Mega-cap tech performance dominates headlines and markets this quarter. It makes it easy to overlook opportunities beyond the biggest names, but investors should ensure they aren’t leaving out midcaps when constructing diversified equity portfolios.

Midcap companies toe the line between large-cap stability and the potential growth that makes small-caps appealing. Companies that qualify as midcaps generally have a market cap between $2 billion and $10 billion. In ongoing market volatility, these companies provide diversified returns from their large and small-cap peers.

Index construction for mid-cap stocks offers exposure to a different blend of sectors compared to their small- and large-cap counterparts. Large caps favor tech, financials, and healthcare, while small caps tilt towards industrials, financials, and healthcare (as measured by the S&P 500 and Russell 2000, respectively). Meanwhile, midcaps favor industrials, financials, and consumer discretionary, as measured by the S&P 400.

Performance by midcaps demonstrates why investors should not overlook the space. In the last 32 calendar years, the S&P Midcap 400 beat out the S&P 500 approximately half of the time, reported the WSJ. What’s more, they also beat the Russell 2000 in 17 of the last 32 calendar years.

VNMC Generates Strong Performance Within Midcaps

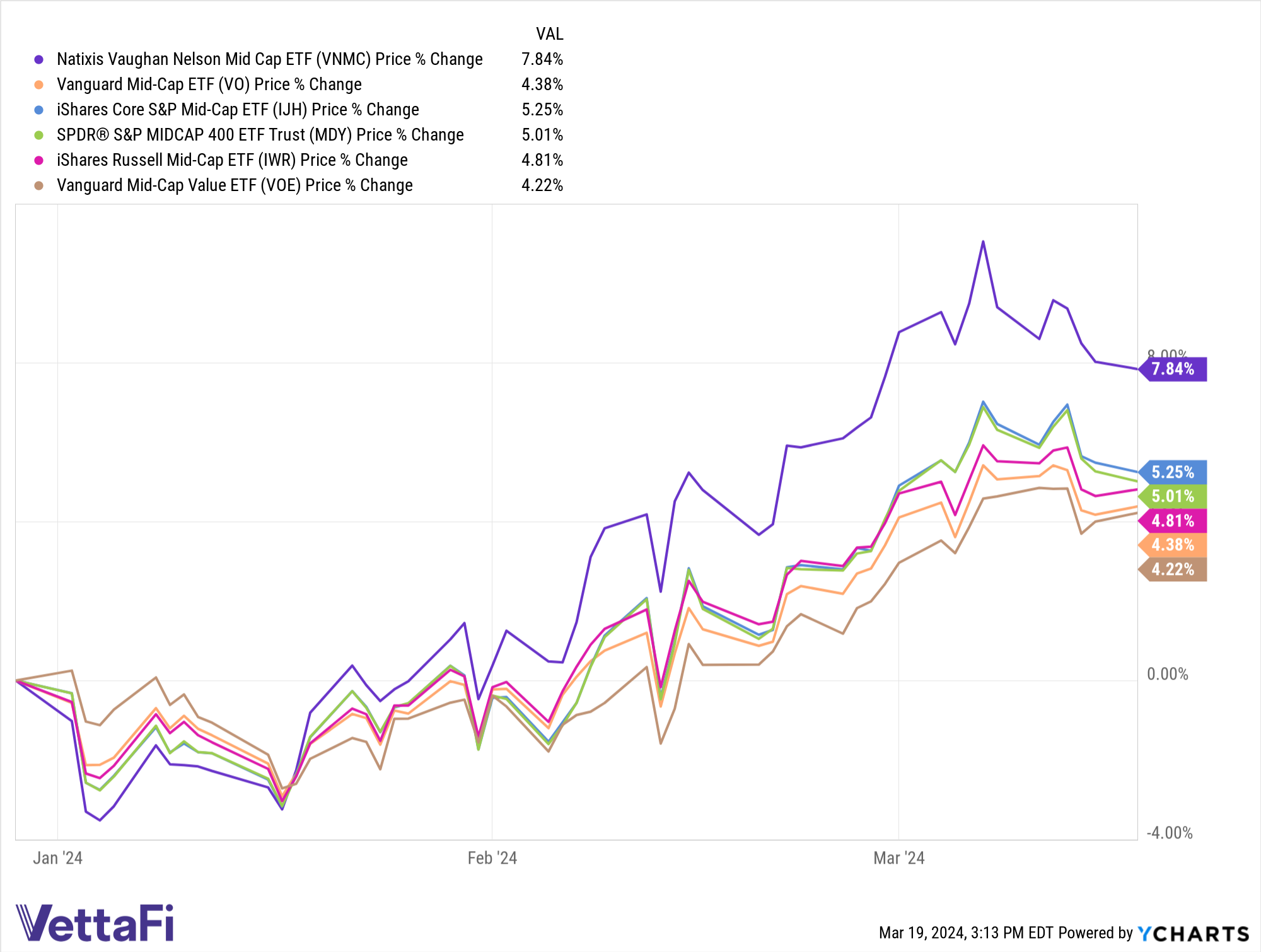

For investors looking to diversify their equity holdings with midcaps, the Natixis Vaughan Nelson Mid Cap ETF (VNMC) is worth strong consideration. The fund outperforms its largest midcap peers both YTD and in the last 12 months.

Looking back further, in the last year, VNMC generated significant outperformance above its peers. VNMC rose 28.53% between 03/17/2023 through 03/18/2024 on a price return basis. The next closest midcap ETF, the SPDR S&P Midcap 400 ETF (MDY), generated 23.02% price returns over the same period.

VNMC seeks to invest in mid-cap companies trading below their longer-term fundamental value. The fund is actively managed, and the strategy focuses on cash-flow-based projections and company balance sheets when selecting stocks.

Companies included demonstrate a disconnect between their earnings growth and current valuation. They are also priced at a discount to their asset value and have a demonstrable ability to close that gap. VNMC invests in companies with stable, high dividends and low perceived downside risk.

VNMC is a strong addition to any existing mid-cap exposures and a diversifier within a broader equity strategy that includes large caps and midcaps.

For more news, information, and analysis, visit the Portfolio Construction Channel.