The Invesco DWA Emerging Markets Momentum ETF (PIE) provides investors with a compelling alternative to the usual cap-weighted exchange traded funds that are so common in the emerging markets realm.

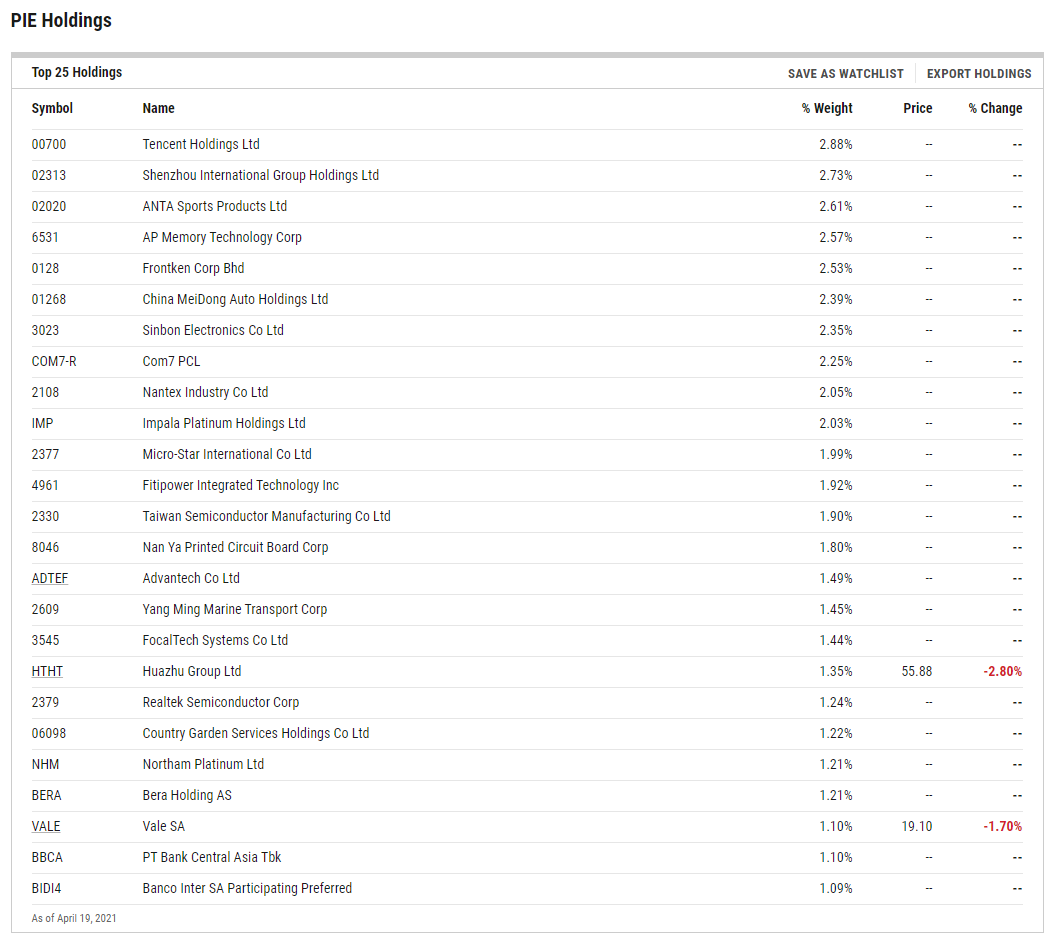

PIE invests in public equity markets of the global emerging region. It invests in stocks of companies operating across diversified sectors. The fund invests in momentum stocks of large cap companies. It seeks to track the performance of the Dorsey Wright Emerging Markets Technical Leaders Index by using a full replication technique. The fund will invest at least 90% of its total assets in the securities that comprise the underlying index. The underlying index is comprised of equity securities of large-capitalization companies based in emerging market countries.

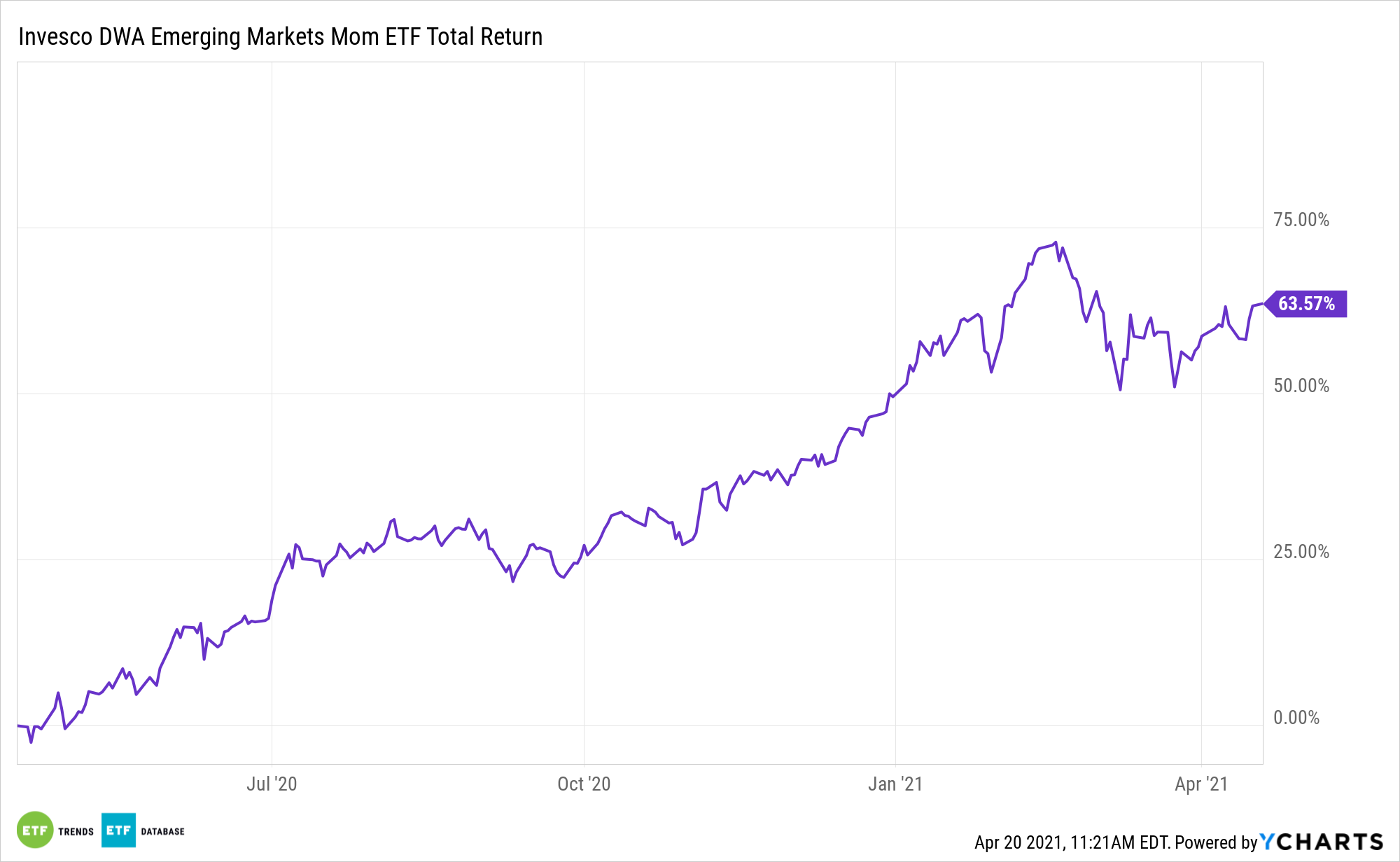

PIE’s momentum-based strategy is an attractive near-term proposition.

“We see the economic restart and greater stability in U.S. government bond yields – as indicated by our new nominal theme – supporting emerging market assets over coming months,” according to BlackRock research. “Their valuations appear relatively attractive in a world of low yields after a choppy start to the year. Risks to our view include potential policy tightening and sluggish vaccine rollouts in some EMs.”

PIE’s Potential

Analysts have been upwardly revising earnings estimates on emerging market companies faster than for those in developed countries. These factors could be signs that investors may want to deploy active management when allocating to developing economies.

The emerging market space has attracted the attention of some big money managers. For example, Ashmore Group Plc, JPMorgan Chase & Co., and UBS Group AG have all been supporting a bullish case for emerging market equities so far in 2021, predicting the category to be a prime beneficiary of the post-coronavirus economic recovery process.

PIE’s underlying index includes approximately 100 companies from the Nasdaq Emerging Markets Index that possess powerful relative strength characteristics and are domiciled in emerging market countries including but not limited to Brazil, Chile, China, India, Indonesia, Philippines, South Africa, Thailand, and Turkey. The Index excludes US companies listed on a US stock exchange. The Index is computed using the net return, which withholds applicable taxes for non-resident investors.

“We expect our new nominal theme – a more muted response in nominal yields to higher inflation expectations – to hold as we move toward a full reopening. The U.S. dollar has strengthened so far this year, reflecting the faster-than-expected restart in the U.S. fueled by an accelerated vaccine rollout and large fiscal spending,” adds BlackRock.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.