By David Haviland, Beaumont Capital Management

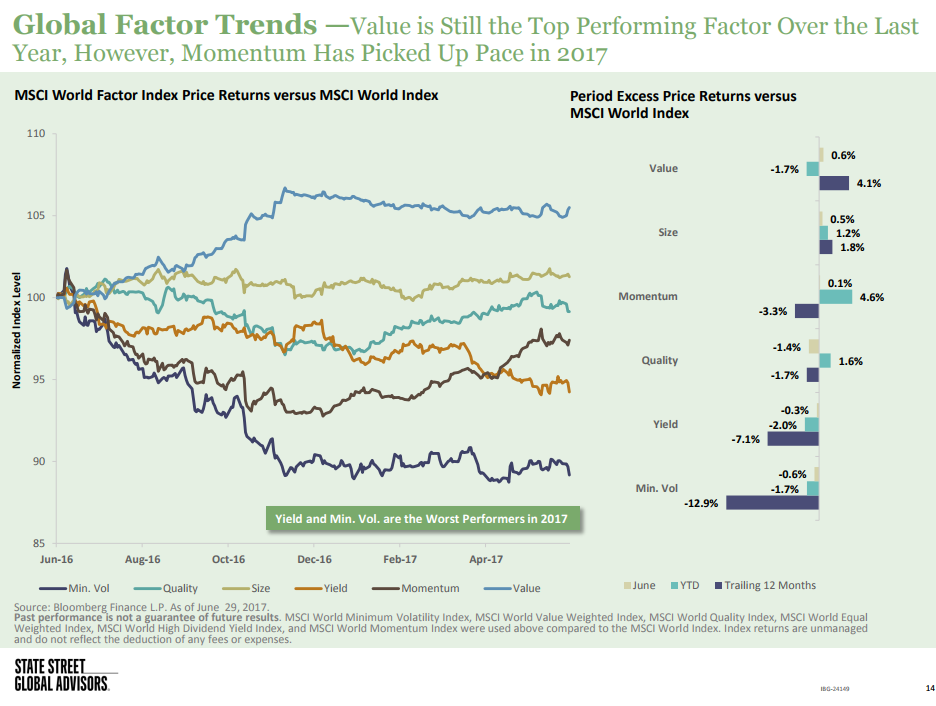

This is a great chart from State Street Global Advisors showing how the 6 most common factors, often referred to as “Smart Beta”, have performed over the past year. Market volatility, as measured by the Chicago Board Options Exchange (CBOE) Volatility Index (VIX) and the standard deviation of the S&P500® Index, has been at or near historic lows. Yet the minimum volatility factor has been the worst performing factor for the last 12 months. Why? Empirically, it does make sense. If the markets as a whole are exhibiting extremely low levels of volatility, then the factor isolating low volatility does not add any value. In short, the low volatility factor needs high market volatility to add value.

We also note that the yield factor has underperformed relative to the market. Some of this is cyclical in nature as the Technology and other cyclical growth sectors have led the markets higher. But the yield factor has two little discussed “enemies”: concentration risk and (low) quality risk.

Yield factor ETFs with large over-weights to sub-sectors such as Utilities, REITs or MLPs often find that these concentrations add or subtract value quickly and substantially. The first two are relatively small sectors of the S&P 500 as they constitute around 3% of the market cap index’s weight. MLPs are part of the energy sector. ETFs that concentrate too much in one or more sectors will live and die by the same sword. What many forget is that these industries are also subject to interest rate and other peripheral risks. In a rising interest rate environment, yield ETFs over-exposed to one or more of these sub-sectors will likely face significant headwinds.

Yield ETFs should also be scrutinized for how they deal with value or the lack thereof. High dividends are sometimes caused by falling prices and thus the expression “trying to catch a falling knife”. Back in 2008-09, were the bank stocks a safe play when their yields rose? No! If you bought the bank stocks when their yields were the highest, you would have experienced significant dividend cuts (some to zero!) along with further large price declines. Is a company or sector financing their high dividends by taking on debt? It happens! The point is that yield ETFs and the indices they track need to screen for the quality of their dividends or they risk having some nasty consequences.

All in all, Smart Beta can add tremendous value over time. But in the 2007-2009 drawdown, the six factors noted in the chart above, if held in equal weights, had a drawdown virtually identical to the 51% loss in the S&P 500. Factor investments often act like other stocks in corrections and bear markets. While factor ETFs may help add a percent or two of excess return in bull markets or even sideways markets, clearly they add little help in bear markets.

For this, an investor needs a rules-based investment system engineered to capture both paradigms…the capture of the risk premia over time from the factors in normal markets and the loss avoidance capabilities of a disciplined investment system in bear markets.

David Haviland is a Managing Partner and Portfolio Manager at Beaumont Capital Management, a participant in the ETF Strategist Channel.

Disclosure:

An investment cannot be made directly in an index.

This material is for informational purposes only. It is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument, nor should it be construed as financial or investment advice.