The S&P 500 rallied before markets opened on Thursday as traders processed strong macroeconomic updates and a key earnings release.

Shares of Meta (META) surged in premarket trading on Thursday, reaching their highest level since January 2022. Meta stock climbed 8% on the company’s better-than-expected second-quarter earnings report after the bell on Wednesday.

See more: “Meta Reports After Market Close; Watch Overnight Returns”

Meanwhile, GDP data released before markets opened on Thursday showed U.S. economic growth unexpectedly accelerated during the last quarter. GDP increased 2.4% in the second quarter, beating analysts’ expectations of a 2% rise.

Many key macro and earnings updates are released during the post-close (between the closing bell and midnight) or the pre-open (between midnight and the opening bell), greatly influencing returns during the overnight trading session.

See more: “With Q2 Earnings Underway, Keep an Eye on the Overnight Session”

The Day and Night Return Gap on Thursday

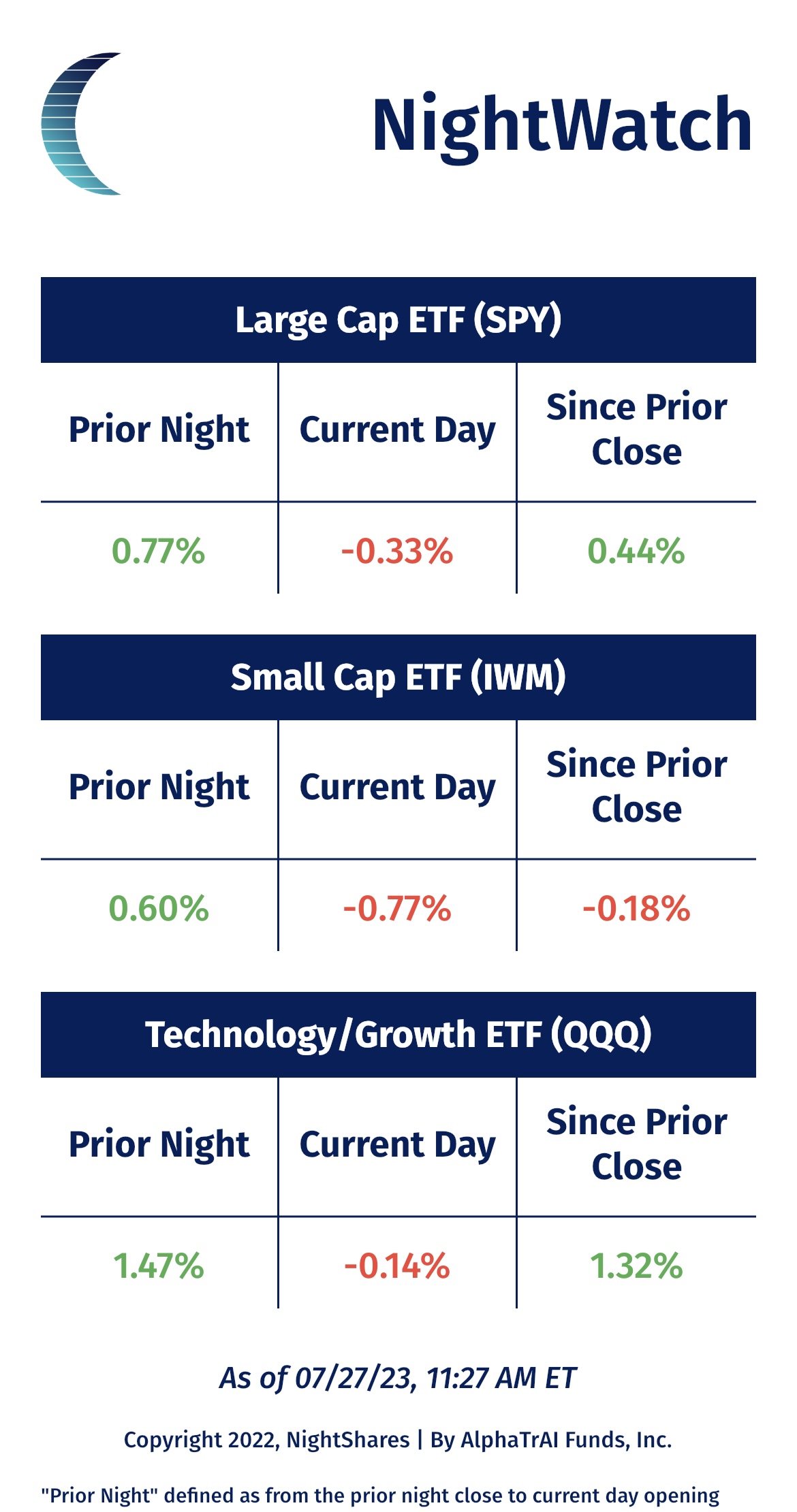

While the S&P 500 is up on Thursday, all of the positive performance by midday came while markets were closed, from the prior night close to the current day opening. During the prior overnight session, the SPDR S&P 500 ETF Trust (SPY) was up 0.8%. Since the opening bell on Thursday, SPY has declined around 0.3% by 11:30 AM.

Investors with leveraged exposure to the overnight trading session are often better positioned than buy-and-hold investors when earnings and macro updates are upbeat. The NightShares 500 1x/1.5x ETF (NSPL) provides exposure that corresponds to 1x the performance of the S&P 500 during the day and 1.5x the portfolio performance at night, capturing overnight returns.

While SPY is up about 0.4% in midday trading on Thursday, NSPL is up about 0.9%.

By leveraging the overnight session with NSPL, investors are efficiently capturing the night effect. The night effect is a persistent pattern whereby the majority of large- and small-cap returns come in during the overnight session. Meanwhile, most of the volatility comes during the daytime session.

For more news, information, and analysis, visit the Night Effect Channel.