The last two years resulted in a proliferation of income-seeking funds as investors increasingly leaned into options-based strategies. When looking for equity income enhancements, investors don’t want to miss the recently launched Natixis Gateway Quality Income ETF (GQI).

GQI launched in December 2023, sub-advised by Gateway Investment Advisers. The fund seeks reliable cash flow derived from option premiums and equity dividends. It does so by investing in high-quality, established companies that demonstrate low leverage and high relative profitability.

Factoring in Quality

The fund employs a multi-factor quantitative strategy to identify large and mid-cap companies within the S&P 500. GQI generally invests in between 75-150 companies at any given time. These companies demonstrate consistent earnings, profitability, and efficient utilization of capital. Exposure to equities is achieved through investing in common and preferred stocks, ADRs, and ETFs.

The equity exposures are complemented by a laddered call option strategy on the S&P 500 Index. The options are overlayed on half the portfolio, allowing for the other half to participate in market upswings, balancing income potential with capital appreciation.

GQI invests in equity-linked notes (ELNs) for income generation purposes by replicating a covered call strategy. They combine stock and index-covered call writing to obtain the economic characteristics of both. The ELNs are also structured to offer a level of protection should losses occur. When reaching maturity, any losses incurred by the ELN are capped at what the fund paid for the initial principal.

The income generated from the options helps mitigate volatility. It provides a small buffer should the equity portion of the portfolio decline while enhancing income in rising markets. However, the options limit potential upside of the equity portion of the portfolio.

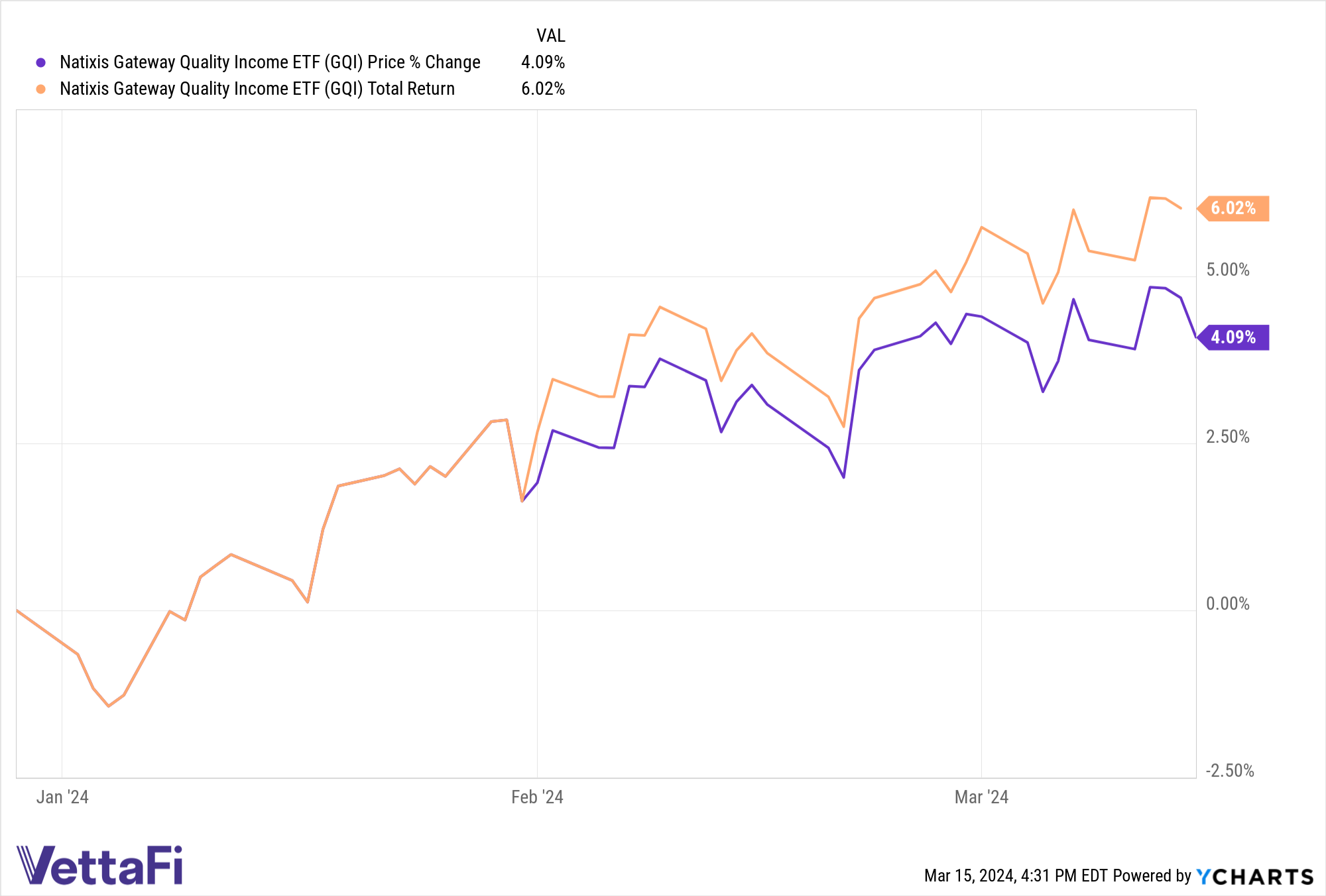

GQI is up 4.68% on a price returns basis and 6.02% on a total returns basis YTD as of 03/14/2024, according to Y-Charts data.

How to Slot GQI Into Your Portfolio

The fund makes a strong addition to a portfolio with three different potential applications. GQI is a noteworthy complement to existing equity allocation, adding risk-adjusted exposure. Because it focuses on high-quality, established companies, it offers the potential for reliable equity exposure. The measure of volatility mitigation also means it’s at home with other minimum volatility funds.

It’s also a notable addition to an income sleeve as an alternative to dividend yield strategies. Through the fund’s options strategy and focus on quality stocks, it seeks to provide consistent income through dividends and premiums.

Lastly, GQI slots nicely as a complement to existing credit allocations. Because it generates its income from dividends and premiums, it doesn’t carry interest rate risk. This makes it a great addition to currently held credit strategies such as high yield or as a replacement. The fund seeks to generate yields relative to those of bonds.

GQI is actively managed, fully transparent, and has an expense ratio of 0.34%.

For more news, information, and analysis, visit the Portfolio Construction Channel.