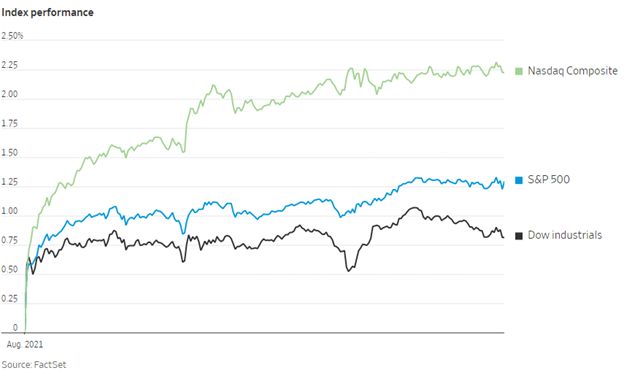

The Nasdaq closed at another record high on Wednesday as markets continue to ride the bevy of boosts from recent favorable government approvals, reports The Wall Street Journal. Full approval of the Pfizer COVID-19 vaccine combined with Congress moving to vote on the nearly $1 trillion infrastructure bill in September had markets moving in positive directions.

The upswing also reflects the hope of a favorable Federal Reserve meeting on Friday, with bond yields rising in advance of the meeting. The meeting will hopefully provide better guidelines on the Fed’s intentions towards inflation and indicate if potential tapering of federal stimulus support will occur.

Anastasia Amoroso, chief investment strategist at iCapital Network, believes that fears around the Federal Reserve meeting have faded.

“I think the expectations for the Fed to do anything at Jackson Hole have been lowered quite a bit, and that was a big worry. If the Fed was talking about tapering … amid the surge in delta [Covid] cases, that was not going to be great for the market,” she told CNBC. “But now the base case for everyone is there’s going to be a lot of talk amongst central bankers at Jackson Hole, but it’s going to be no taper and there’s not going to be much action.”

Paul Hickey, co-founder of Bespoke Investment Group, agrees with the Fed assessment. “It’s August and we’re looking for something to focus on, and Jackson Hole fills that void, but it’s usually more bark than bite. What you want to focus on here is there’s a lot of liquidity in the market; it’s not going anywhere in the near future here,” he said.

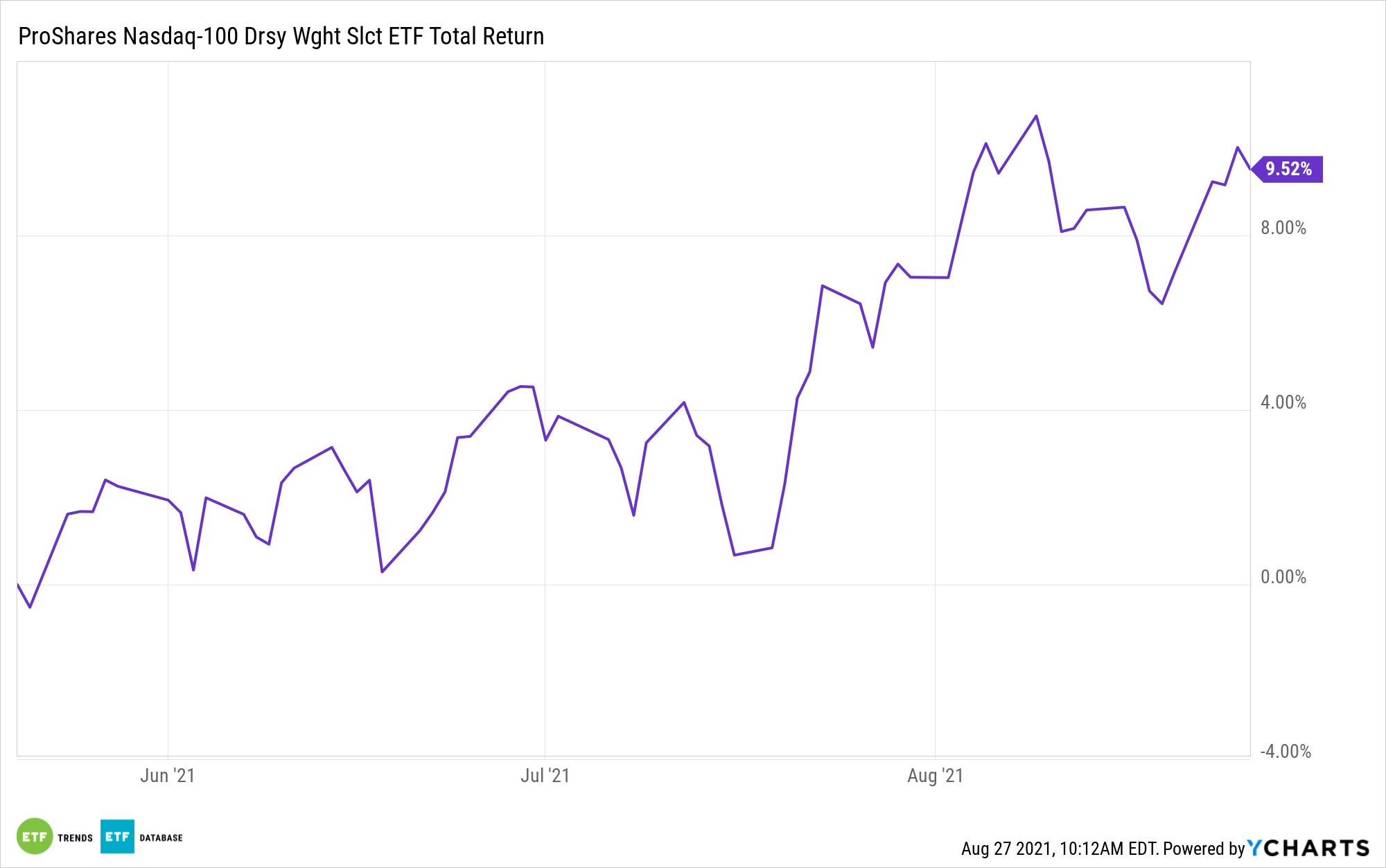

QQQA Gives Diversified Momentum Exposure to Nasdaq

The ProShares Nasdaq-100 Dorsey Wright Momentum ETF (QQQA) is a smart beta ETF that, despite only holding 21 securities, is more diversified than the broader Nasdaq-100, according to Todd Rosenbluth, head of ETF and Mutual Fund Research for CFRA.

The Nasdaq-100 Index tracks the largest domestic and international non-financial mega-cap growth stocks of the tech-heavy Nasdaq. It serves as the benchmark for the Invesco QQQ Trust (QQQ), one of the most widely traded ETFs in the world.

QQQA, meanwhile, utilizes a momentum strategy to select top performers within the Nasdaq-100 Index.

To build the portfolio, Dorsey Wright, a leader in momentum investing, uses a “relative strength” signal to select the top 21 companies within the Nasdaq-100 based on their highest price momentum at the time of rebalance.

Unlike the cap-weighted QQQ, QQQA is equal-weighted. Collectively, after its rebalance, the fund now has a 42.39% allocation to information technology, a 25.90% allocation to healthcare, and a 14.19% allocation to communication services.

Moderna Inc. (MRNA) is currently the top holding in QQQA at 7.56%, followed by ASML Holding (ASML), a major supplier for the semiconductor industry at 5.17%, and Align Technology (ALGN), a global medical device company at 5.06%.

QQQA has an expense ratio of 0.58% and carries 21 holdings.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.