The night effect is handily outpacing many traditional investment factors in 2023.

The night effect is a persistent pattern whereby most large and small cap returns come in during the overnight session. Conversely, most of the volatility comes during the daytime session. Investors can tilt their exposure toward the overnight session to enhance risk-adjusted returns.

The night effect is best classified as a nontraditional investment factor. Similar to traditional factors (think value, momentum, growth), the night effect rotates in and out of favor and has the potential to enhance performance.

During the 20 years between 2003 and 2022, the night session was up 56% of the time. However, performance can diverge when looking at shorter durations. Year to date in 2023, the night is lagging its historical performance and has been up about 48%; however, the night effect is still beating other traditional investment factors.

How the Night Effect Stacks Up Against Traditional Investment Factors

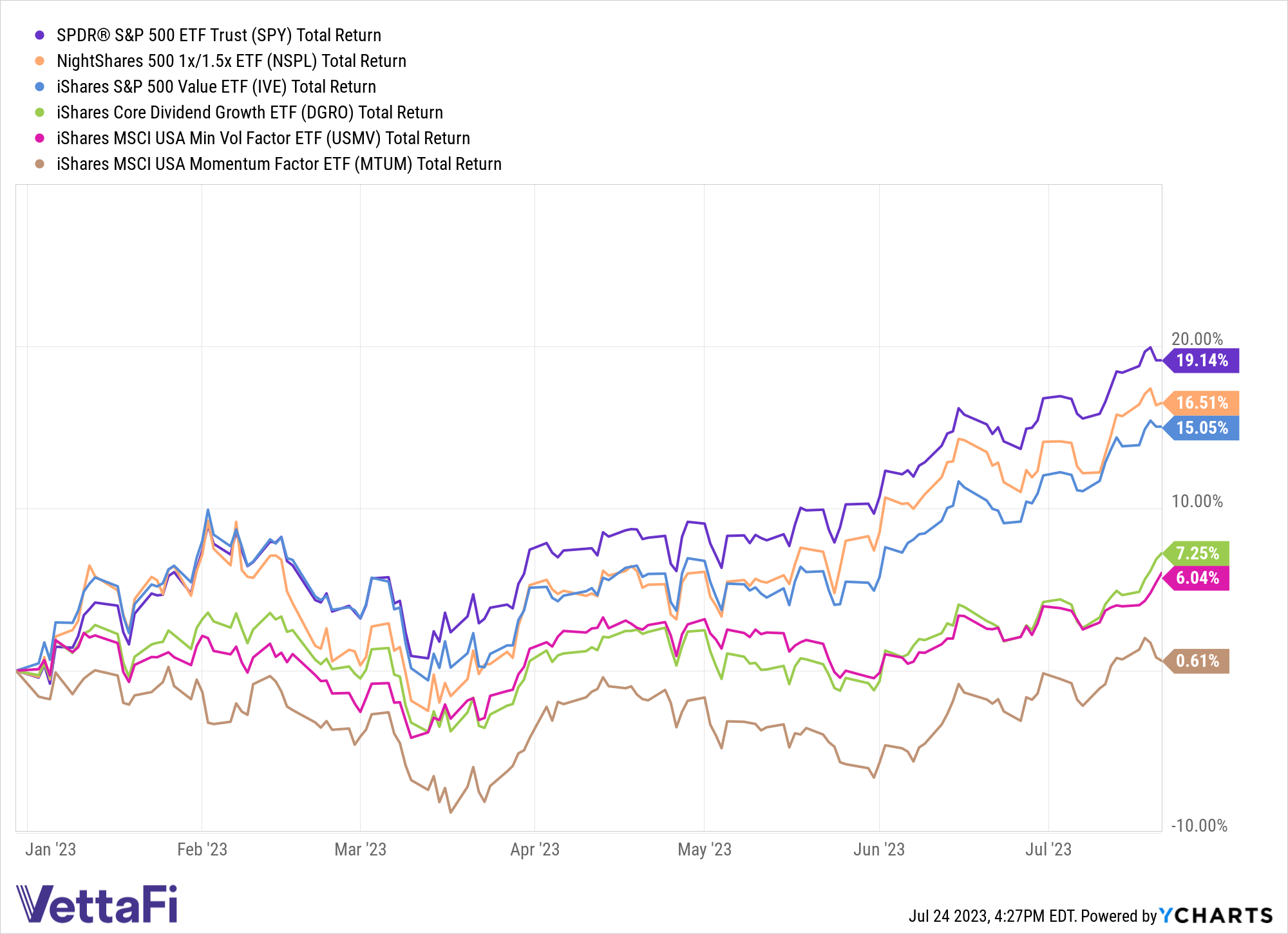

Looking at some of the most popular factor-based ETFs, the NightShares 500 1x/1.5x ETF (NSPL) is in the lead, trailing only the benchmark SPDR S&P 500 ETF Trust (SPY).

NSPL leverages the overnight trading session to provide exposure to the night effect. NSPL seeks to provide investment results that correspond to 100% of the performance of the S&P 500 during the day and 150% of the portfolio performance at night.

SPY is up 19.1% year to date as of July 24, while NSPL has climbed 16.5%. The iShares S&P 500 Value ETF (IVE), which provides exposure to the value factor, is up 15.1%.

Meanwhile, the more defensive iShares Core Dividend Growth ETF (DGRO) and iShares MSCI USA Min Vol Factor ETF (USMV) have gained 7.3% and 6.0%, respectively.

The iShares MSCI USA Momentum Factor ETF (MTUM) is relatively flat year to date – up just 0.6%.

History has demonstrated most investors will improperly time the market and miss out on returns when trying to be tactical. Therefore, the night effect, like other investment factors, is generally used as a long-term holding.

For more news, information, and analysis, visit the Night Effect Channel.