The heated debate surrounding traditional 60/40 portfolios in today’s markets has dwindled in recent months. Given ongoing market volatility and the growing popularity of alternatives, does the traditional portfolio hold up today?

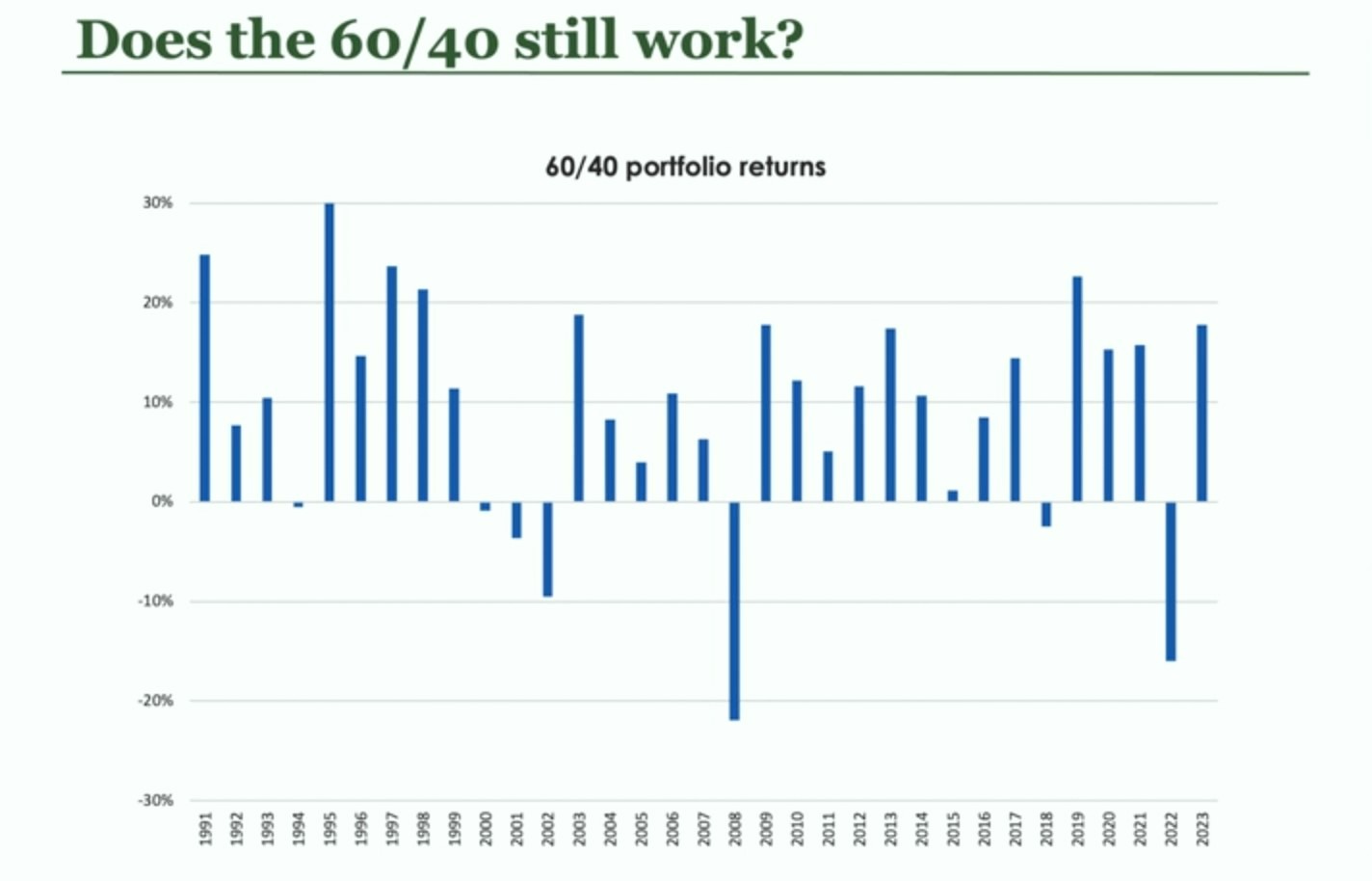

When the traditional portfolio, comprised of 60% equities and 40% fixed income, underperforms, it does so rather spectacularly. The pain that 60/40 portfolios felt in 2022 likely remains indelibly etched in the minds of advisors and investors.

However, those years of underperformance are few and far between. Bill Nygren, CFA, CIO-U.S., and Adam Abbas, head of fixed income, PM at Harris Associates, reviewed the 60/40 portfolio in a recent video.

Image source: Natixis Investment Managers

“Importantly, you can see that there have only been three significant down years” since 1991, Nygren points out. “As always, after the worst years, people seem to question whether or not the concept makes sense.”

It’s a notable track record, but perhaps the best benefit is reducing volatility when blending into a single benchmark. A blended 60/40 benchmark offers less volatility than the volatility of the individual components added together. This is due primarily to differences in correlation between stocks and bonds.

Historically, a traditional 60/40 portfolio offered substantial volatility reduction as stocks and bonds moved inversely. However, 2022 and 2023 resulted in high correlations between stocks and bonds. This dampened the blended portfolio’s ability to generate reduced volatility.

The Role of Bonds in the 60/40 Portfolio

Fixed income offers several benefits to a traditional portfolio beyond just the potential low correlation to stocks. Abbas discussed the three components bonds should provide.

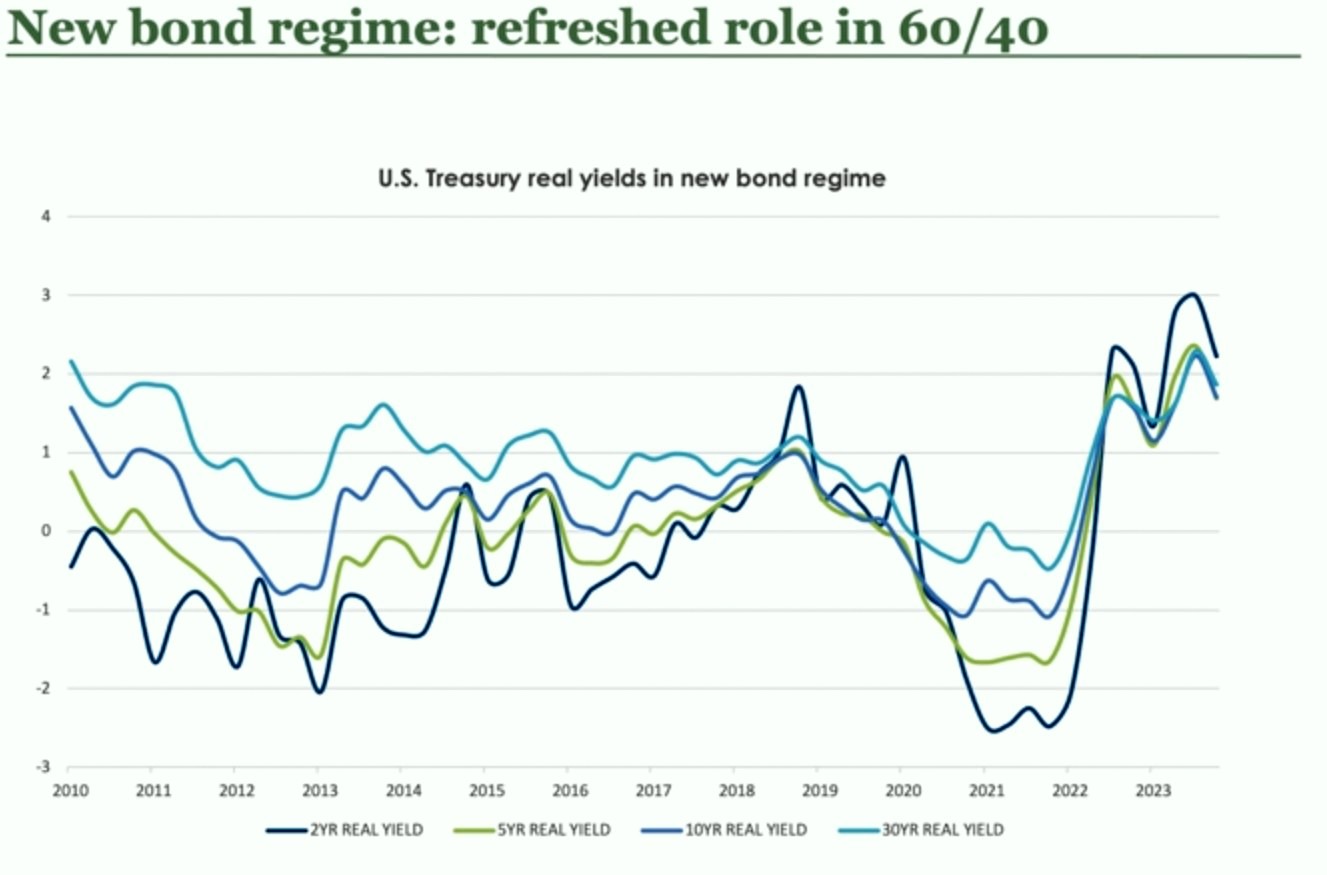

“You need standalone, attractive real yield — the yield you pay for after inflation,” Abbas said.

For over a decade, the Fed’s quantitative easing stance suppressed yields within bonds. This meant that for more than a decade, bonds effectively languished in portfolios. It’s not the case anymore.

Image source: Natixis Investment Managers

Real yields currently sit between 1.5-2%. This creates “great expected, positive outcomes over the next three years,” explained Abbas.

Bonds also offer potential diversification to their stock counterparts. Stock and bond correlations generally rise during interest rate hikes and fall as rates recede. Given the outlook for Fed rate cuts this year, stock and bond correlations will likely fall.

Third, bonds must offer strong all-in yields that include recoveries and defaults.

“You can make the case for most of the prior 15 years, I would argue, we only had one checked of those three,” Abbas said. “Today, we believe all three boxes are checked.”

The forward-looking macro environment appears increasingly favorable for the time-tested 60/40 portfolio. Though alternatives certainly have their place, a 60/40 blended portfolio offers the potential for noteworthy performance looking ahead as bond yields return.

For more news, information, and analysis, visit the Portfolio Construction Channel.