Large- and small-cap stocks in May have seen a stable upward drift during the overnight trading session, only for the day session to claw back returns.

The night effect is a persistent phenomenon whereby overnight markets have historically outperformed the daytime trading session on a risk-adjusted basis. The overnight trading session has delivered much of U.S. large- and small-cap equities’ returns with much lower volatility than the day session over the past 20 years.

See more: “Everything Advisors Need to Know About the Night Effect“

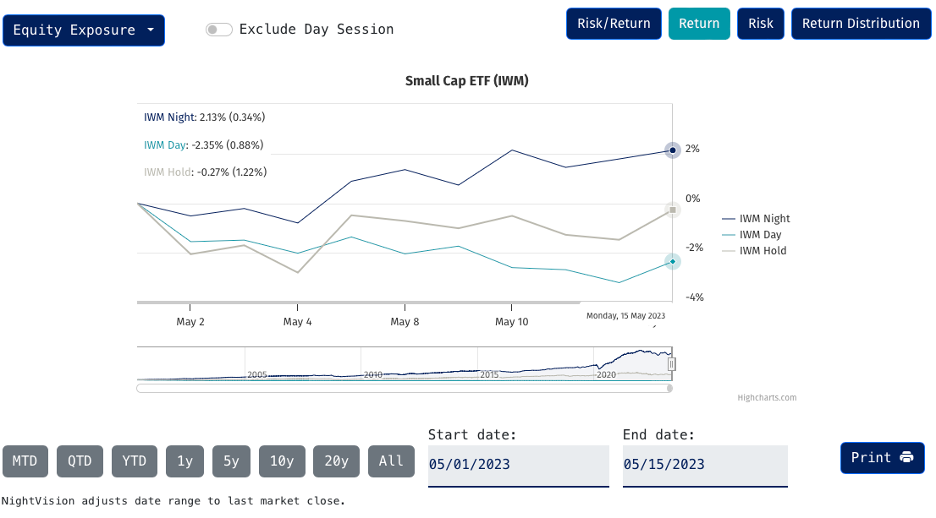

The night effect has historically been more pronounced in small-cap stocks. Over the past 20 years (2003 through 2022), 100% of the returns generated by the iShares Russell 2000 ETF (IWM) have come at night.

So far in May, IWM’s night session trading climbed 2.1%, while the day declined 2.4%.

Between May 1 and May 15, the night session of IWM climbed 2.1% while the day declined 2.4%, bringing buy-and-hold return to -0.3% month to date, according to NightVision.

Investors can get targeted exposure to small caps’ night performance with the NightShares 2000 ETF (NIWM), which offers exposure to the night performance of 2000 small-cap U.S. companies. Investors can use NIWM as a substitute for small-cap exposure, or to complement and enhance existing small-cap exposure by effectively tilting toward the night.

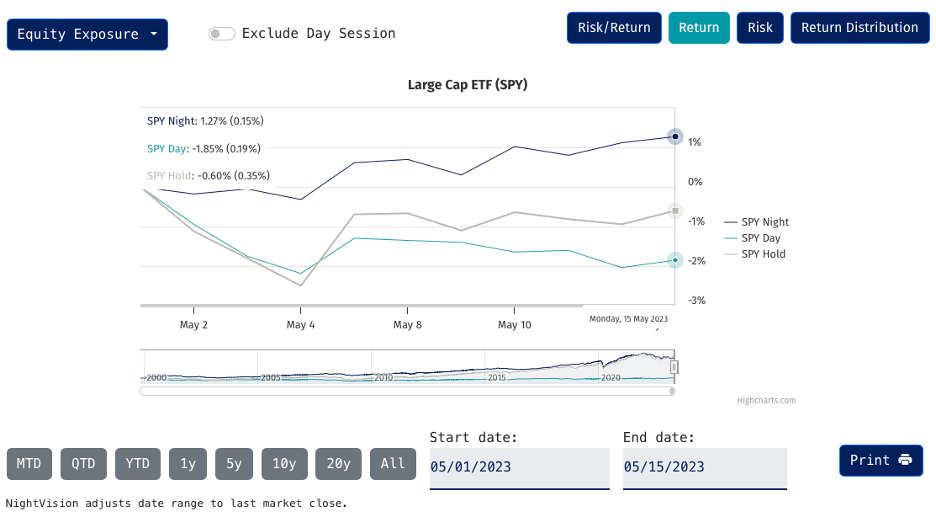

Large Cap Performance in May

In May, SPY returns rose 1.3% overnight, but fell 1.9% in day trading.

Meanwhile, large caps exhibit the same trend month to date. SPY increased 1.3% during the night session. However, the day session, which declined 1.9%, clawed back returns for buy-and-hold investors, according to NightVision.

The NightShares 500 ETF (NSPY) provides exposure to the night performance of 500 large-cap U.S. companies. Conversely, the NightShares 500 1x/1.5x ETF (NSPL) offers exposure to both night (150%) and day sessions (100%), tilting toward the night.

For more news, information, and analysis, visit the Night Effect Channel.