By Todd Rosenbluth, CFRA

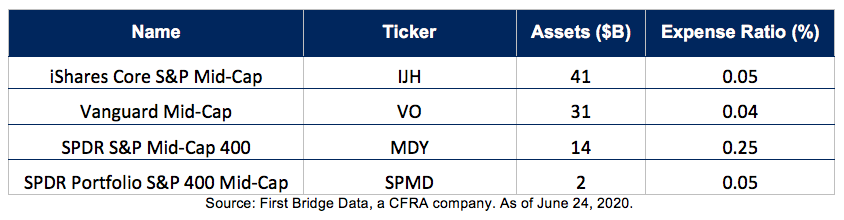

While iShares Core S&P 500 IETF (IVV) is the second largest S&P 500 based ETF, $41 billion iShares Core S&P MidCap (IJH) is the largest of the funds tracking the S&P Mid Cap 400 index, well ahead of $14 billion SPDR S&P Mid-Cap 400 (MDY). The latest fee cut to 0.05% makes it one fifth the price of MDY and matches the cost for much smaller SPDR Portfolio S&P 400 Mid-Cap (SPMD). However, Vanguard Mid-Cap Index ETF (VO) charges a 0.04% expense ratio and has $31 billion in assets. VO tracks a CRSP index that is constructed differently from IJH and peers.

Select U.S. Mid-Cap ETFs

In the past year, IJH incurred $2.8 billion worth of redemptions, but still has 70% share of the money invested in S&P 400 Mid-Cap connected ETFs. SPMD has just 1% of this asset base, yet the fund pulled in approximately $760 million of net ETF flows, highlighting that fees matter to some investors. With IJH now charging the same fee as SPMD, we think iShares could slow SPMD’s gains.

IJR is now even cheaper than another popular iShares small-cap fund. Through iShares, BlackRock (BLK) offers the two largest U.S. focused small-cap ETFs, with $38 billion iShares Core S&P Small Cap ETF (IJR) narrowly bigger than iShares Russell 2000 Index ETF (IWM). But with a new 0.06% expense ratio, IJR is less than one-third the price of IWM, which will likely further extend its lead.

Select U.S. Small-Cap ETFs

For investors favoring the S&P index construction approach that incorporates a profitability screen, IJR has been dominant with 91% market share. Yet SPDR Portfolio S&P 600 Mid-Cap Index ETF (SPSM), which has a 5% share, has gathered $1 billion of net inflows in the past year — doubling its asset base to $2 billion.

With the latest fee cuts of core U.S. equity ETFs, we think iShares is better positioned to appeal to investors who prioritize fees to support asset allocation needs. Yet, the battle for investor attention is likely to persist as Vanguard and State Street Global Advisors have similarly priced S&P index-based ETFs or popular ones that track different benchmarks. For investors, having more low-cost alternatives to consider is overwhelmingly positive.

Todd Rosenbluth is Director of ETF & Mutual Fund Research at CFRA.

All of the views expressed in this research report accurately reflect the research analyst’s personal views regarding any and all of the subject securities or issuers. No part of the analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this research report. For more information and disclosures, please refer to CFRA’s Legal Notice at https://www.cfraresearch.com/legal/.

Copyright © 2020 CFRA. All rights reserved. All trademarks mentioned herein belong to their respective owners.