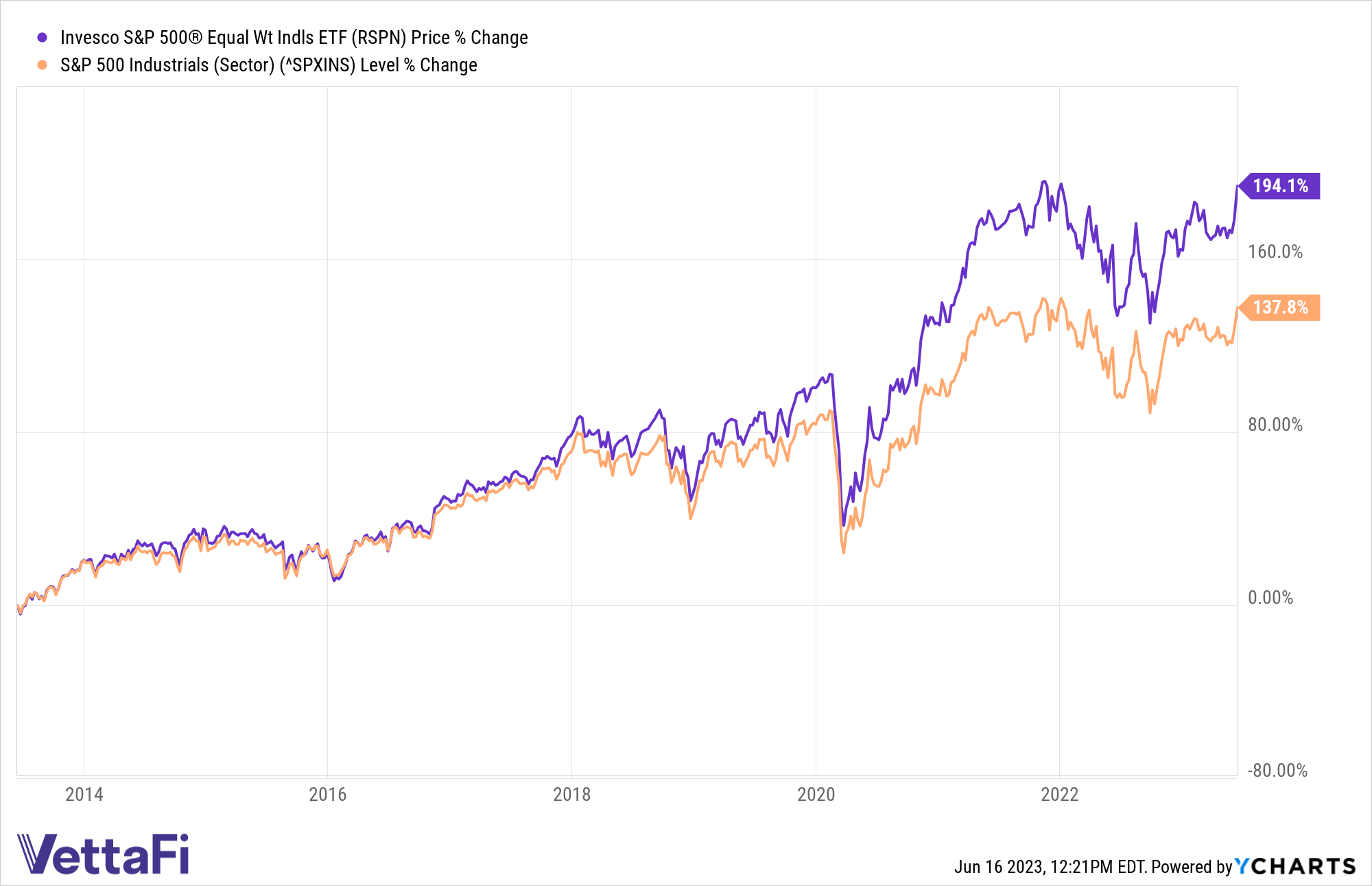

The performance gap between RSPN and the cap-weighted industrials index stands out over a 10-year period. During that time, RSPN has gained 194%, while the cap-weighted index has climbed just 138%. RSPN has noticeably gained ground on the cap-weighted index over the past five years.

As the industrials sector rallies and market uncertainty remains, RSPN has seen an increase in flows. The fund, which has $468 million in assets under management, has seen $60 million in one-week flows.

Despite RSPN’s impressive outperformance, the industrials sector is the least concentrated S&P 500 sector, as of May 31. The top five companies in the industrials sector comprise 21.5%, while the top five names in the most concentrated section, communication services, weigh 75.2%, according to S&P Dow Jones Indices.

The industrials sector covers the following industries: aerospace and defense, building products, construction and engineering, electrical equipment, conglomerates, machinery, commercial services and supplies, air freight and logistics, airlines, and marine, road, and rail transportation infrastructure, according to ETF Database.

For more news, information, and analysis, visit the Portfolio Strategies Channel.