Advisors are using NightShares ETFs in client portfolios for equity returns as well as non-correlated exposure across asset classes.

The overnight session often behaves better than the day session in that it frequently captures much of the upside while avoiding significant downturns. This is referred to as the night effect, a phenomenon whereby equities have historically performed better when local markets are closed than when markets are open.

NightShares launched three ETFs in 2022 that capture that night effect, including the NightShares 500 ETF (NSPY), the NightShares 2000 ETF (NIWM), and the NightShares 500 1x/1.5x ETF (NSPL).

Academic research has suggested multiple reasons as to why the night effect exists, with the frequently stated rationale focusing on the timing of information flow, risk management practices, and liquidity premiums arising from differences in the trading volumes between the day and night session, according to NightShares.

Non-Correlated Exposure

Alternative assets are used to reduce the overall risk and diversify client portfolios. These non-correlated assets can minimize the volatility of the portfolio and often lead to higher overall portfolio returns.

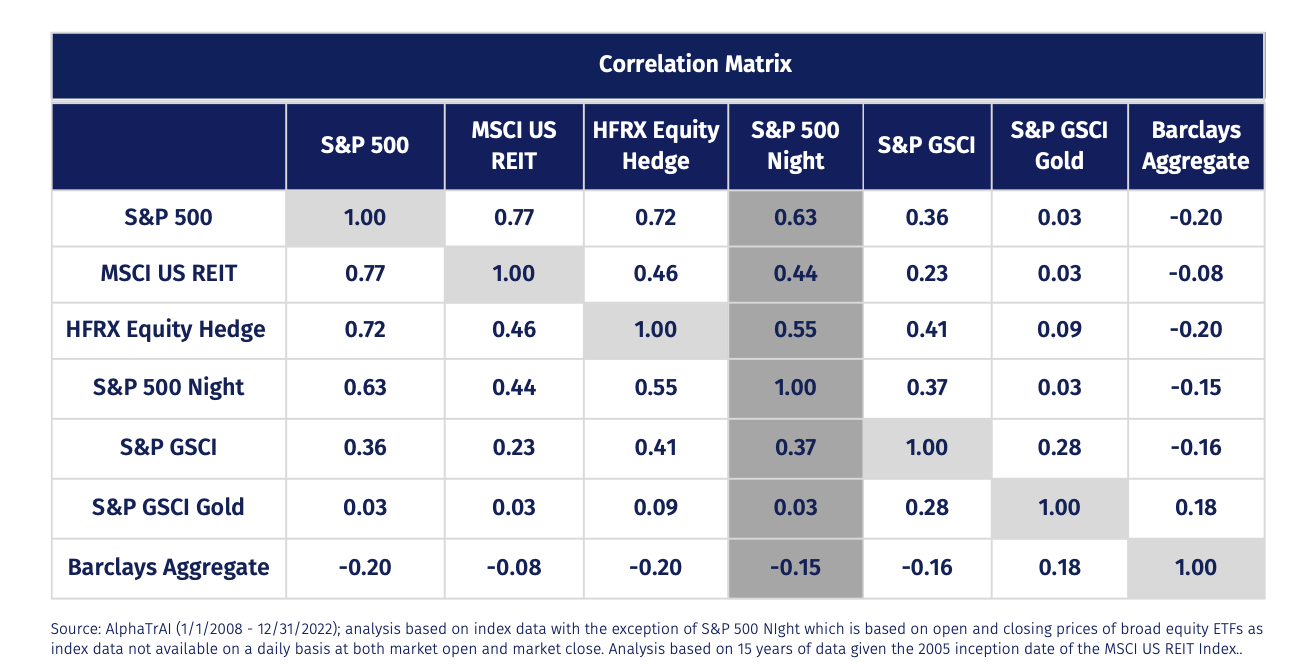

NightShares ETFs can serve as a diversifier in portfolios. The overnight session of the market has a lower correlation to the full market session than commonly used alternatives including real estate and equity hedge funds.

The night session of the U.S. large-cap equity market — accessible through NSPY — is less correlated to the full market cycle than real estate and equity hedge funds based on an analysis of the past 15 years. The night session also has a low correlation to the returns of other alternatives, including commodities and precious metals.

For investors looking to maintain day exposure but overweight the night, NSPL tilts toward the night, providing investment results, before fees and expenses, that correspond to 100% of the performance of a portfolio of 500 large-cap U.S. companies during the day and 150% of the portfolio performance at night.

NIWM provides exposure to the night performance of 2000 small-cap U.S. companies.

Enhancing Returns

The historically lower volatility of the overnight session may lead to better up/down capture ratios, allowing investors to more comfortably maintain their target equity exposure through periods of market volatility.

The SPDR S&P 500 ETF Trust (SPY) Sharpe ratio is 0.54 for holding the fund over 20 years (2003 through 2022). Meanwhile, during the same period, the night session Sharpe ratio is 0.62, while the day session Sharpe ratio is just 0.16.

During the same 20-year period, the power of the night effect is even more pronounced among small caps. The iShares Russell 2000 ETF (IWM) Sharpe ratio is 0.46 for holding the ETF between 2003 and 2022. The night session Sharpe ratio is 0.90, while the day session Sharpe ratio is -0.08.

The day session Sharpe ratio is negative as the session’s returns over the 20-year period have been negative, meaning over 100% of the fund’s returns have come at night.

For more news, information, and analysis, visit the Night Effect Channel.