Americans are more focused than ever on lavishing love on their furry companions.

On Thursday, shares of Petco Health and Wellness Company rocketed by about 50% in their first trading day on the New York Stock Exchange, underscoring the move toward investing in the pandemic-fueled pet care industry.

Petco opened at $26, after being priced at $18, to rise by about $816.5 million. The pet care company is trading under the ticker symbol WOOF.

This is not the first time Petco went public. The San Diego-based pet supply retailer was founded in 1965, and was traded publicly in 1994, but taken private when its ownership changed hands. The company currently has about 1,470 stores across the U.S. and Puerto Rico, including more than 100 in-store veterinary hospitals.

Products and services from pet stores like Petco have grown in popularity during the pandemic, as an increasing number of Americans adopt new dogs, cats, lizards, and hamsters.

With less interaction between human companions, the demand for pet supplies and accessories has only blossomed over the years, as owners spoil their with toys and accessories, and offer them fresh or organic food options. In fact, a LendingTree poll in October found that 1 in 3 pet owners increased spending on their pets during the pandemic, even as unemployment climbed and other types of spending declined.

Pet Gains Are Growing Across the Board

Petco isn’t the only company to benefit from rise in pet ownership. Online rival Chewy’s shares have climbed over 250% in the past year. The company has a subscription-based model that automatically delivers pet supplies for owners, such as dog food or cat litter. And now Barkbox, a provider of subscription boxes of dog treats, said last month that it will go public through a merger with a SPAC.

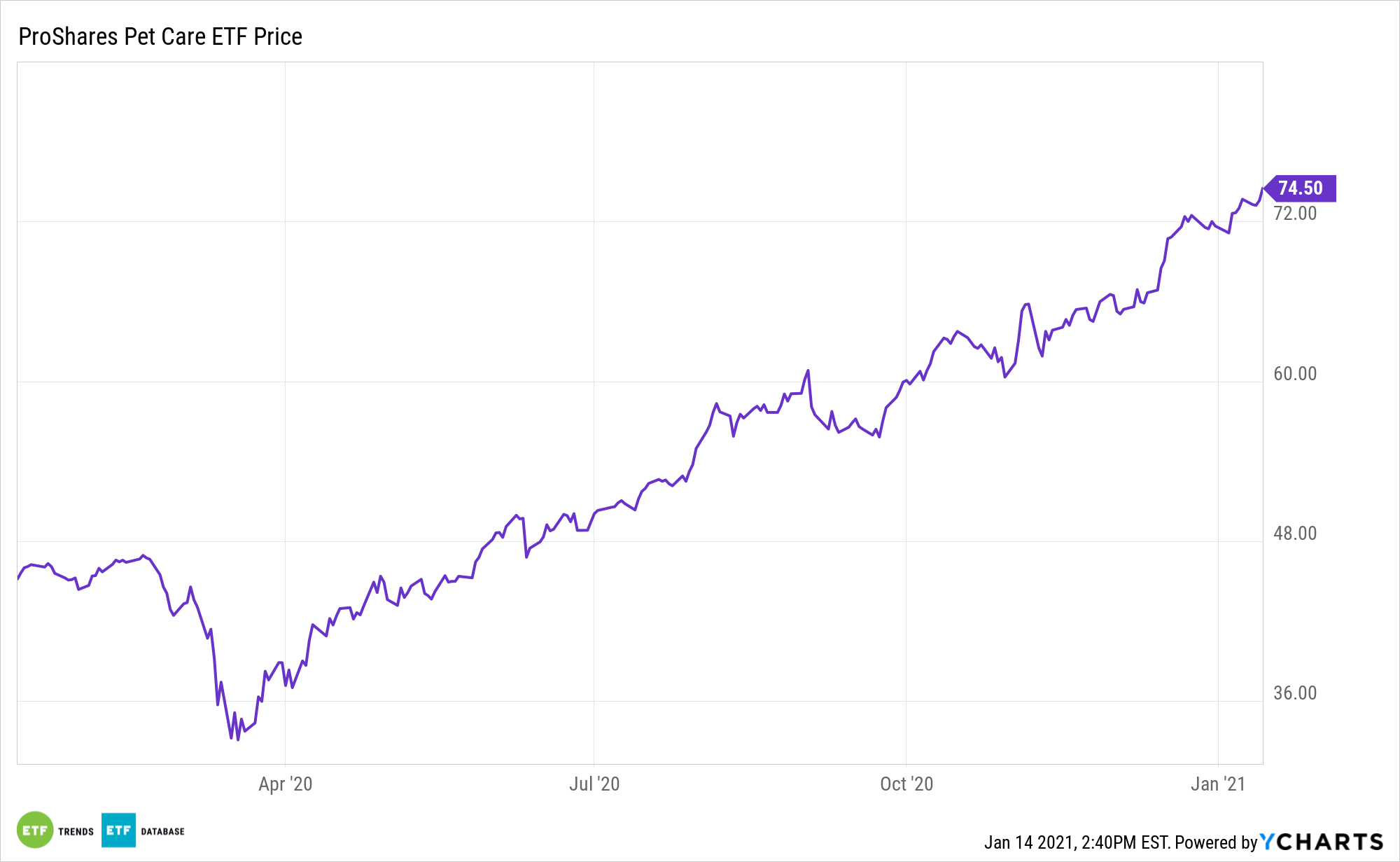

For investors looking to capitalize on the pandemic-fueled pet frenzy, the ProShares Pet Care ETF (CBOE: PAWZ) is one place to start.

PAWZ, the first and only dedicated pet care ETF, seeks investment results, before fees and expenses, that track the performance of the FactSet Pet Care Index. The fund seeks to invest substantially all of its assets in the securities included in the index. Under normal circumstances, the fund will invest at least 80% of its total assets in the component securities of the index. The index consists of U.S. and non-U.S. companies that potentially stand to benefit from interest in, and resources spent on, pet ownership.

PAWZ is proving to investors that the pet care thesis has mettle in a trying market environment.

“In a recent interview on Bloomberg TV, Simeon Hyman, ProShares Global Investment Strategist, explains how the increase in pet adoptions while many people stay at home is an extension of the long-term trends in pet ownership,” writes ProShares.

PAWZ includes sectors such as veterinary pharmaceuticals, diagnostics, services, and product distributors; pet and pet supply stores, and pet food and supply manufacturing. Healthcare and retail stocks make up a significant portion of the PAWZ roster, and the ProShares ETF has the potential to outperform traditional funds tracking those sectors.

For more market trends, visit ETF Trends.