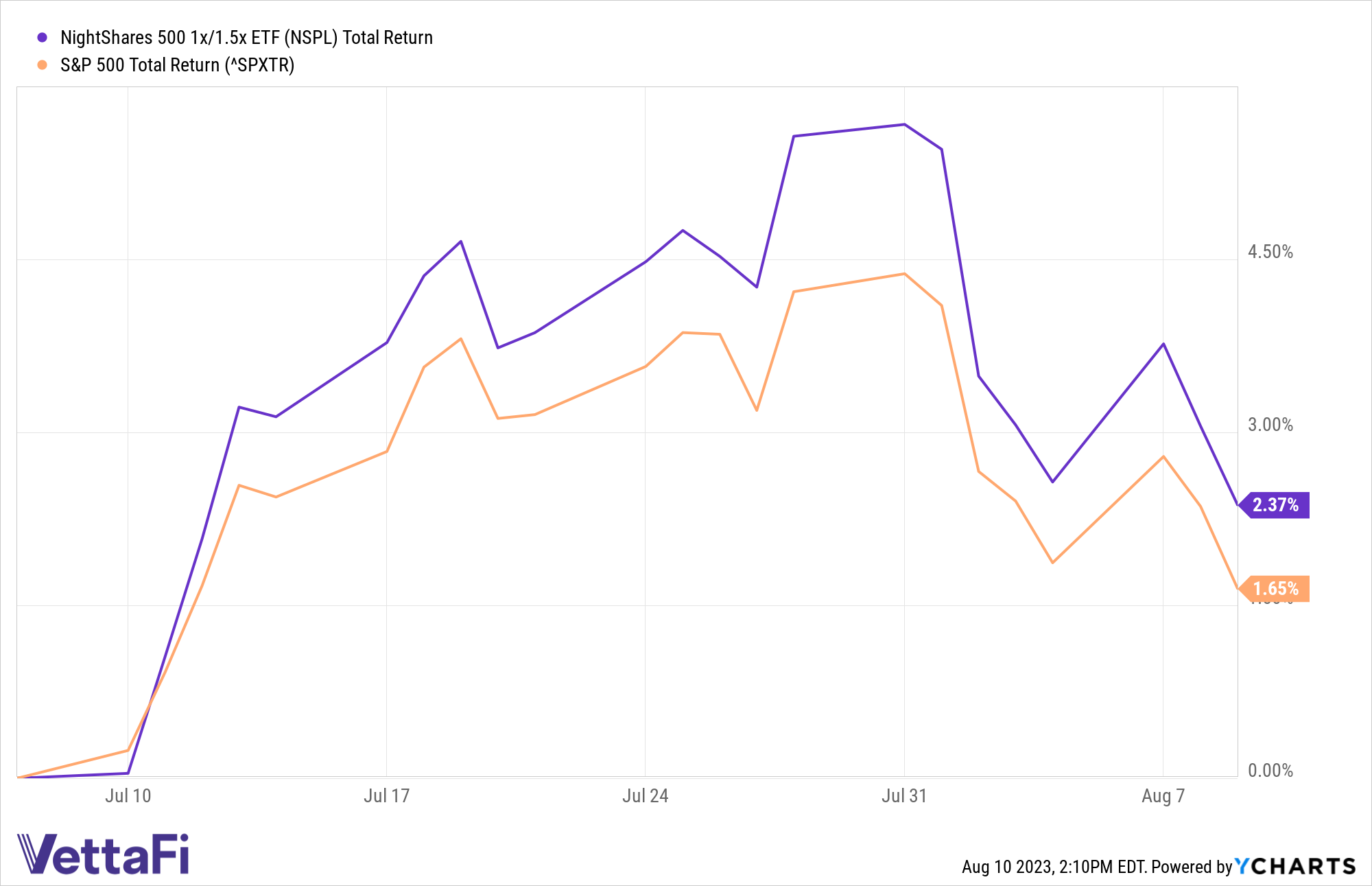

An ETF capturing the night effect is outperforming the benchmark S&P 500 over a one-month period.

The night effect, a nontraditional investment factor, is a pattern whereby equities have historically performed better during the night session when local exchanges are closed than during the day when markets are open. The overnight trading session tends to contribute most of the returns, while the day session contributes most of the volatility.

The NightShares 500 1x/1.5x ETF (NSPL) captures the night effect in a cost-effective and efficient way. The night effect ETF aims to provide returns that correspond to 1x the performance of a portfolio of the S&P 500 during the day and 1.5x the portfolio performance at night.

Over the past one month, NSPL has climbed 2.4% while the benchmark has increased 1.7%. Over a three-month period, NSPL is outpacing the benchmark by 23 basis points.

Similar to traditional factors (think value, size, growth), the night effect rotates in and out of favor and has the potential to enhance performance.

Recently, the night session has rallied on better-than-expected earnings releases and upbeat macroeconomic updates. Many key macro and earnings updates are released during the post-close (between the closing bell and midnight) or the pre-open (between midnight and the opening bell), greatly influencing returns during the overnight trading session.

See more: “Why Leverage the Night Session Before Thursday’s CPI Report”

Thursday’s CPI print, released at 8:30am, sent stocks higher during premarket trading (the night session). Despite month-over-month inflation accelerating slightly, Wall Street celebrated as actual CPI came in lower than analysts’ estimates.

By midday Thursday, the S&P 500 was up only about 0.1%. The night session has gained 0.55%, partially offset by the day session’s 0.45% decline.

For more news, information, and analysis, visit the Night Effect Channel.