Victory Capital Holdings, Inc. (NASDAQ: VCTR), the parent company of asset manager Victory Capital Management and exchange traded funds issuer VictoryShares, is planning to enter the cryptocurrency market and will extend a long-running relationship with Nasdaq as part of that effort.

The San Antonio-based money manager said last week it inked exclusive accords with Nasdaq and crypto-focused asset manager Hashdex Ltd. as part of its crypto market plans.

“Victory Capital will be the exclusive sponsor of private placement funds and other vehicles for U.S. investors, based on the Nasdaq Crypto Index (NCI), a multi-coin crypto index co-developed by Nasdaq and Hashdex,” according to a statement.

That index dates its inception back to Dec. 1, 2020. As of June 1, it allocates about 94% of its combined weight to Bitcoin and Ethereum – the two largest digital coins by market capitalization. Litecoin, Chainlink, and UniSwap are among the other top 10 components in the benchmark. BitGo, Coinbase, Fidelity, and Gemini are the core custodians for the index.

NCI is designed to be adaptable, investable, and representative. Its goal is to simplify access to the booming digital asset market.

“The rules-based index is designed to be dynamic in nature, broadly representative of the investable landscape of the cryptocurrency market, and readily trackable by investors. It employs strict eligibility criteria and is rebalanced quarterly to maintain a current representation of this market,” notes Victory Capital.

Victory Capital is aiming to launch a private placement fund reserved for accredited investors that tracks NCI. The asset manager is also looking to bring to market Bitcoin and Ethereum private placement funds linked to the Nasdaq Bitcoin Reference Price Index as well as the Nasdaq Ethereum Price Index.

No mention of an exchange traded fund was made in the statement, but Hashdex offers the Hashdex Crypto ETF, which tracks NCI on the Bermuda Stock Exchange (BSX). Regulators have yet to approve Bitcoin-backed ETFs in the United States.

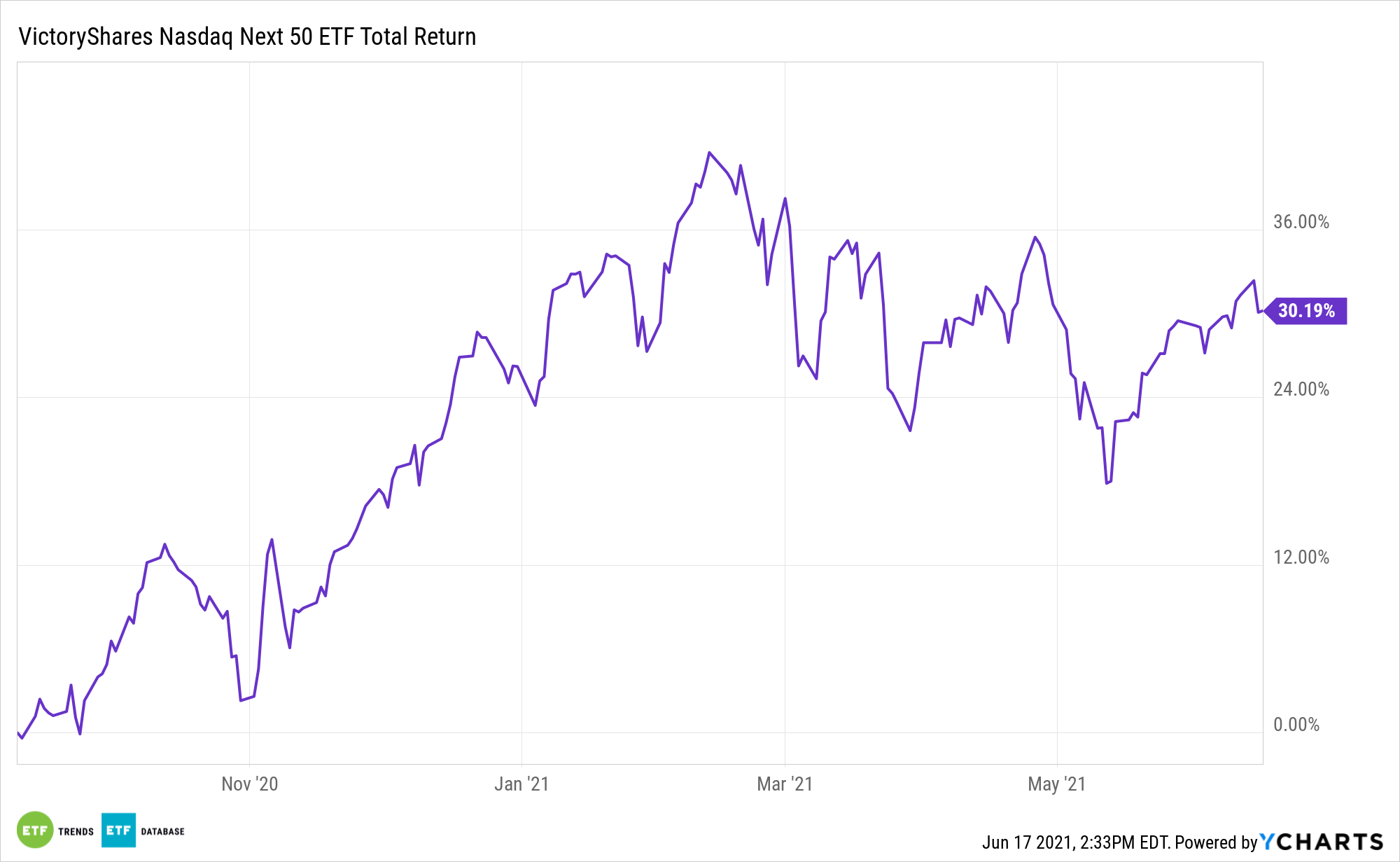

Some well-known VictoryShares ETFs available to all investors in the U.S. include the VictoryShares US 500 Volatility Wtd ETF (CFA), VictoryShares Nasdaq Next 50 ETF (QQQN), and the VictoryShares Dividend Accelerator ETF (VSDA). All of those funds track Nasdaq indices.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.