Investors can add the NightShares 2000 ETF (NIWM) to their small-cap allocation to smooth out volatility and enhance risk-adjusted returns.

NIWM provides exposure to the night performance of 2000 small-cap U.S. companies (comparable to the night session of the Russell 2000). Investing in the overnight trading session capitalizes on a market anomaly referred to as the night effect, whereby overnight markets have historically outperformed the daytime trading session on a risk-adjusted basis,

Advisors can use NIWM in portfolios to dampen volatility, effectively increasing a portfolio’s risk budget elsewhere.

“Advisors are seeking higher reward, yet lower risk incurred through equities,” Todd Rosenbluth, head of research at VettaFi, said. “They might want to consider strategies that incorporate after-hours trading.”

The Night Session Enhances Risk-Adjusted Rewards

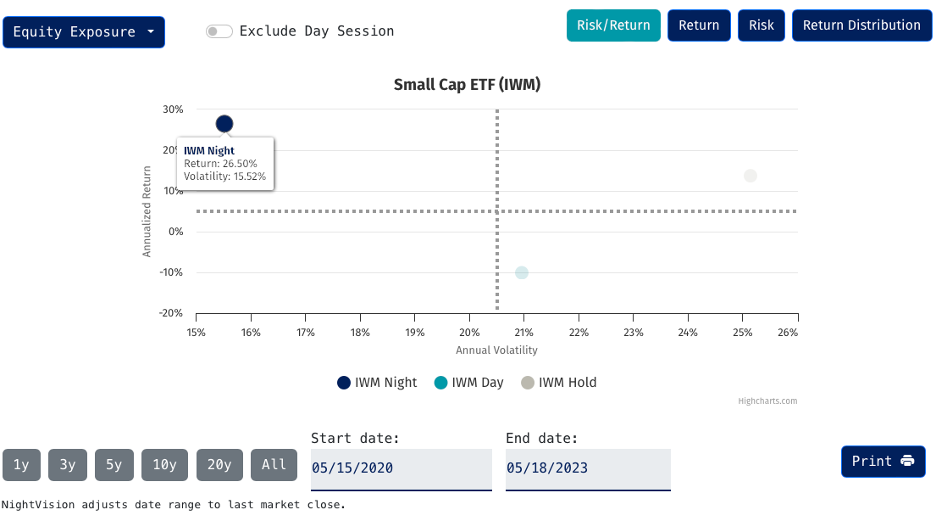

Over three years, the iShares Russell 2000 ETF (IWM) has returned 13.7% annualized, with an annual volatility of 25.1%. Meanwhile, the day session returned -10.1%, with an annual volatility of 21%, and the night session returned 26.5%, with an annual volatility of 15.5%, according to NightVision.

The same trend is observed over a longer horizon. Over 20 years, IWM has returned 9% annualized, with an annual volatility of 24.1%. Meanwhile, the day session returned -2.7%, with an annual volatility of 20.1%. The night session returned 12%, with an annual volatility of 13.1%, according to NightVision.

See more: “If You Hold IWM but Want to Dampen Volatility, Check Out NIWM“

Looking at the IWM Sharpe ratio over 20 years (2003 through 2022) is another way to look at the night session’s track record of delivering stronger risk-adjusted returns. The buy-and-hold session Sharpe ratio is 0.46. Meanwhile, the night session Sharpe ratio is 0.90, while the day session Sharpe ratio is -0.08.

The negative Sharpe ratio for the day session is explained by the session’s negative returns negative, as over 100% of the fund’s returns have come at night.

For more news, information, and analysis, visit the Night Effect Channel.