Growth is essential when investing for dividends, meaning investors should evaluate companies with strong balance sheets and the ability to grow payouts.

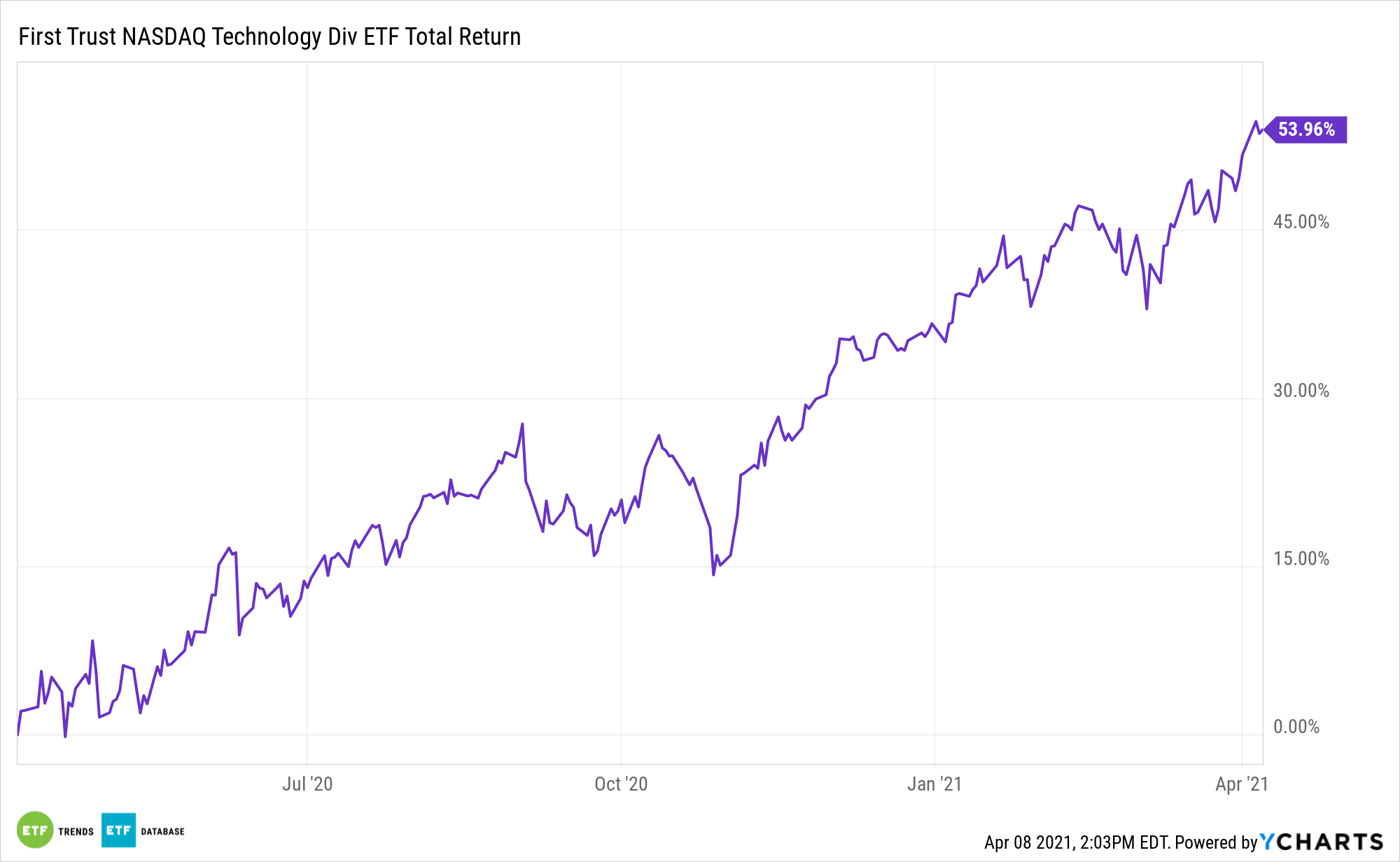

Technology checks those boxes. Enter the First Trust NASDAQ Technology Dividend Index Fund (NasdaqGS: TDIV). TDIV tracks the NASDAQ Technology Dividend Index.

TDIV screens for technology names that have paid a regular or common dividend within the past 12 months, have a yield of at least 0.5%, and have not had a decrease in common dividends per share paid within the past 12 months.

With dividend growth picking up across the board, TDIV could be a standout for dividend investors.

“In the first quarter of 2021, companies were 14 times more likely to have positively raised or initiated a dividend than negatively cut or suspended dividend payments. This was nearly triple the ratio from a year earlier,” notes CFRA Research’s Todd Rosenbluth, head of ETF & mutual fund research. “Dividend increases were common within the Information Technology sector, and companies such as Analog Devices (ADI) and Applied Materials (AMAT) are among the companies that will further boost cash payments, according to CFRA.”

Time to Talk TDIV?

TDIV takes some of the volatility out of the tech sector while providing higher levels of income than what are usually associated with this sector.

“The S&P 500 dividend yield at the end of March 2021 was 1.5%, in line with a year earlier but down from 1.9% two years earlier,” added Rosenbluth. “Throughout this period, Information Technology stocks sported below average yields on average, with the recent 1.0% yield down from 1.3% two years earlier. Yet at the end of the first quarter of 2021, 59% of Information Technology stocks in the S&P 500 paid a dividend. While this is lower than 76% for the broader index, the percentage was higher than the 49% for the fellow growth-oriented Consumer Discretionary sector.”

While yields are low across many sectors, including tech, TDIV is relevant for income investors because it’s home to a group of companies with large cash stockpiles that can sustain and grow payouts.

For years, technology was the not first sector investors thought of when they thought of dividends. The largest sector weight in the S&P 500 is changing that. In fact, in dollar terms, technology is now the largest dividend-paying sector in the United States.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.