Since their inception, exchange traded funds (ETFs) continue to grow their market share and popularity with investors. The tax efficiency for which they are known comes down to three primary mechanisms from which the vehicle wrapper benefits.

ETFs and the Primary Market

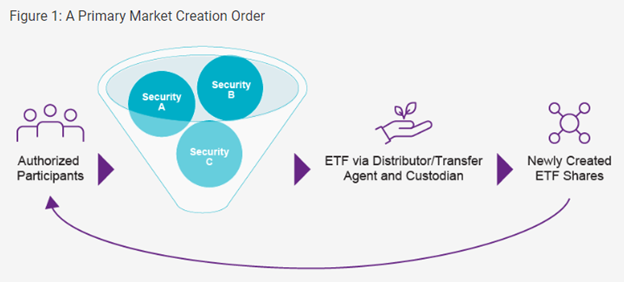

Exchange traded funds benefit from their ability to trade “in-kind” on the primary market. When demand outstrips supply, the ETF issuer is able to trade with an authorized participant (AP). This trade occurs in the primary market, where the issuer trades a pro-rata piece of its portfolio to the AP in exchange for shares.

Image source: Natixis Investment Managers

This transaction is an “in-kind” trade and goes in reverse when shares need to be redeemed. Redemptions also allow the ETF issuer to select lower cost bases by picking which tax lots to push out. This affords even greater tax efficiencies.

Capital gains are not triggered during in-kind trades. This means that any underlying securities with unrealized gains traded from the issuer to the AP don’t trigger for shareholders.

“Investors can maintain a higher level of unrealized capital gains on their books to be realized only when they choose to sell the ETF shares,” explained Tyler Williams, VP, ETF capital markets and product at Natixis Investment Managers, in a recent paper.

The Tax Benefits of ETF Custom Baskets

When it comes time to rebalance a portfolio, ETFs capitalize on their ability to create custom baskets. These trade on the primary market, allowing an ETF issuer to slice away overweight securities or sell out of a position entirely. The fund does so by creating a custom basket of only the securities that need to be reduced or sold out of.

In doing so, the issuer can select their lowest-cost basis tax lots to trade to an AP. “This flexibility enables ETFs to tactically decrease costs and increase tax efficiency when shifting portfolio allocations,” said Williams.

The Role of the Secondary Market

The intraday trading of ETFs by investors happens primarily on exchanges. These transactions occur between investors, brokerage firms, etc., on the secondary market, utilizing the fund’s intraday net asset value (iNAV) for pricing.

Because trades happen between two market participants, current shareholders are not impacted by the trades. This sharply contrasts mutual funds, wherein the fund is forced to utilize its cash reserves or sell underlying securities when a redemption occurs. When mutual funds sell underlying securities with unrealized capital gains, those gains become realized. This creates a taxable capital gain payout to mutual fund shareholders at year’s end.

In addition to the layers of tax-efficiency, fund managers also engage in tax-loss harvesting throughout the year.

For more news, information, and analysis, visit the Portfolio Construction Channel.